Comparative Income Statements and Management Analysis

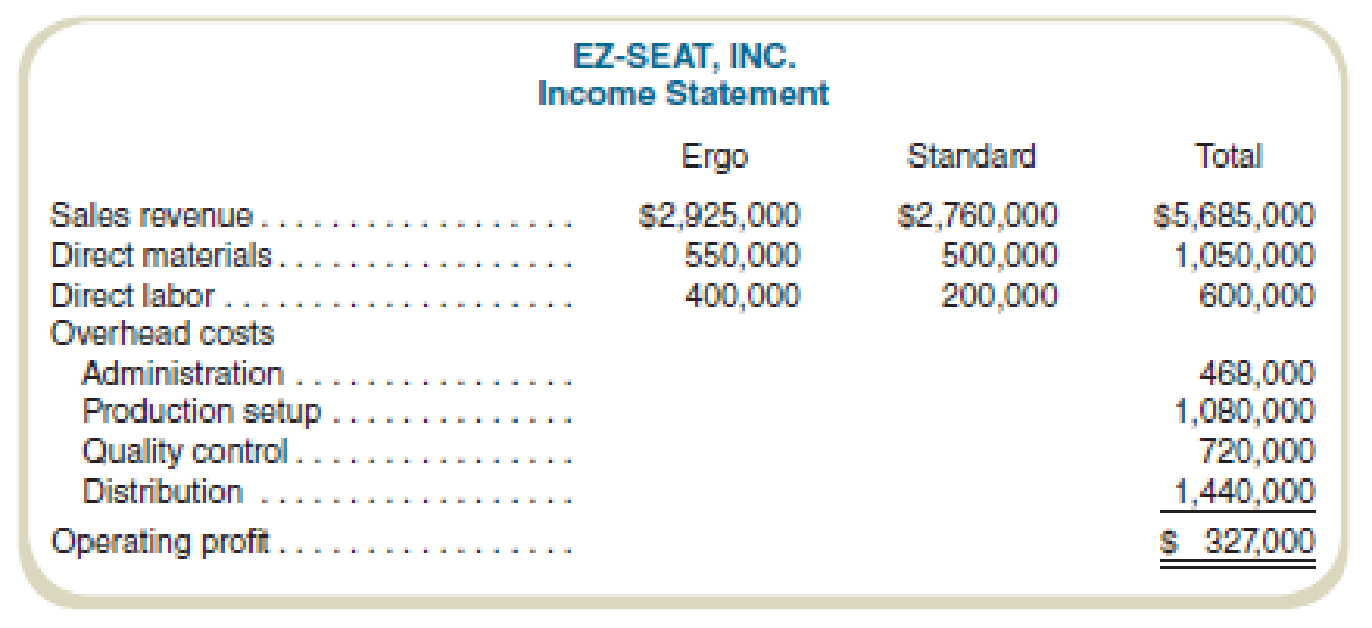

EZ-Seat, Inc., manufactures two types of reclining chairs, Standard and Ergo. Ergo provides support for the body through a complex set of sensors and requires great care in manufacturing to avoid damage to the material and frame. Standard is a conventional recliner, uses standard materials, and is simpler to manufacture. EZ-Seat’s results for the last fiscal year are shown in the statement below.

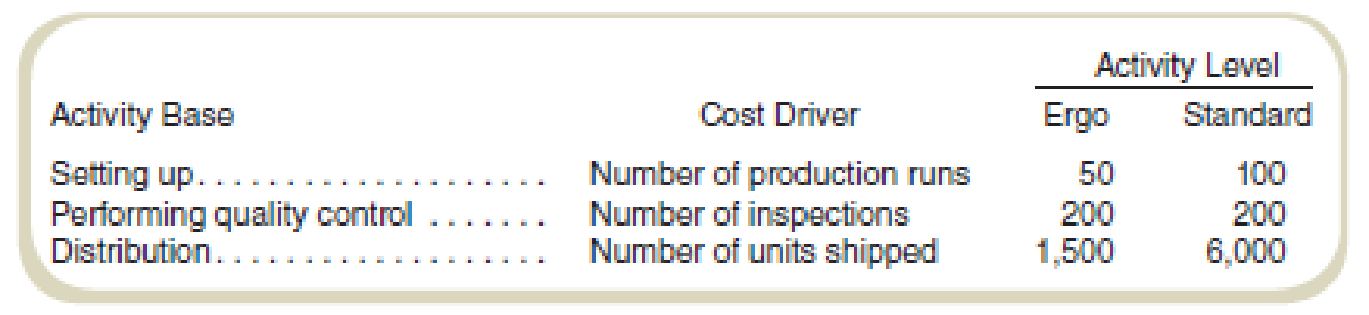

EZ-Seat currently uses labor costs to allocate all overhead, but management is considering implementing an activity-based costing system. After interviewing the sales and production staff, management decides to allocate administrative costs on the basis of direct labor costs but to use the following bases to allocate the remaining costs:

Required

- a. Complete the income statement using the preceding activity bases.

- b. Write a brief report indicating how management could use activity-based costing to reduce costs.

- c. Restate the income statement for EZ-Seat using direct labor costs as the only overhead allocation base.

- d. Write a report to management stating why product line profits differ using activity-based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and why (if you believe it does provide more accurate information). Indicate in your report how the use of labor-based overhead allocation could cause EZ-Seat management to make suboptimal decisions.

a.

Complete the income statement using preceding activity bases.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Complete the income statement using preceding activity bases:

| Particulars | Ergo | Standard | Total |

| Sales revenue | $2,925,000 | $2,760,000 | $5,685,000 |

| Direct materials | $550,000 | $500,000 | $1,050,000 |

| Direct labor | $400,000 | $200,000 | $600,000 |

| Overhead costs: | |||

|

Add: Administration | $312,000 | $156,000 | $468,000 |

|

Add: Production setup | $360,000 | $720,000 | $1,080,000 |

|

Add: Quality control | $360,000 | $360,000 | $720,000 |

|

Add: Distribution | $288,000 | $1,152,000 | $1,440,000 |

| Total overhead costs | $1,320,000 | $2,388,000 | $3,708,000 |

|

Operating profit | $655,000 | ($328,000) | $327,000 |

Table: (1)

Working note 1:

Compute the percentage of direct labor applicable:

Working note 2:

Compute the rate per setup:

Working note 3:

Compute the rate per inspection:

Working note 4:

Compute the shipping cost per unit:

b.

Write a brief report indicating how management could use activity-based costing to reduce costs

Explanation of Solution

Activity-based costing:

Activity-based costing (ABC) refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

ABC method for reducing the cost:

Reduction in the cost of activities may not be the direct result of implementing the ABC method of costing, but it can highlight the activities where the cost reduction can be made. Reducing the setup costs or other overhead costs specifically from the perspective of cost reduction can be identified using the ABC method of costing.

c.

Restate the income statement according to the information given in the question.

Explanation of Solution

Recompute the income statement according to the information given in the question:

| Particulars | Ergo | Standard | Total |

| Sales revenue | $2,925,000 | $2,760,000 | $5,685,000 |

| Direct materials | $550,000 | $500,000 | $1,050,000 |

| Direct labor | $400,000 | $200,000 | $600,000 |

|

Overhead costs | $2,472,000 | $1,236,000 | $3,708,000 |

| Operating profit | ($497,000) | $824,000 | $327,000 |

Table: (2)

Working note 5:

d.

Write a report to management stating why product line profits differ using activity-based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and provide a reason for the same.

Explanation of Solution

Purpose of the report:

To explain the difference between the implementation of ABC costing and traditional labor-based costing method for the computation of the product line profits.

The implication of both methods:

Direct costs do not differ in both the methods implemented. While using the labor-based method, all the overhead costs are computed under one single head, and while using ABC the bifurcation of cost drivers is relevant to their respective cost of allocation

Result using the traditional labor-based method of costing:

The result shows that the product Ergo has incurred a loss of $497,000 which is 17% percent of the sales revenue. And the product standard has attained a profit of $824,000 which is 30% of sales revenue.

Result using the ABC method of costing:

The result shows that the product Ergo has attained a profit of $655,000 which is 22% percent of the sales revenue. And the product Standard has incurred the loss of $328,000 which is 11% of sales revenue.

Conclusion:

The choice of the method adopted should be ABC costing as the results computed from the traditional labor-based method are very high as compared to ABC costing.

Want to see more full solutions like this?

Chapter 9 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Normandy Office Products (NOP) makes two types of office desks, Manager and Executive. The Executive model is adjustable using electric motors and is made with upgraded materials. The manufacturing process for the Executive model is more complex than that for the Manager model, requiring more frequent inspections and shorter production runs. The Manager model is a basic desk, using good, but easy to work with, materials, and is simpler to manufacture. NOP’s results for the last fiscal year are shown in the following statement. NORMANDY OFFICE PRODUCTS Income Statement Manager Executive Total Sales revenue $ 1,113,600 $ 1,235,400 $ 2,349,000 Direct materials 197,200 208,800 406,000 Direct labor 139,200 174,000 313,200 Overhead costs Administration 250,560 Machine setup 417,600 Inspection 278,400 Packing and shipping 556,800 Operating profit $ 126,440 NOP currently uses labor costs to allocate all overhead, but management is…arrow_forwardProduct profitability analysisPower Train Sports Inc. manufactures and sells two .styles of All Terrain Vehicles(ATVs), the Mountain Monster and Desert Dragon, from a single manufacturing facility.The manufacturing facility operates at 100% of capacity. The following per-unitinformation is available for the two products: In addition, the following sales unit volume information for the period is as follows: A. Prepare a contribution margin by product report. Calculate the contributionmargin ratio for each.B. What advice would you give to the management of Power Train Sports Inc.regarding the relative profitability of the two products?arrow_forwardPartial Financial Productivity ABC Corporation makes small parts from steel alloy sheets.Management has the flexibility to substitute direct materials for direct manufacturing labor and viceversa. If workers cut the steel carefully, more parts can be manufactured from a metal sheet, but thisrequires additional direct manufacturing labor hours. Alternatively, ABC can use fewer labor hoursif it is willing to tolerate more waste of direct materials. ABC decided to improve materials productivity this year and the following provides information for the current and prior year:Prior Year Current YearOutput units 400,000 490,000Direct manufacturing labor hours 10,000 13,500Wages per hour $26 $24Direct materials used 160 tons 180 tonsDirect materials cost per ton $3,375 $3,250Required Carry all computations to 4 digits after the decimal point.1. Compute the partial financial productivity for both direct materials and direct labor for each of the 2 years.2. Calculate ABC’s combined direct labor…arrow_forward

- Communication The controller of New Wave Sounds Inc. prepared the following product profitability report for management, using activity-based costing methods for allocating both the factory overhead and the marketing expenses. As such, the controller has confidence in the accuracy of this report. In addition, the controller interviewed the vice president of marketing, who provided the following insight into the companys three products: The home theater speakers are an older product that is highly recognized in the marketplace. The wireless speakers are a new product that was just recently launched. The wireless headphones are a new technology that has no competition in the marketplace, and it is hoped that they will become an important future addition to the companys product portfolio. Initial indications are that the product is well received by customers. The controller believes that the manufacturing costs for all three products are in line with expectations. Based on the information provided: 1. Calculate the ratio of gross profit to sales and the ratio of operating income to sales for each product. 2. Write a brief (one-page) memo using the product profitability report and the calculations in (a) to make recommendations to management with respect to strategies for the three products.arrow_forwardThe Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry White, the firms new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Following are activity and cost information relating to two of Chocolate Bakers major products: Using activity-based costing, which of the following statements is correct? a. The muffins are 2,000 more profitable. b. The cheesecakes are 75 more profitable. c. The muffins are 1,925 more profitable. d. The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.arrow_forwardRizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that: Every shipping error over three shipping errors per month reduces the customer retention rate by 1.5%. On average, each day above three days from ordered to delivered yields a reduction in the customer retention rate of 1%. Each day before three days from order to delivery yields an increase in the customer retention rate of 1%, on average. Rizzo Goal Inc.s current customer retention rate is 60%. The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5% in the same direction. Rizzo Goal Inc.s current market share is 21.4%. Ignoring any other factors, if the company has six shipping errors this month and an average of 3.5 days from ordered to delivered, determine (a) the new customer retention rate and (b) the new market share that Rizzo Goal Inc. expects to have.arrow_forward

- Ventana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventanas income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year. Required: 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.) 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)arrow_forwardThis cost data from Hickory Furniture is for the year 2017. Using the high-low method, express the factory utility expenses as an equation where x represents number of chairs produced. Predict the utility costs if 900 chairs are produced. Predict the utility costs if 750 chairs are produced. Using Excel, create a scatter graph of the cost data and explain the relationship between number of chairs processed and utility expenses.arrow_forwardCost Classification, Income Statement Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateways work comes from contracts with city and state agencies in Nebraska. The companys sales volume averages 3 million, and profits vary between 0 and 10% of sales. Sales and profits have been somewhat below average for the past 3 years due to a recession and intense competition. Because of this competition, Jack constantly reviews the prices that other companies bid for jobs. When a bid is lost, he analyzes the reasons for the differences between his bid and that of his competitors and uses this information to increase the competitiveness of future bids. Jack believes that Gateways current accounting system is deficient. Currently, all expenses are simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yet all bids are based on the costs of laying pipe. With these thoughts in mind, Jack looked more carefully at the income statement for the previous year (see below). First, he noted that jobs were priced on the basis of equipment hours, with an average price of 165 per equipment hour. However, when it came to classifying and assigning costs, he needed some help. One thing that really puzzled him was how to classify his own 114,000 salary. About half of his time was spent in bidding and securing contracts, and the other half was spent in general administrative matters. Required: 1. Classify the costs in the income statement as (1) costs of laying pipe (production costs), (2) costs of securing contracts (selling costs), or (3) costs of general administration. For production costs, identify direct materials, direct labor, and overhead costs. The company never has significant work in process (most jobs are started and completed within a day). 2. Assume that a significant driver is equipment hours. Identify the expenses that would likely be traced to jobs using this driver. Explain why you feel these costs are traceable using equipment hours. What is the cost per equipment hour for these traceable costs?arrow_forward

- Variable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forwardGalaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: In addition, the following sales unit volume information for the period is as follows: a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each. b. What advice would you give to the management of Galaxy Sports Inc. regarding the profitability of the two products?arrow_forwardThis cost data from Hickory Furniture is for the year 2017. Using the high-low method, express the companys utility costs as an equation where X represents number of tables produced. Predict the utility costs if 800 tables are produced. Predict the utility costs if 600 tables are produced. Using Excel, create a scatter graph of the cost data and explain the relationship between number of tables produced and utility expenses.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College