Accounting

27th Edition

ISBN: 9781337272094

Author: WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.2BPR

Aging of receivables; estimating allowance for doubtful accounts

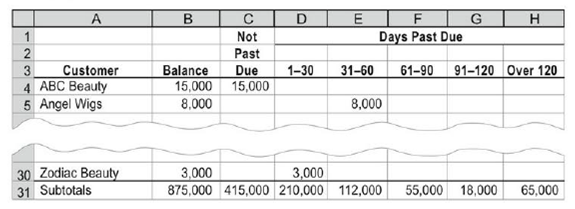

Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Yl:

The following accounts were unintentionally omitted from the aging schedule:

| Customer | Due Date | Balance |

| Arcade Beauty | Aug 17, 20Y1 | $10,000 |

| Creative Images | Oct. 30,20Y1 | 8,500 |

| Excel Hair Products | July 3,20 Y1 | 7,500 |

| First Class Hair Care | Sept. 8,20Y1 | 6,600 |

| Golden Images | Nov. 23, 20Y1 | 3,600 |

| Oh That Hair | Nov. 29, 20Y1 | 1,400 |

| One Stop Hair Designs | Dec. 7, 20Y1 | 4,000 |

| Visions Hair & Nail | Jan. 11, 20Y2 | 9,000 |

Wig Creations has a past history of uncollectible accounts by age category, as follows:

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1 30 days past due | 4 |

| 31-60 days past due | 16 |

| 61-90 days past due | 25 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of $7,375 before adjustment o n December 31, 20Yl. Journalize the adjustment for uncollectible accounts.

- 5. Assuming that the

adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement?

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 9 Solutions

Accounting

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Direct write-off method Journalize the following...Ch. 9 - Direct write-off method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Note receivable Lundquist Company received a...Ch. 9 - Note receivable Prefix Supply Company received a...Ch. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Classifications of receivables Boeing is one of...Ch. 9 - Nature of uncollectible accounts MGM Resorts...Ch. 9 - Entries for uncollectible accounts, using direct...Ch. 9 - Entries for uncollectible receivables, using...Ch. 9 - Entries to write off accounts receivable Quantum...Ch. 9 - Providing for doubtful accounts At the end of the...Ch. 9 - Number of days past due Toot Auto Supply...Ch. 9 - Aging of receivables schedule The accounts...Ch. 9 - Estimating allowance for doubtful accounts...Ch. 9 - Adjustment for uncollectible account Using data in...Ch. 9 - Estimating doubtful accounts Performance Bike Co....Ch. 9 - Entry for uncollectible accounts Using the data in...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Effect of doubtful accounts on net income During...Ch. 9 - Effect of doubtful accounts on net income Using...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Determine due date and interest on notes Determine...Ch. 9 - Entries for notes receivable Spring Designs ...Ch. 9 - Entries for notes receivable The series of five...Ch. 9 - Entries for notes receivable, including year-end...Ch. 9 - Entries for receipt and dishonor of note...Ch. 9 - Entries for receipt and dishonor of notes...Ch. 9 - Receivables on the balance sheet List any errors...Ch. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Accounts receivable turnover Use the data in...Ch. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Ethics in Action Bud Lighting Co. is a retailer of...Ch. 9 - Prob. 9.2CPCh. 9 - Communication On January 1, Xtreme Co. began...Ch. 9 - Estimate uncollectible accounts For several years,...Ch. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Prob. 9.7CPCh. 9 - Accounts receivable turnover and days sales in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aging of receivables; estimating allowance for doubtful accounts Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy Fish prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y4: The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year. Trophy Fish has a past history of uncollectible accounts by age category, as follows: Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of 3,600 before adjustment on December 31. Journalize the adjusting entry for uncollectible accounts. 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement?arrow_forwardWig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y1: The following accounts were unintentionally omitted from the aging schedule: Wig Creations has a past history of uncollectible accounts by age category, as follows: Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of 7,375 before adjustment on December 31, 20Y1. Journalize the adjustment for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement?arrow_forwardAging of receivables schedule The accounts receivable clerk for Evers Industries prepared the following partially completed aging of receivables schedule as of the end of business on July 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of July 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forward

- Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardAging Receivables and Bad Debt Expense Perkinson Corporation sells paper products to a large number of retailers. Perkinsons accountant has prepared the following aging schedule for its accounts receivable at the end of the year. Before adjusting entries are entered, the balance in the allowance for doubtful accounts is a debit of $480. Required: 1. Calculate the desired postadjustment balance in Perkinsons allowance for doubtful accounts. 2. Determine bad debt expense for the year.arrow_forwardUsing data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of 6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forward

- The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardThe accounts receivable clerk for Kirchhoff Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardBad Debt Expense: Aging Method Glencoe Supply had the following accounts receivable aging schedule at the end of a recent year. The balance in Glencoes allowance for doubtful accounts at the beginning of the year was $58,620 (credit). During the year, accounts in the total amount of $62,400 were written off. Required: 1. Determine bad debt expense. 2. Prepare the journal entry to record bad debt expense. 3. If Glencoe had written off $90,000 of receivables as uncollectible during the year, how much would bad debt expense reported on the income statement have changed?arrow_forward

- AGING ACCOUNTS RECEIVABLE An analysis of the accounts receivable of Johnson Company as of December 31, 20--, reveals the following: REQUIRED 1. Prepare an aging schedule as of December 31, 20--, by adding the following column to the three columns shown above: Estimated Amount Uncollectible. 2. Assuming that Allowance for Doubtful Accounts had a credit balance of 620 before adjustment, record the end-of-period adjusting entry in general journal form to enter the estimate for uncollectible accounts.arrow_forwardAging Method Bad Debt Expense Cindy Bagnal, the manager of Cayce Printing Service, has provided the following aging schedule for Cayces accounts receivable Cindy indicates that the $121,100 of accounts receivable identified in the table does not include $4,600 of receivables that should be written off. Required: 1. Journalize the $4,600 write-off. 2. Determine the desired post adjustment balance in allowance for doubtful accounts (round each aging category to the nearest dollar). 3. If the balance in allowance for doubtful accounts before the $4,600 write-off was a debit of $700, compute bad debt expense. Prepare the adjusting entry to record bad debt expense.arrow_forwardAGING ACCOUNTS RECEIVABLE An analysis of the accounts receivable of Matsushita Company as of December 31, 20--, reveals the following: REQUIRED 1. Prepare an aging schedule as of December 31, 20--, by adding the following column to the three columns shown above: Estimated Amount Uncollectible. 2. Assuming that Allowance for Doubtful Accounts had a credit balance of 1,750 before adjustment, record the end-of-period adjusting entry in general journal form to enter the estimate for uncollectible accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License