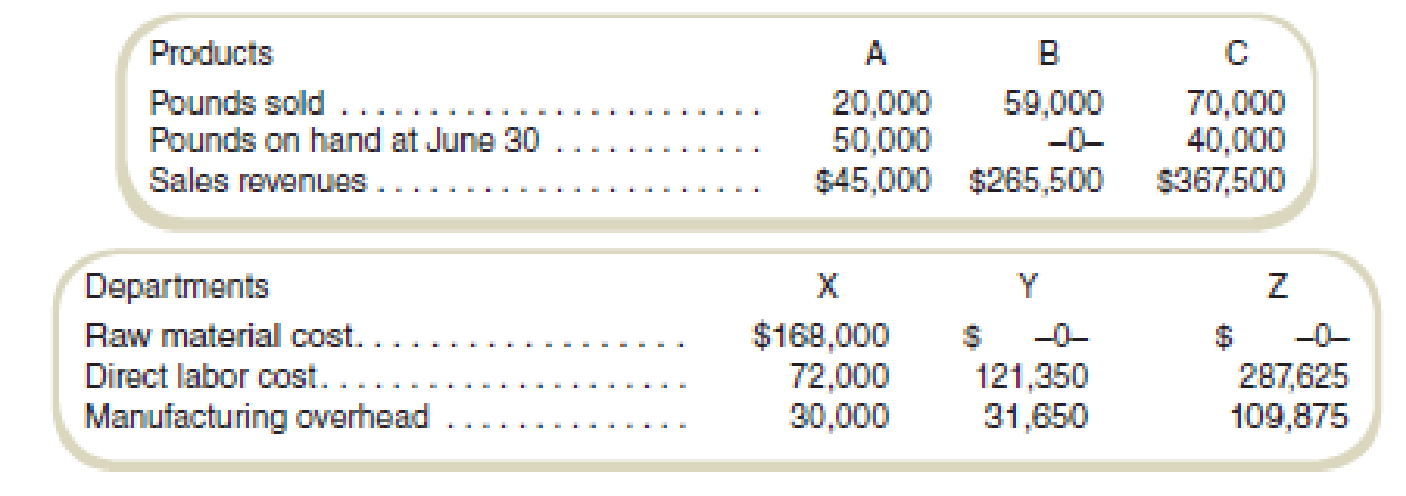

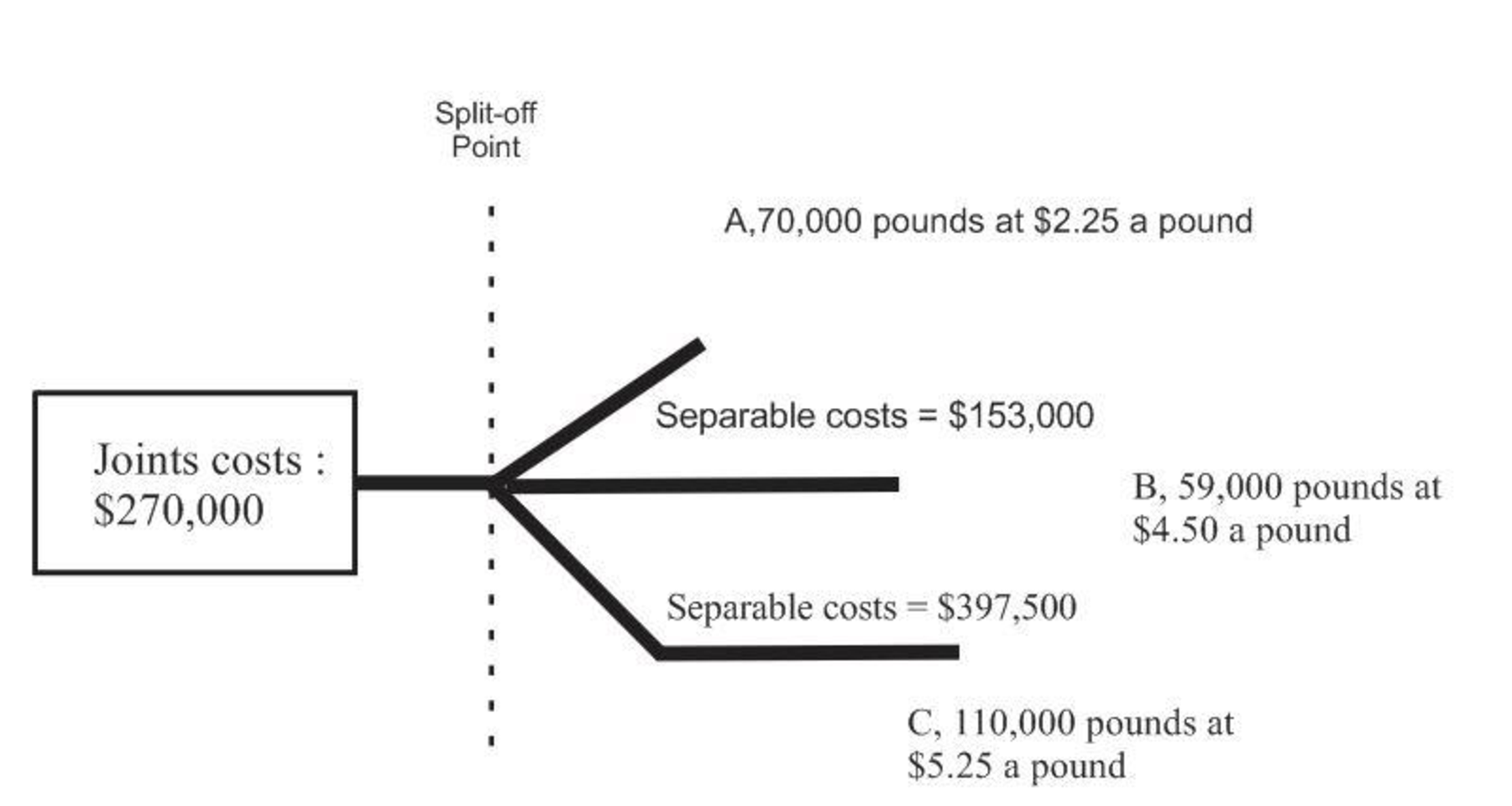

Fletcher Fabrication, Inc., produces three products by a joint production process. Raw materials are put into production in Department X, and at the end of processing in this department, three products appear. Product A is sold at the split-off point with no further processing. Products B and C require further processing before they are sold. Product B is processed in Department Y, and product C is processed in Department Z. The company uses the estimated net realizable value method of allocating joint production costs. Following is a summary of costs and other data for the quarter ended June 30.

No inventories were on hand at the beginning of the quarter. No raw material was on hand at June 30. All units on hand at the end of the quarter were fully complete as to processing.

Required

- a. Determine the following amounts for each product: (1) estimated net realizable value used for allocating joint costs, (2) joint costs allocated to each of the three products, (3) cost of goods sold, and (4) finished goods inventory costs, June 30.

- b. Assume that the entire output of product A could be processed further at an additional cost of $6.00 per pound and then sold for $12.90 per pound. What would have been the effect on operating profits if all of product A output for the quarter had been further processed and then sold rather than being sold at the split-off point?

- c. Write a memo to management indicating whether the company should process product A further and why.

a.

Determine the following amounts for each product:

(1) The estimated net realizable value used for allocating joint costs

(2) The joint costs allocated to each of the three products

(3) The cost of goods sold, and

(4) The finished goods inventory costs, June 30.

Explanation of Solution

Joint cost allocation:

Joint cost allocation allocates the common cost of the various departments of the business. IT, accounting and administration services are utilized by various departments so it should be allocated to the various departments based on the usage of the cost.

Determine the estimated net realizable value used for allocating joint costs:

1.

| Particulars | Product A | Product B | Product C | Total |

| Selling price per pound: | ||||

| A: | $ 2 | |||

| C: | $ 5 | |||

| Pounds produced: | ||||

| A: | 70,000 | |||

| C: | 110,000 | |||

| Gross sales values | $ 157,500 | $ 265,500 | $ 577,500 | |

| Less: Costs of separate processing: | ||||

| A: | $ - | |||

| B: | $ 153,000 | |||

| C: | $ 397,500 | |||

| Estimated net realizable values at split-off point | $ 157,500 | $ 112,500 | $ 180,000 | $450,000 |

| Percentage of total | 35% | 25% | 40% | 100% |

Table: (1)

2.

Determine the joint costs allocated to each of the three products:

Product A:

Product B:

Product C:

Total joint costs:

Thus, the total amount of the joint cost is $270,000.

3.

| Particulars | Total costs | Cost of goods sold | Ending inventory |

| Product A: | |||

| Joint costs allocated | $ 94,500 | ||

| Sold: | $ 27,000 | ||

| Inventory | $ 67,500 | ||

| Product B: | |||

| Joint costs allocated | $ 67,500 | ||

| Separate processing costs | $ 153,000 | ||

| Total of sales | $ 220,500 | $ 220,500 | $ - |

| Product C: | |||

| Joint costs allocated | $ 108,000 | ||

| Separate processing costs | $ 397,500 | ||

| Total costs of Z | $ 505,500 | ||

| Sold: | $ 321,682 | ||

| Inventory | $ 183,818 | ||

| Total | $ 820,500 | $ 569,182 | $ 251,318 |

Table: (2)

4.

Thus, the cost of the finished goods inventory as on June 30 is $569,182.

b.

Identify the effect on operating profits if all of the product A output had been further processed for the quarter and then sold rather than being sold at the split-off point.

Explanation of Solution

Operating profit:

The operating profit is the excess of total revenues over total expenses after adjusting for depreciation and taxes.

Compute the incremental revenue of further processing:

Compute the incremental costs of further processing:

Compute the effect on operating profits:

Thus, the operating profits have been increased by $325,500 when all of the product A output for the quarter had been further processed and then sold rather than being sold at the split-off point.

c.

Prepare a memo to management indicating whether product A should be processed by the company or not.

Explanation of Solution

Memo

From

ABC

To

XYZ

Re: Whether product A should be continued by the management or not.

Dear XYZ,

I am glad to share that Product A is going to bring an additional operating profit of $325,500. So, here I am explaining to you whether Product A should be continued by the management.

Product A:

The incremental revenue arising out of the product is $745,500, and the incremental costs are $420,000. Thus, it results in an extra profit of $325,500.

Thus, the company should continue with product A because it is going to be profitable if it is further processed.

I hope now you are clear about the information I have provided regarding whether the product should be processed or not. You can revert if you need some more information or clarification on the information provided.

Regards,

ABC

Want to see more full solutions like this?

Chapter 11 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

Additional Business Textbook Solutions

Fundamentals of Financial Accounting

Fundamentals Of Financial Accounting

FINANCIAL ACCT.FUND.(LOOSELEAF)

Financial Accounting

Cost Accounting (15th Edition)

Managerial Accounting: Tools for Business Decision Making

- A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs 12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Required: 1. Allocate the joint cost to L-Ten, Triol, and Pioze using the net realizable value method. (Round the percentages to four significant digits. Round all cost allocations to the nearest dollar.) 2. What if it cost 2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to the three products?arrow_forwardOakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forwardBoard-It, Inc., produces the following types of 2 4 10 wood boards: washed, stained, and pressure treated. These products are produced jointly until they are cut. One batch produces 45 washed boards, 35 stained boards, and 20 pressure treated boards. The joint production process costs a total of 710 per batch. Using the physical units method, allocate the joint production cost to each product.arrow_forward

- Breegle Company produces three products (B-40, J-60, and H-102) from a single process. Breegle uses the physical volume method to allocate joint costs of 22,500 per batch to theproducts. Based on the following information, which product(s) should Breegle continue toprocess after the split-off point in order to maximize profit? a. B-40 only b. J-60 only c. H-102 only d. B-40 and H-102 onlyarrow_forwardMan OFort Inc. produces two different styles of door handles, standard and curved. The door handles go through a joint production molding process costing 29,000 per batch and producing 2,000 standard door handles and 1,000 curved door handles at the split-off point. Both door handles undergo additional production processes after the split-off point, but could be sold at that point: the standard style for 4 per door handle and the curved style for 2 per door handle. Determine the amount of joint production costs allocated to each style of door handle using the market value at split-off method.arrow_forwardAdirondack Bat Co. processes rough timber to obtain three grades of lumber, A, B, and C that are then made into baseball bats. The company allocates joint costs to the joint products on the basis of the sales value at the split-off point. During the month of May, Adirondack incurred total joint production costs of $300,000 in producing the following: Make the journal entry to transfer the finished lumber to separate work in process inventory accounts for each product. What would be the allocation of the joint costs if the company were to use the physical measure method?arrow_forward

- Arvin, Inc., produces two products, ins and outs, in a single process. The joint costs of this process were $77,300, and 14,000 units of ins and 36,000 units of outs were produced. Separable processing costs beyond the split-off point were as follows: ins, $17,500; outs, $9,000. Ins sell for $8.00 per unit; outs sell for $15.00 per unit. Required: Allocate the $77,300 joint costs using the estimated net realizable value method. Suppose that ins could be sold at the split-off point for $7.00 per unit. Should Arvin sell ins at split-off or process them further? Show supporting computations. Which of the four data analytic types—descriptive, diagnostic, predictive, or prescriptive—is used to determine whether Arvin should process further or sell at the split-off point?arrow_forwardLuzon Manufacturing Corp. manufactures two products from a joint distilling process. The two products developed are Light Brandy and Primera Brandy. A standard production run incurs costs of P3,000,000 and results in 6,000 units of Light Brandy and 9,000 units of Primera Brandy. Each Light Brandy sells for P200 per unit, and each Primera Brandy sells for P400 per unit. Assuming no further processing work is done after the split-off point, the amount of joint cost allocated to Primera Brandy on a physical quantity allocation basis would be?arrow_forwardAllison, Inc., produces two products, X and Y, in a single joint process. Last month the joint costs were $75,000 when 10,000 units of Product X and 15,000 units of Product Y were produced. Addi-tional processing costs were $15,000 for Product X and $10,000 for Product Y. Product X sells for $10, and Product Y sells for $5. The joint cost allocations to Products X and Y using the net realizable value method would be: Group of answer choices $42,500 $32,500 $30,000 $45,000 $42,857 $32,143 $45,000 $30,000 none of the above. Flag question: Question 2 Question 23 pts The joint cost allocations to Products X and Y using the physical units method would be: Group of answer choices $30,000 $45,000 $42,500 $32,500 $42,857 $32,143 $45,000 $30,000 none of the above. Flag question: Question 3 Question 33 pts The joint cost allocations to Products X and Y using the constant gross margin percentage method would be: Group of answer choices $42,143…arrow_forward

- The following information relates to a joint production process for three products, with a total joint production cost of $175,000. There are no separable processing costs for any of the three products. Product Sales Value at Split-Off Units at Split-Off 1 $ 227,500 680 2 87,500 1,020 3 35,000 1,700 $ 350,000 3,400 What percentage of joint cost is allocated to each of the three products using the physical units method?arrow_forwardDallas Company produces joint products, TomL and JimmyJ, each of which incurs separable production costs after the splitoff point. Information concerning a batch produced at a $200,000 joint cost before splitoff follows:arrow_forwardTwo products, TD and IB, emerge from a joint process. Product TD has been allocated $31,200 of the total joint costs of $48,000. A total of 5,000 units of product TD are produced from the joint process. Product TD can be sold at the split-off point for $24 per unit, or it can be processed further for an additional total cost of $15,000 and then sold for $26 per unit. If product TD is processed further and sold, what would be the effect on the overall profit of the company? It the change is a decrease, enter your number with a – in front. Otherwise, just enter the number. ENTER YOUR ANSWER WITHOUT DOLLAR SIGNS OR OTHER DISCRIPTIONS.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub