Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 10E

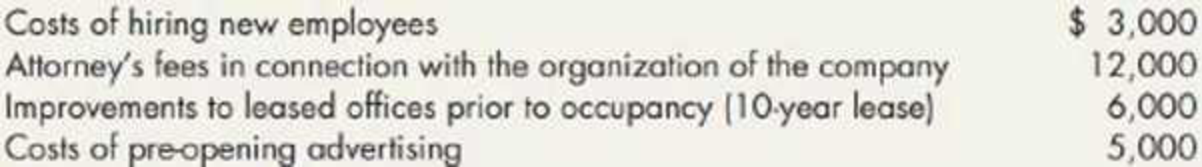

Kling Company was organized in late 2019 and began operations on January 2, 2020. Prior to the start of operations, it incurred the following costs:

Required:

- 1. What amount should the company expense in 2019? In 2020?

- 2. Next Level What is the justification of the accounting treatment of these costs?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Kling Company was organized in late 2019 and began operations On January 2, 2020. Prior to the start of operations, it incurred the following costs:

1. what amount should the compmy expense in 2019? In 2020? 2. Next Level What is the justification of the accounting treatment of these costs?

Banko Company used the cost recovery method of accounting since it began operations in 2016. In 2019, management decided to adopt the percentage of completion method.

Blossom Construction Company uses the percentage-of-completion method of accounting. In 2021, Blossom began work on a contract it had received which provided for a contract price of $47500000. Other details follow:

2021

Costs incurred during the year

$22000000

Estimated costs to complete as of December 31

16000000

Billings during the year

21500000

Collections during the year

10500000

What should be the gross profit recognized in 2021?

Chapter 12 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 12 - Prob. 1GICh. 12 - Prob. 2GICh. 12 - Prob. 3GICh. 12 - Prob. 4GICh. 12 - Prob. 5GICh. 12 - Prob. 6GICh. 12 - Prob. 7GICh. 12 - What activities are included in RD? Which are...Ch. 12 - What elements of RD activities does a company...Ch. 12 - How does a company record a patent worth 100,000...

Ch. 12 - Prob. 11GICh. 12 - Prob. 12GICh. 12 - Over how many years are patents amortized?...Ch. 12 - Prob. 14GICh. 12 - Prob. 15GICh. 12 - Prob. 16GICh. 12 - Prob. 17GICh. 12 - Prob. 18GICh. 12 - Prob. 19GICh. 12 - Prob. 20GICh. 12 - What is the proper time or time period over which...Ch. 12 - Prob. 2MCCh. 12 - Prob. 3MCCh. 12 - Which of the following assets typically are...Ch. 12 - Prob. 5MCCh. 12 - Prob. 6MCCh. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - Steel Magnolia Incorporated purchased a trademark...Ch. 12 - Match the following items with correct accounting...Ch. 12 - Notting Hill Company incurred the following costs...Ch. 12 - Hook Corp. incurred the following start-up costs,...Ch. 12 - Mystic Pizza Company purchased a patent from Prime...Ch. 12 - Mystic Pizza Company purchases a franchise from NY...Ch. 12 - Prob. 7RECh. 12 - Prob. 8RECh. 12 - Prob. 9RECh. 12 - Prob. 10RECh. 12 - Prob. 1ECh. 12 - On January 4, 2019, Franc Company purchased for...Ch. 12 - On January 11, 2019, Hughes Company applied for a...Ch. 12 - Gansac Publishing Company signed a contract with...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - KLK Clothing Company manufactures professional...Ch. 12 - Cressman Company incurred RD costs for various...Ch. 12 - In 2019, Lalli Corporation incurred RD costs as...Ch. 12 - Kling Company was organized in late 2019 and began...Ch. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Company is considering purchasing EKC Company....Ch. 12 - Prob. 18ECh. 12 - Prob. 19ECh. 12 - Prob. 20ECh. 12 - Prob. 1PCh. 12 - Prob. 2PCh. 12 - Prob. 3PCh. 12 - Halpern Companys controller prepared the following...Ch. 12 - Prob. 5PCh. 12 - Prob. 6PCh. 12 - Hamilton Companys balance sheet on January 1,...Ch. 12 - Prob. 8PCh. 12 - Lee Manufacturing Corporation was incorporated on...Ch. 12 - Information concerning Tully Corporations...Ch. 12 - Prob. 11PCh. 12 - In examining Samson Manufacturing Companys books,...Ch. 12 - Prob. 2CCh. 12 - Prob. 3CCh. 12 - Prob. 4CCh. 12 - On June 30, 2019, your client, Sprauge...Ch. 12 - Prob. 6CCh. 12 - NBC paid 401 million for the rights to televise...Ch. 12 - Prob. 8C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Berg Company began operations on January 1, 2019, and uses the FIFO method in costing its raw materials inventory. During 2020, management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed: Required: What is the effect on income before income taxes in 2020 of a change to the LIFO method?arrow_forwardKoolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.arrow_forwardOn March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.arrow_forward

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense at December 31, 2020, if the double-declining-balance method were used? a. $187,200 b. $192,000 c. $195,200 d. $312, 000arrow_forwardShannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800arrow_forwardAt the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.arrow_forward

- Winterfell Products manufactures electrical switches for the aerospace industry. For the year ending 2019, they reported these revenues and expenses. Use this information to construct an income statement for the year 2019.arrow_forwardSoon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.arrow_forwardIn December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in December 2019 and a cash payment of S4,500 for services to be performed in January 2020. Swanstrom also receives the December utility bill for S600 but does not pay this bill until 2020. For 2019, under the accrual basis of accounting, Swanstrom would recognize: a. $8,000 of revenue and $600 of expense. b. $8,000 of revenue and $0 of expense. c. $3,500 of revenue and $600 of expense. d. $3,500 Of revenue and $0 of expense.arrow_forward

- It is the end of 2019 and you are an accountant for Stone Company. During 2019, sales of the companys products slumped and the companys earnings are expected to be much less than those of 2018. The president comes to you with an idea. He says, Our companys property, plant, and equipment cost 300,000, and that is the amount we usually report on our balance sheet. However, I just had these assets appraised by an independent appraiser, and she says they are worth 400,000. I think that the company should report the property, plant, and equipment at this amount on its December 31, 2019, balance sheet and should report the 100,000 increase in value as a gain on the 2019 income statement. If we use this approach, it will show how much our company is really worth and increase our earnings. This will make our shareholders happy. What do you think? Required: Prepare a written response to the president.arrow_forwardPF Consolidated Inc. provided consulting services to its subsidiary, Sessions Athletic Gear, during 2020. PF Consolidated charged $5,000,000 of travel, salary, overhead and supplies costs to its administrative expenses account, and charged Sessions $8,000,000 for the services. By December 31, 2020, the end of PF’s accounting year, Sessions has paid all but $100,000 of the balance due to PF. Sessions categorizes the services as administrative. Required: What balances appear in the December 31, 2020, trial balances of PF and Sessions with respect to these intercompany services? What balances should appear on the consolidated financial statements? Prepare the working paper eliminating entries needed for these intercompany services at December 31, 2020.arrow_forwardABC Company Inc., which operates on accrual basis accounting, hired an employee who started work on May 15, 2022. Per the company’s policies, the employee became eligible to start earning paid time off (PTO) after 6 months at a rate of 10 hours per month and PTO is paid out upon termination. Which financial statements are affected in the year 2022? * Balance Sheet only Income Statement only Balance Sheet & Income Statement Neither the Balance Sheet nor the Income Statement please explain why the option is correct and remaining incorrect no use of AI need correct answer with explanationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Accounting for Derivatives_1.mp4; Author: DVRamanaXIMB;https://www.youtube.com/watch?v=kZky1jIiCN0;License: Standard Youtube License

Depreciation|(Concept and Methods); Author: easyCBSE commerce lectures;https://www.youtube.com/watch?v=w4lScJke6CA;License: Standard YouTube License, CC-BY