Concept explainers

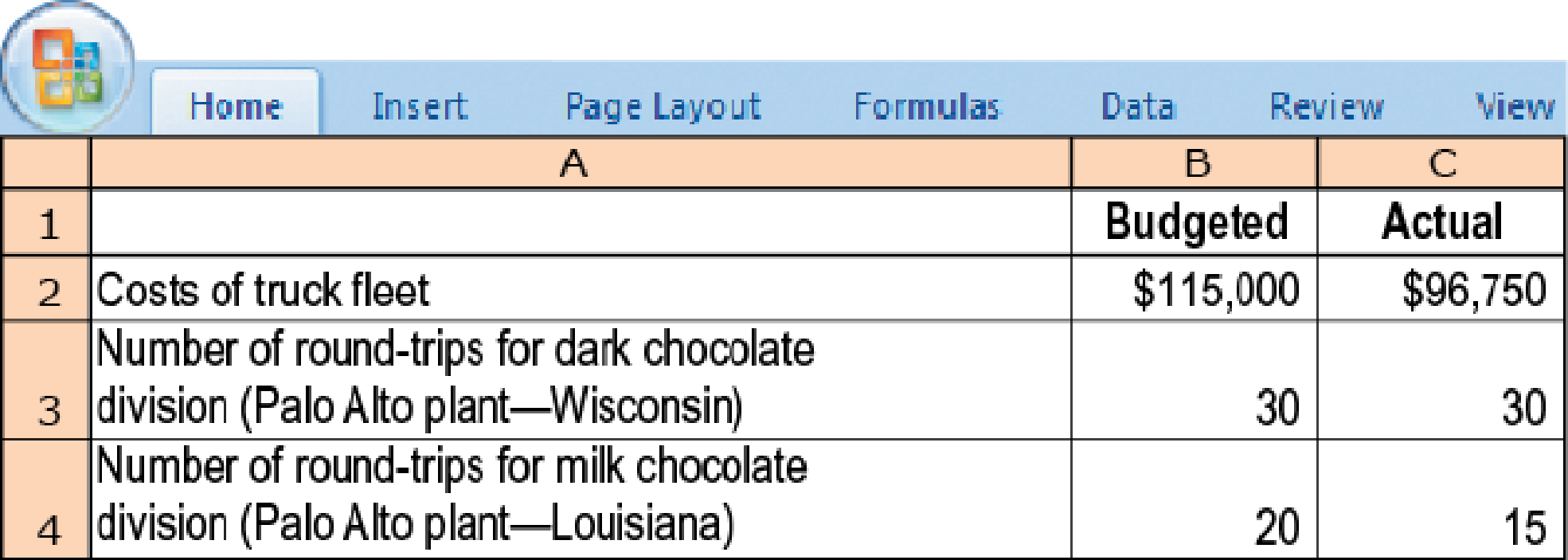

Single-rate method, budgeted versus actual costs and quantities. Chocolat Inc. is a producer of premium chocolate based in Palo Alto. The company has a separate division for each of its two products: dark chocolate and milk chocolate. Chocolat purchases ingredients from Wisconsin for its dark chocolate division and from Louisiana for its milk chocolate division. Both locations are the same distance from Chocolat’s Palo Alto plant.

Chocolat Inc. operates a fleet of trucks as a cost center that charges the divisions for variable costs (drivers and fuel) and fixed costs (vehicle

- 1. Using the single-rate method, allocate costs to the dark chocolate division and the milk chocolate division in these three ways.

- a. Calculate the budgeted rate per round-trip and allocate costs based on round-trips budgeted for each division.

- b. Calculate the budgeted rate per round-trip and allocate costs based on actual round-trips used by each division.

- c. Calculate the actual rate per round-trip and allocate costs based on actual round-trips used by each division.

- 2. Describe the advantages and disadvantages of using each of the three methods in requirement 1. Would you encourage Chocolat Inc. to use one of these methods? Explain and indicate any assumptions you made.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

COST ACCOUNTING

- Rouse manufactures coffee mugs that it sells to other companies for customizing with their own logos. Rouse prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budge volume of 59,700 coffee mugs per month:arrow_forwardZarson’s Netballs is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the number of setups. Equipment and maintenance costs increase with the number of machine-hours, and lease rent is paid per square foot. Capacity of the facility is 14,000 square feet, and Zarson is using only 80% of this capacity. Required. Zarson records the cost of unused capacity as a separate line item and not as a product cost. The following is the budgeted information for Zarson:(RESOURCE IN PICTURE ATTATCHED) Q.What is the budgeted cost of unused capacity?arrow_forwardZarson’s Netballs is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the number of setups. Equipment and maintenance costs increase with the number of machine-hours, and lease rent is paid per square foot. Capacity of the facility is 14,000 square feet, and Zarson is using only 80% of this capacity. Required. Zarson records the cost of unused capacity as a separate line item and not as a product cost. The following is the budgeted information for Zarson:(RESOURCE IN PICTURE ATTATCHED) Q. What is the budgeted total cost and the cost per unit of resources used to produce (a) basketballs and (b) volleyballs?arrow_forward

- Zarson’s Netballs is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the number of setups. Equipment and maintenance costs increase with the number of machine-hours, and lease rent is paid per square foot. Capacity of the facility is 14,000 square feet, and Zarson is using only 80% of this capacity. Required. Zarson records the cost of unused capacity as a separate line item and not as a product cost. The following is the budgeted information for Zarson:(RESOURCE IN PICTURE ATTATCHED) Q. Calculate the budgeted cost per unit of cost driver for each indirect cost pool.arrow_forwardZarson’s Netballs is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the number of setups. Equipment and maintenance costs increase with the number of machine-hours, and lease rent is paid per square foot. Capacity of the facility is 14,000 square feet, and Zarson is using only 80% of this capacity. Zarson records the cost of unused capacity as a separate line item and not as a product cost. The following is the budgeted information for Zarson Zarson’s Netballs Budgeted Costs and Activities For the Year Ended December 31, 2017 Direct materials—basketballs $ 168,100 Direct materials—volleyballs 303,280 Direct manufacturing labor—basketballs 111,800 Direct manufacturing labor—volleyballs…arrow_forwardZarson’s Netballs is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the number of setups. Equipment and maintenance costs increase with the number of machine-hours, and lease rent is paid per square foot. Capacity of the facility is 14,000 square feet, and Zarson is using only 80% of this capacity. Zarson records the cost of unused capacity as a separate line item and not as a product cost. The following is the budgeted information for Zarson Zarson’s Netballs Budgeted Costs and Activities For the Year Ended December 31, 2017 Direct materials—basketballs $ 168,100 Direct materials—volleyballs 303,280 Direct manufacturing labor—basketballs 111,800 Direct manufacturing labor—volleyballs…arrow_forward

- Venus Creations sells window treatments (shades, blinds, and awnings) to both commercial and residential customers. The following information relates to its budgeted operations for the current year. Commercial Residential Revenues $295,000 $475,000 Direct materials costs $29,000 $49,000 Direct labor costs 99,000 287,500 Overhead costs 80,000 208,000 149,000 485,500 Operating income (loss) $87,000 $(10,500) The controller, Peggy Kingman, is concerned about the residential product line. She cannot understand why this line is not more profitable given that the installations of window coverings are less complex for residential customers. In addition, the residential client base resides in close proximity to the company office, so travel costs are not as expensive on a per client visit for residential customers. As a result, she has decided to take a closer look at the overhead costs assigned to…arrow_forwardGonzales Corp. needs to set a target price for its newly designed product EverReady. The following data relate to this product. Per Unit Total Direct Material $20 Direct Labor $40 Variable manufacturing Overhead $10 Fixed manufacturing overhead $1,200,000 Variable selling and administrative $5 Fixed selling and administrative $1,120,000 The costs shown above are based on a budgeted volume of 80,000 units produced and sold each year. Gonzales uses cost-plus pricing methods to set its target selling price. Because some managers prefer absorption-cost pricing and others prefer variable-cost pricing, the accounting department provides information under both approaches using a markup of 50% on absorption cost and a markup of 70% on variable cost.…arrow_forwardThe following table depicts the budgeted sales volume and per unit costs and profits for an English manufacturer (Toys Ltd.) of two different children’s toys, both of which are produced in the same factory (b) Consider Toys Ltd. again. Assume that the production manager is considering a new packaging machine. For a total investment of £10,000, Fixed Overhead Cost can be reduced by £5,000 and the per unit cost of material and labor can both be reduced by 10%, for both products. Calculate the impact of such a scheme on total profits. Should they accept or reject this new scheme?arrow_forward

- Young Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forwardCarleigh, Inc., is a pork processor. Its plants, located in the Midwest, produce several products from a common process: sirloin roasts, chops, spare ribs, and the residual. The roasts, chops, and spare ribs are packaged, branded, and sold to supermarkets. The residual consists of organ meats and leftover pieces that are sold to sausage and hot dog processors. The joint costs for a typical week are as follows: The revenues from each product are as follows: sirloin roasts, 68,000; chops, 71,000; spare ribs, 33,000; and residual, 9,800. Carleighs management has learned that certain organ meats are a prized delicacy in Asia. They are considering separating those from the residual and selling them abroad for 52,000. This would bring the value of the residual down to 2,650. In addition, the organ meats would need to be packaged and then air freighted to Asia. Further processing cost per week is estimated to be 27,500 (the cost of renting additional packaging equipment, purchasing materials, and hiring additional direct labor). Transportation cost would be 12,100 per week. Finally, resource spending would need to be expanded for other activities as well (purchasing, receiving, and internal shipping). The increase in resource spending for these activities is estimated to be 3,120 per week. Required: 1. What is the gross profit earned by the original mix of products for one week? 2. Should the company separate the organ meats for shipment overseas or continue to sell them at split-off? What is the effect of the decision on weekly gross profit?arrow_forwardUse the following information for Problems 9-67 through 9-69: Ladan Suriman, controller for Healthy Pet Company, has been instructed to develop a flexible budget for overhead costs. The company produces two types of dog food. BasicDiet is a standard mixture for healthy dogs. SpecialDiet is a reduced protein formulation for older dogs with health problems. The two dog foods use common raw materials in different proportions. The company expects to produce 80,000 bags of each product during the coming year. BasicDiet requires 0.20 direct labor hour per bag, and SpecialDiet requires 0.30 direct labor hour per bag. Ladan has developed the following fixed and variable costs for each of the four overhead items: Problem 9-68 Flexible Budget for Various Production Levels Refer to the information for Healthy Pet Company on the previous page. Required: 1. Calculate the direct labor hours required for production that is 10% higher than expected. Calculate the direct labor hours required for production that is 20% lower than expected. 2. Prepare an overhead budget that reflects production that is 10% higher than expected and for production that is 20% lower than expected. (Hint: Use total direct labor hours calculated in Requirement 1.)arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,