Concept explainers

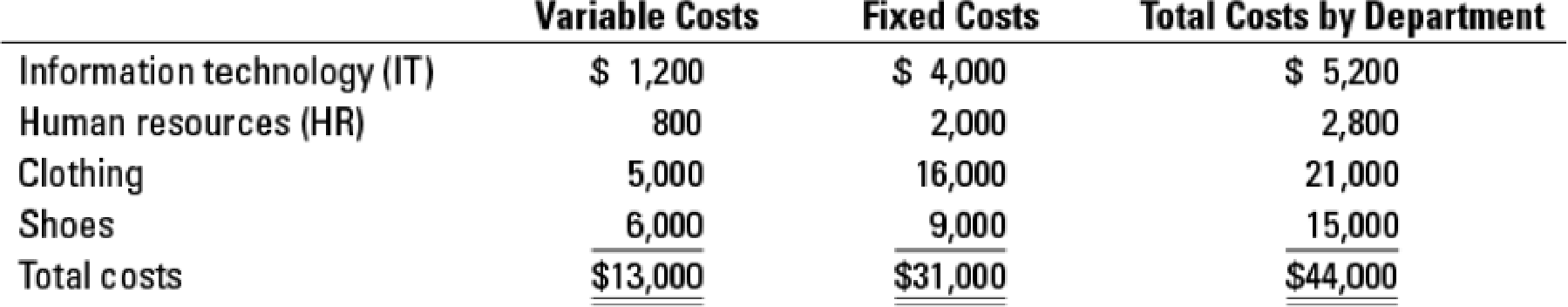

Support-department cost allocations; single-department cost pools; direct, step-down, and reciprocal methods. Sportz, Inc., manufactures athletic shoes and athletic clothing for both amateur and professional athletes. The company has two product lines (clothing and shoes), which are produced in separate manufacturing facilities; however, both manufacturing facilities share the same support services for information technology and human resources. The following shows costs (in thousands) for each manufacturing facility and for each support department.

The total costs of the support departments (IT and HR) are allocated to the production departments (clothing and shoes) using a single rate based on the following:

| Information technology: | Number of IT labor-hours worked by department |

| Human resources: | Number of employees supported by department |

Data on the bases, by department, are given as follows:

| Department | IT Hours Used | Number of Employees |

| Clothing | 10,080 | 440 |

| Shoes | 7,920 | 176 |

| Information technology | — | 184 |

| Human resources | 6,000 | — |

- 1. What are the total costs of the production departments (clothing and shoes) after the support-department costs of information technology and human resources have been allocated using (a) the direct method, (b) the step-down method (allocate information technology first), (c) the step-down method (allocate human resources first), and (d) the reciprocal method?

Required

- 2. Assume that all of the work of the IT department could be outsourced to an independent company for $97.50 per hour. If Sportz no longer operated its own IT department, 30% of the fixed costs of the IT department could be eliminated. Should Sportz outsource its IT services?

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

COST ACCOUNTING

Additional Business Textbook Solutions

Horngren's Accounting (11th Edition)

Financial Accounting (11th Edition)

Managerial Accounting: Tools for Business Decision Making

Intermediate Accounting (2nd Edition)

Introduction To Managerial Accounting

Financial Accounting (12th Edition) (What's New in Accounting)

- A manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardPelder Products Company manufactures two types of engineering diagnostic equipment used in construction. The two products are based upon different technologies, X-ray and ultrasound, but are manufactured in the same factory. Pelder has computed the manufacturing cost of the X-ray and ultrasound products by adding together direct materials, direct labor, and overhead cost applied based on the number of direct labor hours. The factory has three overhead departments that support the single production line that makes both products. Budgeted overhead spending for the departments is as follows: Pelders budgeted manufacturing activities and costs for the period are as follows: The budgeted cost to manufacture one ultrasound machine using the activity-based costing method is: a. 225. b. 264. c. 293. d. 305.arrow_forwardSupport department cost allocation Blue Mountain Masterpieces produces pictures, paintings, and other home decor. The Printing and Framing production departments are supported by the Janitorial and Security departments. Janitorial costs are allocated to the production departments based on square feet, and security costs are allocated based on asset value. Information about these departments is detailed in the following table: Management has experimented with different support department cost allocation methods in the past. The different allocation methods did not yield large differences of cost allocation to the production departments. Instructions 1. Determine which support department cost allocation method Blue Mountain Masterpieces would most likely use to allocate its support department costs to the production departments. 2. Determine the total costs allocated from each support department to each production department using the method you determined in part (1). 3. Without doing calculations, consider and answer the following: If Blue Mountain Masterpieces decided to use square feet instead of asset value as the cost driver for security services, how would this change the allocation of Security Department costs?arrow_forward

- A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardHighland Publishing Company is a large organization offering a variety of printing and binding work. The Printing and Binding departments are supported by three service departments. The costs of these service departments are allocated to other departments in the order listed below. The Personnel cost is allocated based on number of employees. The Custodial Services cost is allocated based on square feet of space occupied and the Maintenance cost is allocated based on machine-hours. Department Total Labor-Hours Square Feet of Space Occupied Number of Employees Machine-Hours Direct Labor-Hours Personnel 16,400 12,600 27 Custodial Services 8,600 3,900 49 Maintenance 14,300 10,200 65 Printing 30,600 40,300 109 162,000 13,000 Binding 101,000 21,000 307 41,000 80,000 170,900 88,000 557 203,000 93,000 Budgeted overhead costs in each department for the current year are shown below: Personnel $ 320,000 Custodial Services 65,300 Maintenance 93,300…arrow_forwardScotland Beauty Products (SBP) manufactures face cream, body lotion, and liquid soap in a joint manufacturing process in one manufacturing facility. SBP has three general managers with each one in charge of a separate product line. Michelle Tallerico oversees the face cream line, Becky Borger oversees the body lotion line, and Lorie Osho oversees the liquid soap line. Consider the following performance report for the three general managers and their product lines, where each line is assigned direct costs and allocated support costs and joint costs. Michelle TallericoFace Cream Becky BorgerBody Lotion Lorie OshoLiquid Soap Actual Target Over(Under)Target Actual Target Over(Under)Target Actual Target Over(Under)Target Direct materials $104,567 $107,000 $(2,433) $178,748 $175,000 $3,748 $146,792 $150,000 $(3,208) Direct labor 238,102 225,000 13,102 280,928 250,000 30,928 234,857 244,000 (9,143) Allocated support costs 598,342 600,000 (1,658) 598,090 625,000 (26,910) 605,342…arrow_forward

- Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. No effort is made to separate fixed and variable costs; however, only budgeted costs are allocated. Allocations for the coming year are based on the following data: Use the rounded values for subsequent calculations. Support Departments Operating Divisions Power General Factory Pottery Retail Overhead costs $150,000 $171,600 $97,000 $55,000 Machine hours 2,000 2,500 7,000 3,000 Square footage 2,500 1,700 4,000 6,000 Round all allocation ratios to four significant digits. Round all allocated amounts to the nearest dollar. Required: 1. Allocate the support service costs using the direct method. Note: Input to two decimal places. Allocation…arrow_forwardDuweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. No effort is made to separate fixed and variable costs; however, only budgeted costs are allocated. Allocations for the coming year are based on the following data: Use the rounded values for subsequent calculations. Support Departments Operating Divisions Power General Factory Pottery Retail Overhead costs $150,000 $171,600 $97,000 $55,000 Machine hours 2,000 2,500 7,000 3,000 Square footage 2,500 1,700 4,000 6,000 Round all allocation ratios to four significant digits. Round all allocated amounts to the nearest dollar. Required: 2. Allocate the support service costs using the sequential method. The support departments are ranked in order of…arrow_forwardData Performance, a computer software consulting company, has three major functional areas: computer programming, information systems consulting, and software training. Carol Bingham, a pricing analyst, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Carol is considering three different methods of the departmental allocation approach to allocate overhead costs: the direct method, the step method, and the reciprocal method. She assembled the following data from the two service departments, information systems and facilities: Service Departments Production Departments Information Systems Facilities Computer Programming Information Systems Consulting Software Training Total Budgeted overhead (base) $ 368,000 $ 184,000 $ 736,000 $ 874,000 $ 575,000 $ 2,737,000 Information Systems (computer hours) 600 1,200 300 900 3,000 Facilities (square feet) 240 960 600 600…arrow_forward

- Cost allocation to divisions. Forber Bakery makes baked goods for grocery stores and has three divisions: bread, cake, and doughnuts. Each division is run and evaluated separately, but the main headquarters incurs costs that are indirect costs for the divisions. Costs incurred in the main headquarters are as follows: The Forber upper management currently allocates this cost to the divisions equally. One of the division managers has done some research on activity-based costing and proposes the use of different allocation bases for the different indirect costs—number of employees for HR costs, total revenues for accounting department costs, square feet of space for rent and depreciation costs, and equal allocation among the divisions of “other” costs. Information about the three divisions follows: Allocate the indirect costs of Forber to each division equally. Calculate division operating income after allocation of headquarter costs. Allocate headquarter costs to the individual…arrow_forwardBoysenberry Corp. has two support departments, Personnel (P) and Maintenance (M), and two producing departments, Blending (B) and Finishing (F). Estimated direct costs and percentages of services used by these departments are as follows: Used by Department Support Dept. P M B F P - 10% 60% 30% M 10% - 40% 50% Direct costs Required: $9,000 $13,500 $40,000 $35,000 Prepare a schedule allocating the support department costs to the producing departments using the direct allocation method. Prepare a schedule allocating the support department costs to the producing departments using the sequential allocation method.arrow_forwardSupport Department Cost Allocation—Reciprocal Services Method Blue Africa Inc. produces laptops and desktop computers. The company’s production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company’s production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $242,000. The total cost of the Cafeteria Department is $490,000. The number of employees and the square footage in each department are as follows: Employees Square Feet Security Department 10 520 Cafeteria Department 28 2,400 Laser Department 40 3,200 Forming Department 50 2,400 Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning