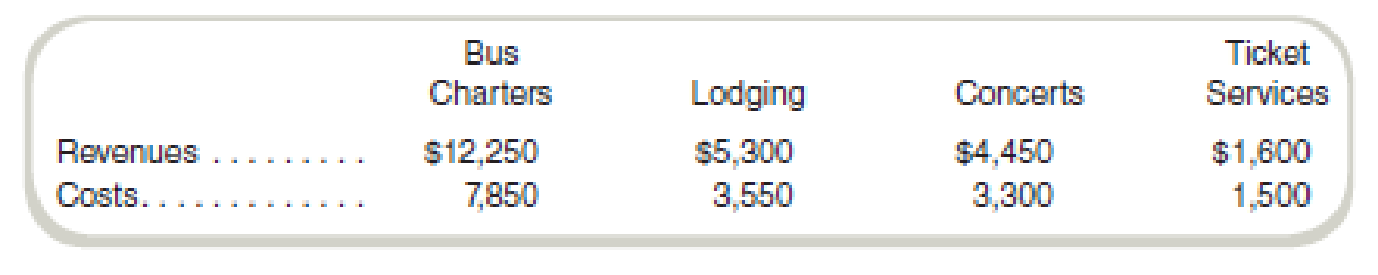

Midwest Entertainment has four operating divisions: Bus Charters, Lodging, Concerts, and Ticket Services. Each division is a separate segment for financial reporting purposes. Revenues and costs related to outside transactions were as follows for the past year (dollars in thousands):

Bus Charters Division participates in a frequent guest program with Lodging Division. During the past year, Bus Charters reported that it traded lodging award coupons for travel that had a retail value of $1.3 million, assuming that the travel was redeemed at full fares. Concerts Division offered 20 percent discounts to Midwest’s bus passengers and lodging guests. These discounts to bus passengers were estimated to have a retail value of $350,000. Midwest’s lodging guests redeemed $150,000 in concert discount coupons. Midwest’s hotels also provided rooms for Bus Charters’s employees (drivers and guides). The value of the rooms for the year was $650,000.

Ticket Services Division sold chartered tours for Bus Charters valued at $200,000 for the year. This service for intracompany lodging was valued at $100,000. It also sold concert tickets for Concerts; tickets for intracompany concert admission were valued at $50,000.

While preparing all of these data for financial statement presentation, Lodging Division’s controller stated that the value of the bus coupons should be based on their differential and opportunity costs, not on the full fare. This argument was supported because travel coupons are usually allocated to seats that would otherwise be empty or that are restricted similar to those on discount tickets. If the differential and opportunity costs were used for this transfer price, the value would be $250,000 instead of $1.3 million. Bus Charters’s controller made a similar argument concerning the concert discount coupons. If the differential cost basis were used for the concert coupons, the transfer price would be $50,000 instead of the $350,000.

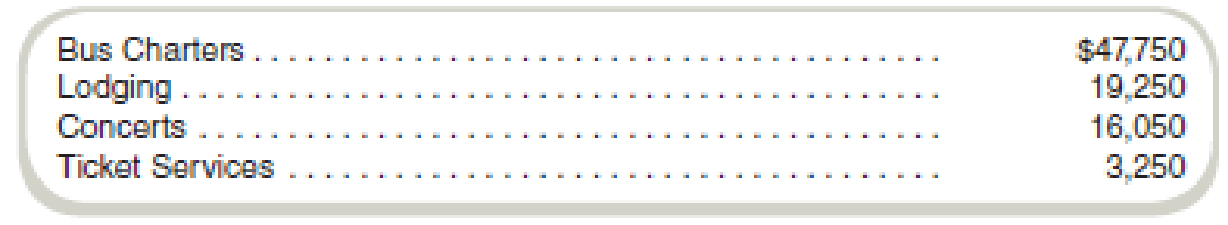

Midwest reports assets in each division as follows (dollars in thousands):

Required

- a. Using the retail values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest division?

- b. What are the operating profits for each Midwest division using the differential cost basis for pricing transfers?

- c. Rank each division by

ROI using the transfer pricing methods in requirements (a) and (b). What difference does the transfer pricing system have on the rankings?

Trending nowThis is a popular solution!

Chapter 15 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows: The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 8,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. a. Determine the return on investment for the Specialty Products Division for the past year. b. Determine the Specialty Products Division managers bonus for the past year. c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places. d. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. e. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.arrow_forwardDeere Company (DE) manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deeres credit division loans money to customers to finance the purchase of their farm and construction equipment. The following information is available for three recent years (in millions except per-share amounts): 1. Calculate the following ratios for each year. Round ratios and percentages to one decimal place, except for per-share amounts, which should be rounded to the nearest cent. a. Return on total assets b. Return on stockholders' equity c. Earnings per share d. Dividend yield e. Price-earnings ratio 2. Based on these data, evaluate Deeres profitability.arrow_forwardPandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2021, year-end trial balance contained the following income statement items: Account Title Debits CreditsSales revenue $ 12,500,000Interest revenue 50,000Loss on sale of investments $ 100,000Cost of goods sold 6,200,000Selling expense 620,000General and administrative expense 1,520,000Interest expense 40,000Research and development expense 1,200,000Income tax expense 900,000 Required:Calculate…arrow_forward

- Merton Electronics operates two retail outlets in Port Wren, one downtown and the other in Docklands. The stores share the use of a corporate staff responsible for functions such as personnel, IT, marketing, purchasing, and so on. The cost of the corporate activities for last year was $162,000. The following are the operating results for the two stores for the year: Downtown Docklands Sales revenue $ 720,000 $ 900,000 Number of employees 45 30 Required: Allocate the cost of the corporate activities to the two stores based on: Number of employees. store revenue.arrow_forwardYozamba Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: Tech Support Department $800,100 Purchasing Department 258,000 Other corporate administrative expenses 455,000 Total corporate expense $1,513,100 The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Support Department charges the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department charges divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 390 computers 6,000 purchase orders Commercial Division 240 11,200 Total 630 computers 17,200 purchase orders The service department charges of the…arrow_forwardYozamba Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: Tech Support Department $459,200 Purchasing Department 96,900 Other corporate administrative expenses 545,000 Total corporate expense $1,101,100 The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Support Department charges the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department charges divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 380 computers 1,900 purchase orders Commercial Division 180 3,800 Total 560 computers 5,700 purchase orders The service department charges of…arrow_forward

- "Company B, is a private company that designs, manufactures and distributes certain consumer products. In this fiscal year, Company B had revenues of $90 Millions of USDs and earnings of $30 of Millions of USDs. Company B has filed a registration statement with the SEC for its IPO. If the industry average Price/Earnings ratio and Price/Revenues ratio for the recent fiscal year were 14 and 0.8 respectively. Estimate the IPO price for Company B using the Price/Earnings ratio and assuming that they will issue 15 Million shares."arrow_forwardRichmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodeling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodeled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the Situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: According to the IMA’s Statement of Ethical Professional Practice, would it be ethical for Perlman not to report the inventory…arrow_forwardAlpha Milk Corp is considering taking over their competitor, Dana Dairy Products, and asked your consultancy firm to perform financial statement analysis to assess feasibility of this strategic initiative. You are given the following key financial ratios, the firm’s income statement and the balance sheet. You can assume that there are 365 days in a year. a) Using the information provided for 31 Dec 2005, calculate the following: net working capital, current ratio, quick ratio, inventory turnover, average collection period, total debt ratio, gross profit margin, net profit margin, return on total assets, return on equity. b) Evaluate the company’s performance against industry average ratios and compare with last year’s results. To answer, please refer to pictures attachedarrow_forward

- Arden Books Limited is considering the acquisition of a bookbinding company to expand the publishing interests. Its chief executive has highlighted two possible target, Cliff Binding Limited and Harry Publishing Services Limited. The following information has been obtained for their most recent financial year: Cliff Binding Profit & Sale ££ Sales 68,000 Cost of sales 30,000 Gross profit margin 38,000 Selling & distribution costs 16,000 Administrative cost 10,000 16,000 Profit before Tax 12,000 Taxation 3,000 Profit after Tax 9,000 Statement of Financial Position Non-current assets 10,600 Current assets 18,000 Payables 28,000 Cash - 46,000 Current Liabilities Creditors 26,000 Overdraft 5,000 31,000 Net current assets 15,000 25,600 Capital and reserves Ordinary share capital 10,000 Harry Publishing ££ 61,500 38,000 23,500 10,000 6,500 16,500 7,000 1,750 5,250 8,300 8,000 10,000 2,000 20,000 6,000 - 6,000 14,000 22,00 12,000…arrow_forwardYozamba Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: Tech Support Department $567,000 Purchasing Department 96,900 Other corporate administrative expenses 590,000 Total corporate expense $1,253,900 The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Support Department charges the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department charges divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 360 computers 1,990 purchase orders Commercial Division 270 3,710 Total 630 computers 5,700 purchase orders The service department charges of…arrow_forwardEcru Company has identified five industry segments: plastics, metals, lumber, paper, and finance. It appropriately consolidated each of these segments in producing its annual financial statements. Information describing each segment (in thousands) follows: Plastics Metals Lumber Paper Finance Sales to outside parties $ 6,325 $ 2,144 $ 636 $ 347 $ 0 Intersegment transfers 108 131 96 108 0 Interest income from outside parties 0 19 6 0 27 Interest income from intersegment loans 0 0 0 0 159 Operating expenses 3,914 1,612 916 579 16 Interest expense 61 16 51 31 87 Tangible assets 1,291 2,986 314 561 104 Intangible assets 72 361 0 48 0 Intersegment loans (debt) 0 0 0 0 664 Ecru does not allocate its $1,250,000 in…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT