Kent Tessman, manager of a Dairy Products Division, was pleased with his division’s performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the division’s reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management.

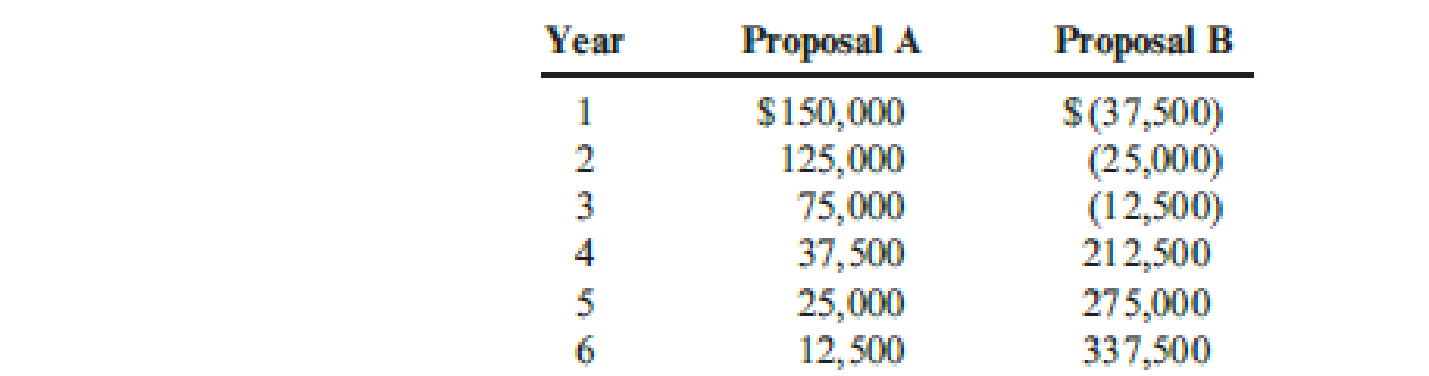

Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The division’s cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of $250,000, and Proposal B requires $312,500. Both projects could be funded, given the status of the division’s capital budget. Both have an expected life of six years and have the following projected after-tax cash flows:

After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B.

Required:

- 1. Compute the

NPV for each proposal. - 2. Compute the payback period for each proposal.

- 3. According to your analysis, which proposal(s) should be accepted? Explain.

- 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.

Trending nowThis is a popular solution!

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Dana Baird was manager of a new Medical Supplies Division. She had just finished her second year and had been visiting with the companys vice president of operations. In the first year, the operating income for the division had shown a substantial increase over the prior year. Her second year saw an even greater increase. The vice president was extremely pleased and promised Dana a 5,000 bonus if the division showed a similar increase in profits for the upcoming year. Dana was elated. She was completely confident that the goal could be met. Sales contracts were already well ahead of last years performance, and she knew that there would be no increases in costs. At the end of the third year, Dana received the following data regarding operations for the first three years: The predetermined fixed overhead rate is based on expected actual units of production and expected fixed overhead. Expected production each year was 10,000 units. Any under-or overapplied fixed overhead is closed to Cost of Goods Sold. Assumes a LIFO inventory flow. Upon examining the operating data, Dana was pleased. Sales had increased by 20 percent over the previous year, and costs had remained stable. However, when she saw the yearly income statements, she was dismayed and perplexed. Instead of seeing a significant increase in income for the third year, she saw a small decrease. Surely, the Accounting Department had made an error. Required: 1. Explain to Dana why she lost her 5,000 bonus. 2. Prepare variable-costing income statements for each of the three years. Reconcile the differences between the absorption-costing and variable-costing incomes. 3. If you were the vice president of Danas company, which income statement (variable-costing or absorption-costing) would you prefer to use for evaluating Danas performance? Why?arrow_forwardBill Fremont, division controller and CMA, was upset by a recent memo he received from the divisional manager, Steve Preston. Bill was scheduled to present the divisions financial performance at headquarters in one week. In the memo, Steve had given Bill some instructions for this upcoming report. In particular, Bill had been told to emphasize the significant improvement in the divisions profits over last year. Bill, however, didnt believe that there was any real underlying improvement in the divisions performance and was reluctant to say otherwise. He knew that the increase in profits was because of Steves conscious decision to produce more inventory. In an earlier meeting, Steve had convinced his plant managers to produce more than they knew they could sell. He argued that by deferring some of this periods fixed costs, reported profits would jump. He pointed out two significant benefits. First, by increasing profits, the division could exceed the minimum level needed so that all the managers would qualify for the annual bonus. Second, by meeting the budgeted profit level, the division would be better able to compete for much-needed capital. Bill objected but had been overruled. The most persuasive counterargument was that the increase in inventory could be liquidated in the coming year as the economy improved. Bill, however, considered this event unlikely. From past experience, he knew that it would take at least two years of improved market demand before the productive capacity of the division was exceeded. Required: 1. Discuss the behavior of Steve Preston, the divisional manager. Was the decision to produce for inventory an ethical one? 2. What should Bill Fremont do? Should he comply with the directive to emphasize the increase in profits? If not, what options does he have? 3. Chapter 1 listed ethical standards for management accountants. Identify any standards that apply in this situation.arrow_forwardDantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)arrow_forward

- Malone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make any move. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,900,000 Variable expenses 14,313,400 Contribution margin 8,586,600 Fixed expenses 6,205,000 Net operating income $ 2,381,600 Divisional average operating assets $ 4,580,000 The company had an overall return on investment (ROI) of 17.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product line that…arrow_forwardI know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make any move. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 23,000,000 Variable expenses 14,365,000 Contribution margin 8,635,000 Fixed expenses 6,220,000 Net operating income $ 2,415,000 Divisional average operating assets $ 5,001,000 The company had an overall return on investment (ROI) of 16.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new…arrow_forward

- Payback, NPV, Managerial Incentives, Ethical Behavior Kent Tessman, manager of a Dairy Products Division, was pleased with his division's performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the division's reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The division's cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward

- “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forwardSunshine Industrial Ltd, a massive retailer of electronic products, is organised in four separatebusiness divisions. The four divisional managers are evaluated at year-end, and bonuses areawarded based on return on investment (ROI). Last year, the corporation as a whole achieved aROI of 13%.During the past week, the divisional manager of the Asia-Pacific Division was approachedabout the possibility of acquiring a competitor that had decided to redirect its retail activities.The following data relates to the recent performance of the Asia-Pacific Division and thecompetitor:Asia-Pacific Division CompetitorInvested capital $1,850,000 $ 625,000Sales $8,400,000 $5,200,000Variable costs 70% of sales 65% of salesFixed costs $2,150,000 $1,670,000Management has determined that in order to upgrade the competitor to Sunshine’s standards,an additional $375,000 of invested capital would be needed.Required:(a) Compute the ROI of the Asia-Pacific Division for the following scenarios:(i) before the…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub