Concept explainers

Plantwide and Departmental Predetermined Overhead Rates;

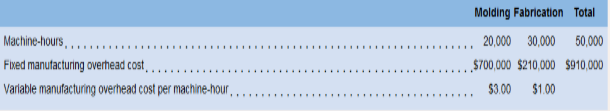

Delph Company uses a job-order costing system and bas two manufacturing departments- Molding and Fabrication. The company provided the following estimates at the be2innina of the year:

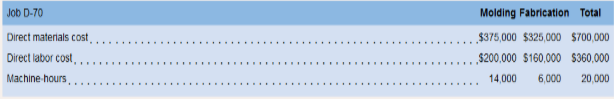

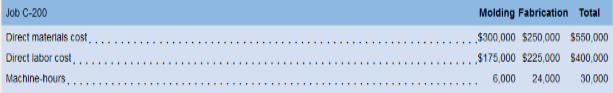

During the year, the company had no beginning or ending inventories and it stated, completed, and sold only two jobs—Job D-70 and Job C-200. It provided the following information related to those two jobs:

Delph had no underapplied or overapplied overhead during the year.

Required:

Assume Delph uses a p1antide predetermined overhead rate based on machine-hours.

a. Compute the pIantwide predetermined overhead rate.

b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200.

c. If Delph establishes bid prices that are 150% of total manufacturing cost what bid prices would it have established for Job D-70 and Job C-200?

d. What is Delph’s cost of goods sold for the year?

2. Assume Delph uses departmental predetermined overhead rates based on machine-hours.

a. Compute the departmental predetermined overhead rates.

b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200.

c. If Delph establishes bid prices that are 150% of total

d. What is Delph’s cost of goods sold for the year?

3. What managerial insights are revealed by the computations that you performed in this problem? (Hint: Do the cost of goods sold amounts that you computed in requirements 1 and 2 differ from one another? Do the bid prices that you computed in requirements 1 and 2 differ from one another? Why?

Requirement − 1:

(a).

Predetermined overhead rate: Predetermined overhead rate refers to the rate of estimated overhead which need to be followed by a firm.

To find: Plant wide predetermined overhead rate.

Answer to Problem 15E

Solution:

Explanation of Solution

- Given: Following information are given in the question:

Fixed manufacturing overhead for molding department = $700000

Fixed manufacturing overhead for fabrication department = $210000

Variable manufacturing overhead rate for molding department= $3

Variable manufacturing overhead rate for fabrication department = * $1

Machine hours for molding department= 20000

Machine hours for fabrication department = 30000

- Formula: Following formula will be used;

- Calculation:

As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours.

Fixed manufacturing overheadfor molding department = $700000

Fixed manufacturingoverheadfor fabrication department = $210000

Now let’s put values in the above given formula;

Thus, above calculated is the plantwide predetermined overhead rate.

(b).

Total manufacturing cost: Total manufacturing cost refers to the overall costs of manufacturing a specific product..

To identify: Total manufacturing cost assigned to Job D-70 and Job C-200.

Formula:

Total manufacturing cost = (Direct materials + Direct labor cost + Manufacturing overhead applied)

Answer to Problem 15E

Solution:

For Job D-70;

For Job C-200;

Explanation of Solution

- Given: Following information are given;

For Job D-70;

Direct material costs = $700000

Direct labor cost = $360000

For Job C-200;

Direct material costs = $550000

Direct labor cost = $400000

- Formula used: Following formula will be used;

- Calculation:

As per information of the question direct materials, direct labor cost are given but we have to calculate manufacturing overhead applied.

For Job D-70;

For Job C-200;

So far we have calculated total manufacturing cost of each job. Thus for calculating total manufacturing cost of both job, we need to add both manufacturing costs.

Thus, above calculated is the total manufacturing cost assigned to Job D-70 and Job C-200.

(c).

Bid price per unit: Bid price refers to the maximum price at which Delph Company would sale its’ manufactured to the customers.

To identify: Bid price for Job D-70 and for Job C-200, if Delph established bid price 150% of it’s total manufacturing cost.

Answer to Problem 15E

Solution:

Bid price for Job D-70;

Bid price for Job C-200;

Explanation of Solution

- Given: Following information are given;

Manufacturing cost for Job D-70 = $1460000

Manufacturing cost for Job C-200 = $1550000

Bid price is 150% of manufacturing cost

- Formula used: Following formula will be used;

- Calculation:

Bid price for Job D-70;

As we know that;

Total manufacturing cost for Job D-70 = $1460000

Bid price is (150% of total manufacturing cost) =

Bid price for Job C-200;

As we know that;

Total manufacturing cost for Job C-200 = $1550000

Bid price is (150% of total manufacturing cost) =

Thus, above calculated is the bid price for job D-70 and for Job C-200.

(d).

Cost of Goods Sold: Cost of goods sold refers to the cost which incurrred till the saleof product by a firm.

To identify: Cost of goods sold for the year.

Answer to Problem 15E

Solution:

Explanation of Solution

- Given: Following information are given;

Total manufacturing cost for Job D-70 = $1460000

Total manufacturing cost for Job C-200 = $1550000

- Formula used: Following formula will be used;

- Calculation:

As we have already calculated manufacturing cost of each job.

Total manufacturing cost for Job D-70 = $1460000

Total manufacturing cost for Job C-200 = $1550000

Thus, above calculated is the cost of goods sold for the year.

Requirement − 2

(a).

Predetermined overhead rate: Predetermined overhead rate refers to the rate of estimated overhead which need to be followed by a firm.

To identify: Departmental predetermined overhead rate.

Answer to Problem 15E

Solution:

As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours for each department.

For Molding Department;

For Fabrication Department;

Explanation of Solution

- Given: Following information are given;

For Molding Department;

Fixed manufacturing overhead for molding department = $700000

Variable manufacturing overhead rate for molding department = $3

Estimated machine hours for molding department = 20000

For Fabrication Department;

Fixed manufacturing overhead for fabrication department = $210000

Variable manufacturing overhead rate for molding department = $1

Estimated machine hours for fabrication department = 30000

- Formula used: Following formula will be used;

- Calculation:

As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours for each department.

For Molding Department;

Fixed manufacturing overhead for molding department = $700000

Estimated machine hours for molding department = 20000

Now let’s put values in the above given formula;

For Fabrication Department;

Estimated machine hours for fabrication department = 30000

Now let’s put values in the above given formula;

Thus, above calculated is the departmental predetermined overhead rate for each department.

(b).

Total manufacturing cost: Total manufacturing cost refers to the overall costs of manufacturing a specific product..

To identify: Total manufacturing cost assigned to Job D-70 and Job C-200.

Answer to Problem 15E

Solution:

For Job D-70;

For Job C-200;

So far we have calculated total manufacturing cost of each job. Thus for calculating total manufacturing cost of both job, we need to add both manufacturing costs.

Explanation of Solution

- Given: Following information are given;

For Job D-70;

Direct material costs = $700000

Direct labor cost = $360000

Manufacturing overhead rate = $38

For Job C-200;

Direct material costs = $550000

Direct labor cost = $400000

Manufacturing overhead rate = $8

- Formula used: Following formula will be used;

- Calculation:

As per information of the question direct materials, direct labor cost are given but we have to calculate manufacturing overhead applied.

For Job D-70; Direct material costs = $700000

Direct labor cost = $360000

For Job C-200; Direct material costs = $550000

Direct labor cost = $400000

So far we have calculated total manufacturing cost of each job. Thus for calculating total manufacturing cost of both job, we need to add both manufacturing costs.

Thus, above calculated is the total manufacturing cost assigned to Job D-70 and Job C-200.

(c).

Bid price per unit: Bid price refers to the maximum sale price at which Delph Company would sale its’ manufactured goods to the customers.

To identify: Bid price for Job D-70 and for Job C-200, if Delph established bid price 150% of it’s total manufacturing cost.

Answer to Problem 15E

Solution:

Bid price for Job D-70;

Bid price for Job C-200;

Explanation of Solution

- Given: following information are given;

Total manufacturing cost for Job D-70 = $1820000

Total manufacturing cost for Job C-200 = $1190000

Bid price is 150% of manufacturing costs

- Formula used: Following formula will be used;

- Calculation:

Bid price for Job D-70;

As we know that;

Total manufacturing cost for Job D-70 = $1820000

Bid price is (150% of total manufacturing cost) =

Bid price for Job C-200;

As we know that;

Total manufacturing cost for Job C-200 = $1190000

Bid price is (150% of total manufacturing cost) =

Thus, above calculated is the bid price for job D-70 and for Job C-200.

(d).

Cost of Goods Sold: Cost of goods sold refers to the cost which incurrred till the sale of product by a firm.

To identify: Cost of goods sold for the year.

Answer to Problem 15E

Solution:

Explanation of Solution

- Given: Following information are given;

Total manufacturing cost for Job D-70 = $1820000

Total manufacturing cost for Job C-200 = $1190000

- Formula used: Following formula will be used;

- Calculation:

As we have already calculated manufacturing cost of each job.

Total manufacturing cost for Job D-70 = $1820000

Total manufacturing cost for Job C-200 = $1190000

Now let’s put the values in above given formula;

Thus, above calculated is the cost of goods sold for the year.

Requirement − 3

To Explain: Critically analysis of differences in bid price and cost of goods sold.

Explanation of Solution

As per information of the question it is clear that Delph Company is establishing it’s bid price at 150% markup. It means Delph Company is establishing bid price 150% of manufacturing costs.

When manufacturing costs are different in case of plantwide overhead rate and in case of departmental overhead rate then bid price will also be different because bid price is calculated on the basis of manufacturing costs.

We know that cost of goods sold is total of manufacturing costs of all jobs. So when manufacturing cost is different in case of plantwide overhead rate and in case of departmental overhead rate then cost of goods sold will also be different because cost of goods sold is calculated on the basis of manufacturing costs.

Thus overall we can say that bid price and cost of goods sold differs in both cases due to difference between manufacturing costs.

Want to see more full solutions like this?

Chapter 2 Solutions

Introduction To Managerial Accounting

- Determining job costcalculation of predetermined rate for applying overhead by direct labor cost and direct labor hour methods Beemer Products Inc. has its factory divided into three departments, with individual factory overhead rates for each department. In each department, all the operations are sufficiently alike for the department to be regarded as a cost center. The estimated monthly factory overhead for the departments is as follows: Forming, 64,000; Shaping, 36,000; and Finishing, 10,080. The estimated production data include the following: The job cost ledger shows the following data for X6, which was completed during the month: Required: Determine the cost of X6. Assume that the factory overhead is applied to production orders, based on the following: 1. Direct labor cost 2. Direct labor hours (Hint: You must first determine overhead rates for each department, rounding rates to the nearest cent.)arrow_forwardPrimera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forwardThe following information, taken from the books of Herman Brothers Manufacturing represents the operations for January: The job cost system is used, and the February cost sheet for Job M45 shows the following: The following actual information was accumulated during February: Required: 1. Using the January data, ascertain the predetermined factory overhead rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.arrow_forward

- Overhead application rate Roll Tide Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,700 direct labor hours. Actual activity for March follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forwardOverhead application rate Creole Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,400 direct labor hours. Actual activity for October follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forwardYellowstone Fabricators uses a process cost system and applies actual factory overhead to work in process at the end of the month. The following data came from the records for March: There were no beginning inventories and no ending work in process inventory. From the information presented, compute the following: 1. Unit cost of production under absorption costing and variable costing. 2. Cost of the ending inventory under absorption costing and variable costing.arrow_forward

- Entry for factory labor costs The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: The direct labor rate earned per hour by the three employees is as follows: The process improvement category includes training, quality improvement, and other indirect tasks. A. Journalize the entry to record the factory labor costs for the week. B. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How would the direct labor costs for all three jobs be reflected on the financial statements at the end of the week?arrow_forwardChannel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardJOURNAL ENTRIES FOR MATERIAL, LABOR, AND OVERHEAD Hilburn Manufacturing Corporation had the following transactions for its job order costing operation. Prepare general journal entries to record these transactions. Jan.1 Purchased materials on account, 17,000. 15 Issued direct materials to Job No. 104, 11,000. 20 Issued indirect materials (factory overhead), 5,000. 31 Incurred direct labor, Job No. 104, 9,000. 31 Incurred indirect labor (factory overhead), 2,500. 31 Incurred other indirect costs (factory overhead; credit Accounts Payable), 2,000.arrow_forward

- Lorrimer Company has a job-order cost system. The following debits (credits) appeared in the Work-in-Process account for the month of June. During the month of June, direct labor totaled 30,000 and 24,000 of overhead was applied to production. Finished Goods was debited 100,000 during June. Lorrimer Company applies overhead at a predetermined rate of 80% of direct labor cost. Job number 83, the only job still in process at the end of June, has been charged with manufacturing overhead of 3,400. What was the amount of direct materials charged to Job number 83? a. 3,400 b. 4,250 c. 8,350 d. 7,580arrow_forwardGerken Fabrication Inc. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of March: a. Compute the total production cost of each job. b. Prepare the journal entries to charge the costs of materials, labor, and factory overhead to Work in Process. c. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. d. Compute the unit cost of each job. e. Compute the selling price per unit for each job, assuming a mark-on percentage of 50%.arrow_forwardPrepare Job-Order Cost Sheets, Predetermined Overhead Rate, Ending Balance of WIP, Finished Goods, and COGS At the beginning of March, Mendez Company had two jobs in process, Job 86 and Job 87, with the following accumulated cost information: During March, two more jobs (88 and 89) were started. The following direct materials and direct labor costs were added to the four jobs during the month of March: At the end of March, Jobs 86, 87, and 89 were completed. Only Job 87 was sold. On March 1, the balance in Finished Goods was zero. Required: 1. Calculate the overhead rate based on direct labor cost. (Note: Round to three decimal places.) 2. Prepare a brief job-order cost sheet for the four jobs. Show the balance as of March 1 as well as direct materials and direct labor added in March. Apply overhead to the four jobs for the month of March, and show the ending balances. 3. Calculate the ending balances of Work in Process and Finished Goods as of March 31. 4. Calculate the Cost of Goods Sold for March.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning