Concept explainers

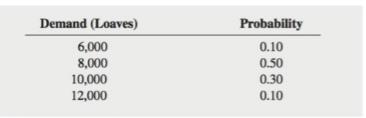

A supermarket chain purchases large quantities of white bread for sale during a week. The stores purchase the bread for

a. Construct a payoff table, indicating the

b. Construct a decision tree.

c. Compute the expected monetary value (EMV) for purchasing 6,000, 8,000, 10,000, and 12,000 loaves.

d. Compute the expected opportunity loss (EOL) for purchasing 6,000, 8,000, 10,000, and 12,000 loaves.

e. Explain the meaning of the

f. Based on the results of (c) or ((1), how many loaves would you purchase? Why?

g. Compute the coef�cient of variation for each purchase level.

h. Compute the return-to-risk ratio (RTRR) for each purchase level.

i. Based on (g) and (h), what action would you choose? Why?

j. Compare the results of (f) and (i) and explain any differences.

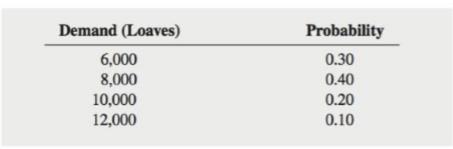

k. Suppose that new information changes the probabilities associated with the demand level. Use the following probabilities to repeat (c) through (j):

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Basic Business Statistics Student Value Edition Plus NEW MyLab Statistics with Pearson eText -- Access Card Package (13th Edition)

Algebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage

Algebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage Calculus For The Life SciencesCalculusISBN:9780321964038Author:GREENWELL, Raymond N., RITCHEY, Nathan P., Lial, Margaret L.Publisher:Pearson Addison Wesley,

Calculus For The Life SciencesCalculusISBN:9780321964038Author:GREENWELL, Raymond N., RITCHEY, Nathan P., Lial, Margaret L.Publisher:Pearson Addison Wesley,