Concept explainers

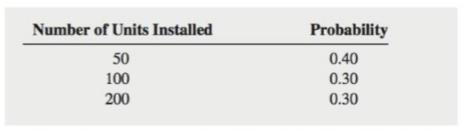

The owner of a company that supplies home heating oil would like to determine whether to offer a solar heating installation service to its customers. The owner of the company has determined that a stamp cost of

a. Construct a payoff table, indicating the

b. Construct a decision tree.

c. Construct an opportunity loss table.

d. Compute the expected monetary value (EMV) for offering this solar heating system installation service.

e. Compute the expected opportunity loss (EOL) for offering this solar heating system installation service.

f. Explain the meaning of the

g. Compute the return-to-risk ratio (RTRR) for offering this solar heating system installation service.

h. Based on the results of (d), (e), and (g), should the company offer this solar heating system installation service? Why?

i. How would your answers to (a) through (h) be affected if the startup cost were

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Basic Business Statistics Student Value Edition Plus NEW MyLab Statistics with Pearson eText -- Access Card Package (13th Edition)

- An insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.08 (8% of all such individuals). Homeowner's Auto N L H 0.04 0.08 0.05 0.02 M 0.07 0.11 0.20 0.08 0.02 0.03 0.15 0.15 Suppose an individual having both types of policies is randomly selected. (a) What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? 0.08 (b) What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible 0.10 homeowner's deductible 0.22 (c) What is the probability that the individual is in the same category for both auto and homeowner's…arrow_forwardAn insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.08 (8% of all such individuals). Homeowner's N L M H Auto 0.04 0.08 0.05 0.01 0.07 0.11 0.20 0.09 н 0.02 0.03 0.15 0.15 Suppose an individual having both types of policies is randomly selected. (a) What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? (b) What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible homeowner's deductible (c) What is the probability that the individual is in the same category for both auto and homeowner's deductibles?…arrow_forwardAn insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.08 (8% of all such individuals). Homeowner's Auto N L H L 0.04 0.08 0.05 0.02 0.07 0.11 0.20 0.08 H. 0.02 0.03 0.15 0.15 Suppose an individual having both types of policies is randomly selected. What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible homeowner's deductible What is the probability that the individual is in the same category for both auto and homeowner's deductibles? Based on…arrow_forward

- An insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.07 (7% of all such individuals). Homeowner's Auto N L M H 0.04 0.07 0.05 0.01 M 0.07 0.11 0.20 0.10 H 0.02 0.03 0.15 0.15 Suppose an individual having both types of policies is randomly selected. (a) What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? (b) What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible homeowner's deductible (c) What is the probability that the individual is in the same category for both auto and homeowner's deductibles?…arrow_forwardAn insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.07 (7% of all such individuals). Auto L M H Homeowner's NLMH Suppose an individual having both types of policies is randomly selected. (a) What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? 0.04 0.07 0.05 0.02 0.07 0.09 0.20 0.11 0.02 0.03 0.15 0.15 (b) What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible homeowner's deductible (c) What is the probability that the individual is in the same category for both auto and homeowner's deductibles?…arrow_forwardAn insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.05 (5% of all such individuals). Auto L M H Homeowner's NLMH 0.04 0.05 0.05 0.02 0.07 0.09 0.20 0.13 0.02 0.03 0.15 0.15 Suppose an individual having both types of policies is randomly selected. (a) What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? (b) What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible homeowner's deductible (c) What is the probability that the individual is in the same category for both auto and homeowner's deductibles?…arrow_forward

- An insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.05 (5% of all such individuals). Homeowner's N L M н Auto L 0.04 0.05 0.05 0.02 M 0.07 0.11 0.20 0.11 0.02 0.03 0.15 0.15 Suppose an individual having both types of policies is randomly selected. (a) What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? (b) What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible homeowner's deductible (c) What is the probability that the individual is in the same category for both auto and homeowner's deductibles?…arrow_forwardAn insurance company offers four different deductible levels-none, low, medium, and high-for its homeowner's policyholders and three different levels-low, medium, and high-for its automobile policyholders. The accompanying table gives proportions for the various categories of policyholders who have both types of insurance. For example, the proportion of individuals with both low homeowner's deductible and low auto deductible is 0.05 (5% of all such individuals). Auto L M H Homeowner's N L M H 0.04 0.05 0.05 0.02 0.07 0.12 0.20 0.10 0.02 0.03 0.15 0.15 Suppose an individual having both types of policies is randomly selected. (a) What is the probability that the individual has a medium auto deductible and a high homeowner's deductible? (b) What is the probability that the individual has a low auto deductible? A low homeowner's deductible? auto deductible homeowner's deductible (c) What is the probability that the individual is in the same category for both auto and homeowner's…arrow_forwardAvicenna, an insurance company, offers five-year commercial property insurance policies to small businesses. If the holder of one of these policies experiences property damage in the next five years, the company must pay out $26,500 to the policy holder. Executives at Avicenna are considering offering these policies for $497 each. Suppose that for each holder of a policy there is a 2% chance they will experience property damage in the next five years and a 98% chance they will not.(If necessary, consult a list of formulas.) If the executives at Avicenna know that they will sell many of these policies, should they expect to make or lose money from offering them? How much? To answer, take into account the price of the policy and the expected value of the amount paid out to the holder. Avicenna can expect to make money from offering these policies. In the long run, they should expect to makedollars on each policy sold. Avicenna can…arrow_forward

- When 20 employees were first hired in 2011 for a creative engineering firm, Company A, the starting annual salary was $35,000. A competing creative engineering firm, Company B, had the same starting salary for 20 employees hired the same year. In 2016, data was collected on the annual salaries of the same employees at each of the two companyies. This data is displayed in the box plot shown. Part A: Compare the annual salary distributions and what are the pros and cons of working at each company? Explain using what you found in Part Aarrow_forwardA cell phone service provider claims that only 1% of their calls get "dropped" (i.e., neither party hangs up, but the connection is lost). You work for the Consumer Protection Agency, and believe that the percent of dropped calls from this provider is higher than 1%. Your agency has been granted access to this company's detailed call records. It takes careful examination of each call transaction to determine if the call can be considered a "dropped call", so you are not able to easily calculate the actual percent of dropped calls directly from the entire database of millions of calls. So, you decide to take a random sample of 2500 calls, and each call is classified as "dropped" or "not dropped". Of the 2500 calls examined, 1.462% of them were classified as "dropped". Calculate the appropriate test statistic. Enter with 2 decimals (eg. 1.96).arrow_forwardClassify each scenario as a cross-sectional study or a longitudinal study. Make sure your answers are legible and spelled correctly. a. A group of kidney transplant recipients is followed for 10 years to determine the effectiveness of their transplant. b. While driving around town one day, a driver searches to find the gas station with the lowest price for regular unleaded gasoline in her neighborhood. c. A labor union conducts a study to determine if pay raises for its members have kept up with the rate of inflation over the last 5 years. d. An economist conducts a study to determine if prolonged periods of low interest rates have an influence on income disparities over time. e. A budget-conscious shopper tries to find the most inexpensive brand of mayonnaise during a trip to the supermarket one evening.arrow_forward

Calculus For The Life SciencesCalculusISBN:9780321964038Author:GREENWELL, Raymond N., RITCHEY, Nathan P., Lial, Margaret L.Publisher:Pearson Addison Wesley,

Calculus For The Life SciencesCalculusISBN:9780321964038Author:GREENWELL, Raymond N., RITCHEY, Nathan P., Lial, Margaret L.Publisher:Pearson Addison Wesley, Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL