Concept explainers

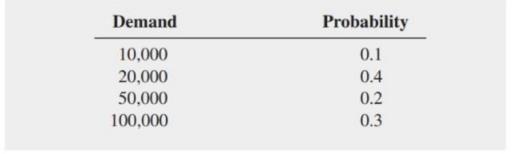

In Problem 20.3, you developed a payoff table for building a small factory or a large factory for manufacturing designer jeans. Given the results of that problem, suppose that the probabilities of the demand are as follows:

a. Determine the optimal action based on the maximax criterion.

b. Determine the optimal action based on the maximin criterion.

c. Compute the expected monetary value (EMV) for building a small factory and building a large factory.

d. Compute the expected opportunity loss (EOL) for building a small factory and building a large factory.

e. Explain the meaning of the

f. Based on the results of (c) or (d), would you choose to build a small factory or a large factory? Why?

g. Compute the coefficient of variation for building a small factory and building a large factory.

h. Compute the return-to-risk ratio (RTRR) for building a small factory and building a large factory.

i. Based on (g) and (h), would you choose to build a small factory or a large factory? Why?

j. Compare the results of (f) and (i) and explain any differences.

k. Suppose that the probabilities of demand are 0.4, 0.2, 0.2, and 0.2, respectively. Repeat (c) through (j) with these probabilities and compare the results with those originally computed in (c)-(j).

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Basic Business Statistics Student Value Edition Plus NEW MyLab Statistics with Pearson eText -- Access Card Package (13th Edition)

- Southland Corporation's decision to produce a new line of recreational products has resulted in the need to choose one of two automated manufacturing systems based on proposals from two vendors, A and B. The economics of this decision depends on the market reaction to the new product line. The possible long-run demand has been defined as low, medium, or high. Based on detailed financial analyses of system costs as a function of volume and sales under each demand scenario, the following payoff table gives the projected profits in millions of dollars. million. Decision Vendor A Vendor B million. Low $70 $160 Long-Run Demand Medium $150 $150 a. Determine the best decisions using the maximax, maximin, and opportunity loss decision criteria. Using the maximax criterion, choose -Select- Using the maximin criterion, choose -Select- To minimize the maximum opportunity loss, choose -Select- b. Assume that the best estimate of the probability of low long-run demand is 0.15, of medium long-run…arrow_forwardA private investment club has $3,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high risk, medium risk, and low risk. Management estimates that high-risk stocks will have a rate of return of 17%/year; medium-risk stocks, 7%/year; and low-risk stocks,6%/year. The members have decided that the investment in low-risk stocks should be a quarter of the sum of the investments in the stocks of the other two categories. Assuming that all the money available for investment is invested, how much should the club invest in each type of stock if the investment goal is to have a return of $413/year on the total investment? (Round your answer to 1 decimal place.)arrow_forwardIf a company has excess capacity, it is contemplating whether a special order should be accepted. The order will not impact regular sales. If the company accepts the special order, what will occur? O Both fixed and variable costs will increase. Net income will increase if the special sales price per unit exceeds the unit variable costs. There are no incremental revenues. Incremental costs will not be affected.arrow_forward

- The Brazilian meat company SoCarnes wishes to start production in France. This new production is associated to a project with the following forecasted cash flows in euros (see table 1 below). The cost of capital in France is 10%, and the spot exchange rate is 6.2 BR$ / 1€ (1 euro buys 6.2 Brazilian reals). The risk-free rate for Brazil is 7% and the risk-free rate for France is 3%. Table 1 Year 0 1 2 3 4 5 CF (in euros) -1000 290 320 370 400 400 Provide another simpler method to compute the project value in Brazilian reals with the same answer as in question 2a).arrow_forwardThe Brazilian meat company SoCarnes wishes to start production in France. This new production is associated to a project with the following forecasted cash flows in euros (see table 1 below). The cost of capital in France is 10%, and the spot exchange rate is 6.2 BR$ / 1€ (1 euro buys 6.2 Brazilian reals). The risk-free rate for Brazil is 7% and the risk-free rate for France is 3%. Table 1 Year 0 1 2 3 4 5 CF (in euros) -1000 290 320 370 400 400 Discuss qualitatively what is the proper cost of capital to be considered by the Brazilian investors in France in the example above. Be precise on the assumptions you make on the Brazilian investors and the French project.arrow_forwardThe Brazilian meat company SoCarnes wishes to start production in France. This new production is associated to a project with the following forecasted cash flows in euros (see table 1 below). The cost of capital in France is 10%, and the spot exchange rate is 6.2 BR$ / 1€ (1 euro buys 6.2 Brazilian reals). The risk-free rate for Brazil is 7% and the risk-free rate for France is 3%. Table 1 Year 0 1 2 3 4 5 CF (in euros) -1000 290 320 370 400 400 What is the project value in Brazilian reals? You should assume that SoCarnes sells forward the future euro cash flows and convert them to Brazilian reals each period.arrow_forward

- The owner of the Columbia Construction Company must decide between building a housing development, constructing a shopping center, and leasing all the company's equipment to another company. The profit that will result from each alternative will be determined by whether material costs remain stable or increase. The profit from each alternative, given the two possibilities for material costs, is shown in the following payoff table: Material Costs Decision Stable Increase $70,000 105,000 Houses $30,000 Shopping center Leasing 20,000 40,000 40,000 Determine the best decision, using the following decision criteria. a. Maximax b. Maximin c. Minimax regret d. Hurwicz (a = .2) e. Equal likelihoodarrow_forward1. The following solved problems refer to this payoff table: New No Bridge Built New Bridge Alternative capacity A 1 14 for new store 2 10 4 6 where A = small, B = medium, and C = large. Assume the payoffs represent profits. Determine the alternative that would be chosen under each of these decision criteria: a. Maximin. b. Маximax. c. Laplace. 2. Using the information in the payoff table, develop a table of regrets, and then a. Determine the alternative that would be chosen under minimax regret. b. Determine the expected value of perfect information using the regret table, assuming that the probability of a new bridge being built is .60. 3. Using the probabilities of .60 for a new bridge and .40 for no new bridge, a. Compute the expected value of each alternative in the payoff table, and identify the alternative that would be selected under the expected-value approach. b. Construct a decision tree for the problem showing expected values. Compute the EVPI using the information from the…arrow_forwardInvestment Club: A private investment club has $4,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high risk, medium risk, and low risk. Management estimates that high-risk stocks will have a rate of return of 17%/year; medium-risk stocks, 7%/year; and low-risk stocks,4%/year. The members have decided that the investment in low-risk stocks should be a quarter of the sum of the investments in the stocks of the other two categories. Assuming that all the money available for investment is invested, how much should the club invest in each type of stock if the investment goal is to have a return of $413/year on the total investment? (Round your answer to 1 decimal place.) The club should invest $ ,$ , and $ in high risk, medium risk and low risk stocks completely.arrow_forward

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman