Concept explainers

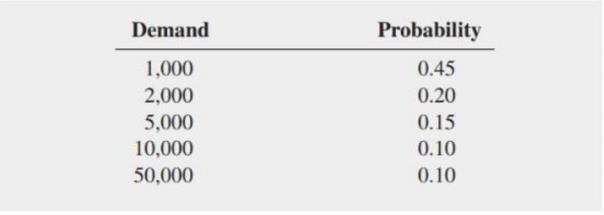

In Problem 20.4, you developed a payoff table to assist an author in choosing between signing with company A or with company B. Given the results computed in that problem. suppose that the probabilities of the levels of demand for the novel are as follows:

a. Determine the optimal action based on the maximax criterion.

b. Determine the optimal action based on the maximin criterion.

c. Compute the expected monetary value (EMV) for signing with company A and with company B.

d. Compute the expected opportunity loss (EOL) for signing with company A and with company B.

e. Explain the meaning of the

f. Based on the results of (c) or (d), if you were the author, which company would you choose to sign with. company A or company B? Why?

g. Compute the coefficient of variation for signing with company A and Signing with company B.

h. Compute the return-to-risk ratio (RTRR) for signing with company A and signing with company B.

i. Based on (g) and (h), which company would you choose to sign with, company A or company B? Why?

j. Compare the results of (f) and (i) and explain any differences.

k. Suppose that the probabilities of demand are 0.3, 0.2, 0.2, 0.1, and 0.2, respectively. Repeat (c) through (j) with these probabilities and compare the results with those in (c)-(j).

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Basic Business Statistics Student Value Edition Plus NEW MyLab Statistics with Pearson eText -- Access Card Package (13th Edition)

- The Brazilian meat company SoCarnes wishes to start production in France. This new production is associated to a project with the following forecasted cash flows in euros (see table 1 below). The cost of capital in France is 10%, and the spot exchange rate is 6.2 BR$ / 1€ (1 euro buys 6.2 Brazilian reals). The risk-free rate for Brazil is 7% and the risk-free rate for France is 3%. Table 1 Year 0 1 2 3 4 5 CF (in euros) -1000 290 320 370 400 400 Discuss qualitatively what is the proper cost of capital to be considered by the Brazilian investors in France in the example above. Be precise on the assumptions you make on the Brazilian investors and the French project.arrow_forwardThe government is attempting to determine whetherimmigrants should be tested for a contagious disease. Let’sassume that the decision will be made on a financial basis.Assume that each immigrant who is allowed into the countryand has the disease costs the United States $100,000, andeach immigrant who enters and does not have the diseasewill contribute $10,000 to the national economy. Assumethat 10% of all potential immigrants have the disease. Thegovernment may admit all immigrants, admit no immigrants,or test immigrants for the disease before determiningwhether they should be admitted. It costs $100 to test aperson for the disease; the test result is either positive ornegative. If the test result is positive, the person definitelyhas the disease. However, 20% of all people who do havethe disease test negative. A person who does not have thedisease always tests negative. The government’s goal is tomaximize (per potential immigrant) expected benefits minusexpected costs. Use a decision…arrow_forwardA private investment club has $200,000 earmarked for investment in stocks. To arrive at anacceptable overall level of risk, the stocks that management is considering have been classifiedinto three categories: high risk, medium risk, and low risk. Management estimates that high-riskstocks will have a rate of return of 15%/year; medium-risk stocks, 10%/year; and low-risk stocks,6%/year. The members have decided that the investment in low-risk stocks should be equal tothe sum of the investments in the stocks of the other two categories. Determine how much theclub should invest in each type of stock if the investment goal is to have a return of$20,000/year on the total investment. (Assume that all the money available for investment isinvested.)Note: Develop the linear system of equations from the above theory and solve the system byGauss Jordon Method.arrow_forward

- A manufacturer produces a toy sold during the summer season at a unit production cost of $5. The manufacturer sells the toy to a retailer, who then sells the product for $35 to the end customer. The manufacturer and retailer have agreed upon a revenue sharing contract that coordinates the supply chain and optimizes the expected profit of the entire supply chain (i.e., the retailer and the manufacturer), which is expected to be $4,000 over the summer selling season. If the wholesale price of the revenue sharing contract is $2, what is the manufacturer’s expected profit? PLEASE SHOW CALCULATIONSarrow_forwardSuppose that a life insurance company insures 1 million 50-year-old people in a given year. (Assume a death rate of 5 per 1000 people.) The cost of the premium is $200 per year, and the death benefit is $50,000 What is the expected profit or loss for the insurance company?arrow_forward1. The following solved problems refer to this payoff table: New No Bridge Built New Bridge Alternative capacity A 1 14 for new store 2 10 4 6 where A = small, B = medium, and C = large. Assume the payoffs represent profits. Determine the alternative that would be chosen under each of these decision criteria: a. Maximin. b. Маximax. c. Laplace. 2. Using the information in the payoff table, develop a table of regrets, and then a. Determine the alternative that would be chosen under minimax regret. b. Determine the expected value of perfect information using the regret table, assuming that the probability of a new bridge being built is .60. 3. Using the probabilities of .60 for a new bridge and .40 for no new bridge, a. Compute the expected value of each alternative in the payoff table, and identify the alternative that would be selected under the expected-value approach. b. Construct a decision tree for the problem showing expected values. Compute the EVPI using the information from the…arrow_forward

- A private investment club has $3,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high risk, medium risk, and low risk. Management estimates that high-risk stocks will have a rate of return of 17%/year; medium-risk stocks, 7%/year; and low-risk stocks,6%/year. The members have decided that the investment in low-risk stocks should be a quarter of the sum of the investments in the stocks of the other two categories. Assuming that all the money available for investment is invested, how much should the club invest in each type of stock if the investment goal is to have a return of $413/year on the total investment? (Round your answer to 1 decimal place.)arrow_forwardFederated South Insurance Company has developed a new screening program for selecting new sales agents. Their past experience indicates that 20% of the new agents hired fail to produce the minimum sales in their first year and are dismissed. Their ex- pectation is that this new screening program will reduce the percentage of failed new agents to 15% or less. If that occurs, they would save $1,000,000 in recruiting and training costs each year. At the end of the first year they want to develop an evaluation to determine if the new program is successful. The following questions are an important part of their re- search design.A total of 20 new agents were selected.a. If this group performs at the same level as past groups, what is the probability 17 or more success- fully meet their minimum sales goals in the first year?b. What is the probability 19 or more reach their min- imum sales goals given performance at the same level?c. If the program has actually increased the prob- ability of…arrow_forward3. What would be the yearly premium for a $50,000 insurance policy against accidental household flood if the likelihood of an accidental household flood is estimated to be 0.005 and the company wishes to have a yearly expected gain of $2000? a. $2, 250. b. $2,550. c. $2,500. d. $2,520. 4. A manufacturer of electronic equipment buys spare parts for replacement and repairs in lots of one-thousand from the supplier. The manufacturer uses these spare parts to fix items under warrantee. Past historical records show that the probability of any one spare part being defective is unlikely and assumed to be one in one-thousand. In a shipment of one-thousand spare parts the probability of two defectives is a. 0.148. b. 0.184. c. 0.366. d. 0.386. 5. What is the probability of getting exactly three heads in five flips of a balance coin? a. 5/16 b. 3/16 c. 7/16 d. 9/16arrow_forward

- Suppose Janice has a 25% chance of totaling her car (worth $13,500) this year and Sam has a 19% chance of totaling his car ($23,700) this year. If you have a car insurance company and you want to offer an insurance policy to these two customers and offer it for the same price, what price should you charge (without any profit mark-up)?arrow_forwardSouthland Corporation's decision to produce a new line of recreational products has resulted in the need to choose one of two automated manufacturing systems based on proposals from two vendors, A and B. The economics of this decision depends on the market reaction to the new product line. The possible long-run demand has been defined as low, medium, or high. Based on detailed financial analyses of system costs as a function of volume and sales under each demand scenario, the following payoff table gives the projected profits in millions of dollars. million. Decision Vendor A Vendor B million. Low $70 $160 Long-Run Demand Medium $150 $150 a. Determine the best decisions using the maximax, maximin, and opportunity loss decision criteria. Using the maximax criterion, choose -Select- Using the maximin criterion, choose -Select- To minimize the maximum opportunity loss, choose -Select- b. Assume that the best estimate of the probability of low long-run demand is 0.15, of medium long-run…arrow_forward38. A real estate development company, Omega, Inc., is considering the purchase of one of three "packages" put together by its director of marketing. Each package contains a different combination of land acreage by type of land, zoning, and geographic location. The value of the investment will depend on which of four population growth patterns occurs in the next few years. The payoff table is given below (in millions): Plan Demand Low Medium High 4,500,000 4,000,000 3,500,000 3,000,000 2,000,000 4,250,000 2 4,750,000 4,250.000 5,000,000 7,500,000 12,500,000 4 3,500,000 a. Determine the Bayes decision, given the following probability density: P( S: ) - 0.20, P( $2 )-0.25, P( $ )-0.45, and P( S. )-0.10. b. Compute the expected value of perfect information. c. Suppose the marketing director spends P5,000,000 on market study and obtains some information, which we denote by I. The conditional likelihood probabilities of I are as follows: P( 1/s, -0.10, P( 11s, )-0.30, P( 11s, -0.35, PI 11s,…arrow_forward

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman