EP FINANCIAL+MANAGERIAL ACCT. >CUSTOM<

5th Edition

ISBN: 9781323590287

Author: *ST.LEO UNIV.

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 24, Problem 8QC

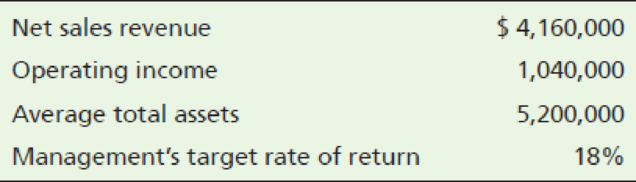

Assume the Residential Division of Kipper Faucets had the following results last year:

What is the division’s

- a. 20%

- b. 25%

- c. 500%

- d. 80%

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume the Residential Division of Kipper Faucets had the following results last year:

What is the division’s ROI?

a. 20%

b. 25%

c. 500%

d. 80%

Chick-Fil-A are the Lord’s Calories (CLC) has the following divisions within their company that achieved the reported ROIs for the previous year:

Division ROI

A 15%

B 20%

C 18%

CLC has been approached with a $350,000 investment opportunity. Which division will AFA choose to invest in, and how much operating income will be generated from the investment?

A. AFA will invest in Division A; the investment will earn operating income of $52,000

B. AFA will invest in Division C; the investment will earn operating income of $63,000

C. AFA will invest in Division B; the investment will earn operating income of $70,000

D. AFA will invest in Division A; the investment will earn operating income of $63,000

Coolbrook Company has the following information available for the past year:

River Division

Stream Division

Sales revenue

$

1,209,000

$

1,810,000

Cost of goods sold and operating expenses

900,000

1,286,000

Net operating income

$

309,000

$

524,000

Average invested assets

$

1,200,000

$

1,460,000

The company’s hurdle rate is 6.26 percent.

Required:

1. Calculate return on investment (ROI) and residual income for each division for last year. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.))

river

steam

ROI

%

%

Residual income (loss)

2. Recalculate ROI and residual income for the division for each independent situation that follows: Operating income increases by 11 percent. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.). Loss…

Chapter 24 Solutions

EP FINANCIAL+MANAGERIAL ACCT. >CUSTOM<

Ch. 24 - Prob. 1TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 3TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 5TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 7TICh. 24 - Prob. 8TICh. 24 - Prob. 9TICh. 24 - Prob. 10TI

Ch. 24 - Prob. 11TICh. 24 - Prob. 12TICh. 24 - Prob. 13TICh. 24 - Match the responsibility center to the correct...Ch. 24 - Prob. 15TICh. 24 - Prob. 16TICh. 24 - Prob. 17TICh. 24 - Prob. 18TICh. 24 - Prob. 19TICh. 24 - Prob. 20TICh. 24 - Sheffield Company manufactures power tools. The...Ch. 24 - Prob. 22TICh. 24 - Which is not one of the potential advantages of...Ch. 24 - The Quaker Foods division of PepsiCo is most...Ch. 24 - Which of the following is not a goal of...Ch. 24 - Which of the following balanced scorecard...Ch. 24 - The performance evaluation of a cost center is...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Penn Company has a division that manufactures a...Ch. 24 - Explain the difference between a centralized...Ch. 24 - Prob. 2RQCh. 24 - List the disadvantages of decentralization.Ch. 24 - What is goal congruence?Ch. 24 - Prob. 5RQCh. 24 - What is the purpose of a responsibility accounting...Ch. 24 - Prob. 7RQCh. 24 - Prob. 8RQCh. 24 - Prob. 9RQCh. 24 - What are the goals of a performance evaluation...Ch. 24 - Prob. 11RQCh. 24 - How is the use of a balanced scorecard as a...Ch. 24 - What is a key performance indicator?Ch. 24 - What are the four perspectives of the balanced...Ch. 24 - Explain the difference between a controllable and...Ch. 24 - Prob. 16RQCh. 24 - What are two key performance indicators used to...Ch. 24 - Prob. 18RQCh. 24 - Prob. 19RQCh. 24 - Prob. 20RQCh. 24 - Prob. 21RQCh. 24 - Prob. 22RQCh. 24 - What is the biggest advantage of using RI to...Ch. 24 - What are some limitations of financial performance...Ch. 24 - Prob. 25RQCh. 24 - Prob. 26RQCh. 24 - Prob. 27RQCh. 24 - Prob. 1SECh. 24 - Prob. 2SECh. 24 - Well-designed performance evaluation systems...Ch. 24 - Consider the following key performance indicators,...Ch. 24 - Management by exception is a term often used in...Ch. 24 - Consider the following data, and determine which...Ch. 24 - XTreme Sports Company makes snowboards, downhill...Ch. 24 - Prob. 8SECh. 24 - Using ROI and RI to evaluate investment centers...Ch. 24 - Henderson Company manufactures electronics. The...Ch. 24 - Prob. 11ECh. 24 - Prob. 12ECh. 24 - Well-designed performance evaluation systems...Ch. 24 - Consider the following key performance indicators,...Ch. 24 - One subunit of Harris Sports Company had the...Ch. 24 - The accountant for a subunit of Speed Sports...Ch. 24 - Zims, a national manufacturer of lawn-mowing and...Ch. 24 - Refer to the data in Exercise E24-17. Calculate...Ch. 24 - Prob. 19ECh. 24 - One subunit of Racer Sports Company had the...Ch. 24 - Consider the following condensed financial...Ch. 24 - Prob. 22APCh. 24 - The Harris Company is decentralized, and divisions...Ch. 24 - One subunit of Track Sports Company had the...Ch. 24 - Consider the following condensed financial...Ch. 24 - Prob. 26BPCh. 24 - The Hernandez Company is decentralized, and...Ch. 24 - Prob. 28PCh. 24 - This problem continues the Piedmont Computer...Ch. 24 - The Trolley Toy Company manufactures toy building...Ch. 24 - Dixie Irwin is the department manager for...Ch. 24 - Prob. 1FCCh. 24 - In 150 words or fewer, list each of the four...

Additional Business Textbook Solutions

Find more solutions based on key concepts

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

How is activity-based costing useful for pricing decisions?

Cost Accounting (15th Edition)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

Analysis of inventory errors A2 Hallam Company’s financial statements show the following. The company recently ...

FINANCIAL ACCT.FUND.(LOOSELEAF)

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forwardDivision A of Kern Co. has sales of $350,000, cost of goods sold of $200,000, operating expenses of $30,000, and invested assets of $600000. What is the return on investment for Division A? A. 20% B. 25% C. 33% D. 40%arrow_forwardAldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)arrow_forward

- Refer to Cornerstone Exercise 10.1. Forchen, Inc., requires an 8 percent minimum rate of return. Required: 1. Calculate residual income for the Small Appliances Division. 2. Calculate residual income for the Cleaning Products Division. 3. What if the minimum required rate of return was 9 percent? How would that affect the residual income of the two divisions?arrow_forwardThe controller of Emery, Inc. has computed quality costs as a percentage of sales for the past 5 years (20X1 was the first year the company implemented a quality improvement program). This information is as follows: Required: 1. Prepare a trend graph for total quality costs. Comment on what the graph has to say about the success of the quality improvement program. 2. Prepare a graph that shows the trend for each quality cost category. What does the graph have to say about the success of the quality improvement program? Does this graph supply more insight than the total cost trend graph does? 3. Prepare a graph that compares the trend in relative control costs versus relative failure costs. Comment on the significance of this trend.arrow_forwardMerkley Company, a manufacturer of machine parts, implemented lean manufacturing at the end of 20X1. Three value streams were established: one for new product development and two order fulfillment value streams. One of the value streams set a goal to increase its ROS to 45% of sales by the end of the year. During the year, the value stream made significant improvements in several areas. The Box Scorecard below was prepared, with performance measures for the beginning of the year, midyear, and end of year. Although the members of the value stream were pleased with their progress, they were disappointed in the financial results. They were still far from the targeted ROS of 45%. They were also puzzled as to why the improvements made did not translate into significantly improved financial performance. Required: 1. From the scorecard, what was the focus of the value-stream team for the first 6 months? The second 6 months? What are the implications of these changes? 2. Using information from the scorecard, offer an explanation for why the financial results were not as good as expected.arrow_forward

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardSearchlight, Inc. uses ROI to evaluate operations and requires the return on its operating units to be 9%. Operating data for the Western division is shown below: Sales $1,000,000 Controllable margin 120,000 Total average assets 600,000 Fixed costs 60,000 How much is ROI for the year? A. 20% B. 17% C. 10% D. 30%arrow_forwardDivision ABC had a ROI last year of 16%. The division's minimum required rate of return is 10%. If the division's average operating assets last year were $450,000, what was the division's residual income? Multiple Choice $27,000 some other answer $22,500 $72,000. $45,000.arrow_forward

- The Break Division of Zoe motors Company had the following financial data for the year: Assets available for use P 1,000,000 BV P1,500,000 MV Residual income P 100,000 Return on investment 15% A. What was the Break Division’s segment income? B. If the manager of the Break Division is evaluated based on return on investment, how much would she willing to pay for an investment that promise to increase net segment income by P50,000?arrow_forwardRoy Toys, a division of Fun Corp. has a net operating income of $60,000 and average operating assets of $300000. 1. The required rate of return for the company is 15%. What is the division's ROI?a. 25%b. 5%c. 15%d. 20% 2. If the manager of the division is evaluated based on ROI, will she want to make an investment of $100000 that would generate an additional net operating income of $18000 per year?a. Yesb. Noarrow_forwardThe Tipton Division of Dudley Company reported the following data last year: Return on investment 20% Minimum required rate of return 12% Residual income $ 50,000 The division's net operating income last year was?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License