College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1PB

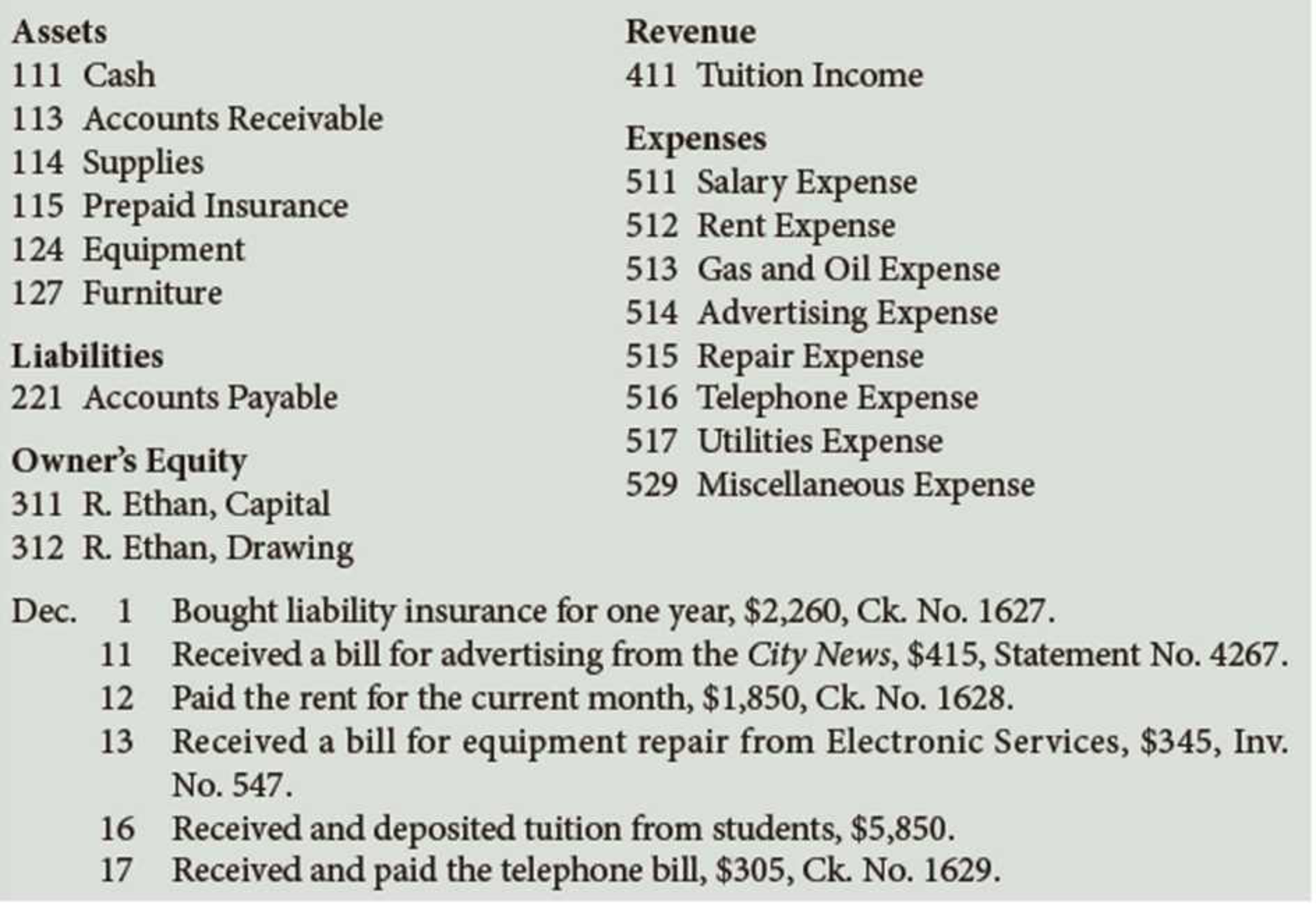

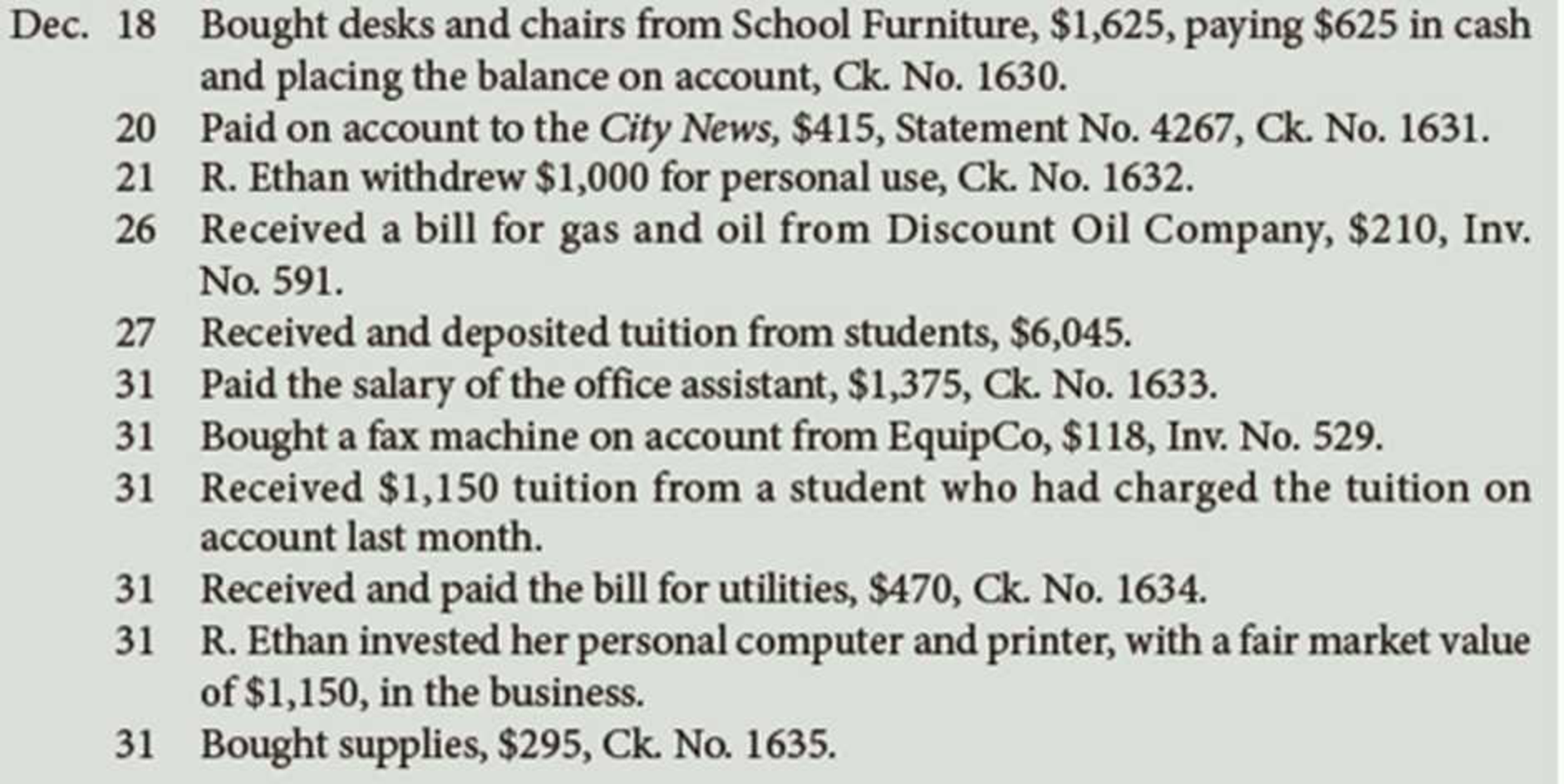

The chart of accounts of Ethan Academy is shown here, followed by the transactions that took place during December of this year.

Required

Record these transactions in the general journal, including a brief explanation for each entry. If you are using working papers, number the journal pages 31 and 32.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using the information in the photo, how would I prepare Journal Entries for the December transactions?

EMB Consulting Services had the following transactions for the month of November. Journalize the transactions and include an explanation with each entry. Thank you

For the March Transactions set forth below, prepare the journal entries for the month of March in a general journal

Chapter 3 Solutions

College Accounting (Book Only): A Career Approach

Ch. 3 - A __________ is a book in which business...Ch. 3 - Transferring information from the journal to the...Ch. 3 - For a journal entry to be complete, it must...Ch. 3 - The __________ is used to determine where the...Ch. 3 - Prob. 5QYCh. 3 - A 250 payment for salaries expense was incorrectly...Ch. 3 - Prob. 1DQCh. 3 - How does the journal differ from the ledger?Ch. 3 - What is the purpose of providing a ledger account...Ch. 3 - List by account classification the order of the...

Ch. 3 - Arrange the following steps in the posting process...Ch. 3 - Prob. 6DQCh. 3 - Prob. 7DQCh. 3 - In the following two-column journal, the capital...Ch. 3 - Decor Services completed the following...Ch. 3 - Montoya Tutoring Service completed the following...Ch. 3 - Prob. 4ECh. 3 - Arrange the following steps in the posting process...Ch. 3 - The bookkeeper for Nevado Company has prepared the...Ch. 3 - Determine the effect of the following errors on a...Ch. 3 - Journalize correcting entries for each of the...Ch. 3 - The chart of accounts of the Barnes School is...Ch. 3 - Laras Landscaping Service has the following chart...Ch. 3 - Following is the chart of accounts of Sanchez...Ch. 3 - The chart of accounts of Ethan Academy is shown...Ch. 3 - Leanders Landscaping Service maintains the...Ch. 3 - Following is the chart of accounts of Smith...Ch. 3 - Why Does It Matter? ECOTOUR EXPEDITIONS, INC.,...Ch. 3 - What Would You Say? You are the new bookkeeper for...Ch. 3 - What Do You Think? You work as an accounting...Ch. 3 - What Would You Do?

You are responsible for...Ch. 3 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The chart of accounts of the Barnes School is shown here, followed by the transactions that took place during October of this year. Required Record these transactions in the general journal, including a brief explanation for each entry. If you are using working papers, number the journal pages 31 and 32.arrow_forwardOn the printed "Worksheet" page, record the information from the "Transactions" page and total of each column at the end of August.arrow_forwardUsing EXCEL => Prepare the appropriate journal entry for each of the transactions for CampIn Inc. during the first three months of 2021 (see Attached file). Using EXCEL => Post the journal entries to the appropriate “T-Accounts.”arrow_forward

- Record any five accounting transactions of your own choice for Ali furniture business (AFB) for the year 2019, Starting from the owner investment of $100,000. Post them in General journal, make ledger, and Trial balance for those entries. with explanation and to make it in best formate.arrow_forwardThe following selected accounts and normal balances existed at year-end. Record the journal entries required to close the booksarrow_forwardRecord any five accounting transactions of your own choice for Ali furniture business (AFB) for the year 2019, Starting from the owner investment of $100,000. Post them in General journal, make ledger, and Trial balance for those entries. with explanation.arrow_forward

- Record the transactions for the month of February in a journal and post the transactions to the ledger.arrow_forwardLeanders Landscaping Service maintains the following chart of accounts: The following transactions were completed by Leander: Required 1. Journalize the transactions in the general journal. Prepare a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated April 30, 20. If you are using CLGL, use the year 2020 when recording transactions and preparing reports.arrow_forwardThe following selected accounts and normal balances existed at year-end. Make the four journal entries required to close the books:arrow_forward

- The following selected transactions were completed by Niles Co. during March of the current year: Instructions Journalize the entries to record the transactions of Niles Co. for March.arrow_forwardSage Learning Centers was established on July 20 to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY