Basics Of Engineering Economy

2nd Edition

ISBN: 9780073376356

Author: Leland Blank, Anthony Tarquin

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 38P

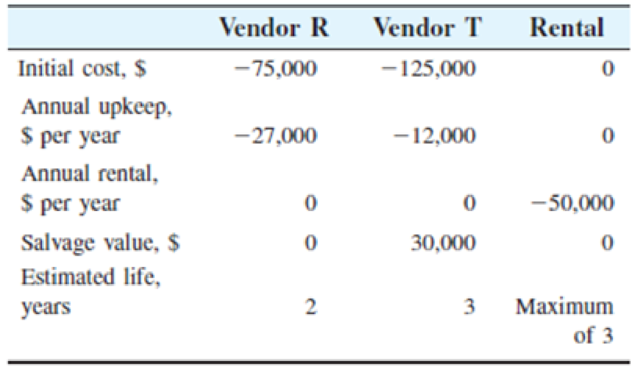

The manager of engineering at the 900-megawatt Hamilton Nuclear Power Plant has three options to supply personal safety equipment to employees. Two are vendors who sell the items, and the third alternative is to rent the equipment for $50,000 per year, but for no more than 3 years per contract. These items have relatively short lives due to constant use. The MARR is 10% per year.

- a. Select from the two vendors using the LCM and PW analysis.

- b. Determine which of the three options is cheaper over a study period of 3 years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Texas Department of Transportation (TxDOT) is considering two designs for crash barriers along a reconstructed portion of I-10. Design 2B will cost $3 million to install and $142,500 per year to maintain. Design 4R will cost $3.7 million to install and $55,000 per year to maintain. Determine which design should be selected based on a rate of return analysis if TxDOT uses a MARR of 6% per year and a 20-year project period.

The rate of return is __ %

Design __ is selected.

A window frame manufacturer is searching for ways to improve revenue from its triple-insulated sliding windows, sold primarily in the far northern areas of the United States. Alternative A is an in- crease in TV and radio marketing. A total of $300,000 spent now is expected to increase revenue by $60,000 per year. Alternative B requires the same investment for enhancements to the in-plant manufacturing process that wil improve the temperature retention properties of the seals around each glass pane. New revenues start slowly for this alternative at an estimated $10,000 the first year, with growth of $15,000 per year as the improved product gains reputation among builders. The MARR is 8% per year and the maximum projection period is 10 years for either alternative.

Compare three alternatives on the basis of their capitalized costs at i=9.00% per year and select the best alternative. (Include a minus sign if necessary.) The capitalized cost of alternative E is $ ox, alternative F is $1375347.55, and alternative G is $ The best alternative is

Chapter 4 Solutions

Basics Of Engineering Economy

Ch. 4 - State two conditions under which the do-nothing...Ch. 4 - Prob. 2PCh. 4 - Prob. 3PCh. 4 - Prob. 4PCh. 4 - Prob. 5PCh. 4 - Prob. 6PCh. 4 - Prob. 7PCh. 4 - Prob. 8PCh. 4 - Prob. 9PCh. 4 - The costs associated with manufacturing a...

Ch. 4 - Prob. 11PCh. 4 - Prob. 12PCh. 4 - Prob. 13PCh. 4 - Prob. 14PCh. 4 - Prob. 15PCh. 4 - Prob. 16PCh. 4 - Prob. 17PCh. 4 - Prob. 18PCh. 4 - Prob. 19PCh. 4 - Prob. 20PCh. 4 - Prob. 21PCh. 4 - Prob. 22PCh. 4 - Prob. 23PCh. 4 - Prob. 24PCh. 4 - Prob. 25PCh. 4 - Prob. 26PCh. 4 - Prob. 27PCh. 4 - Prob. 28PCh. 4 - Prob. 29PCh. 4 - Prob. 30PCh. 4 - Prob. 31PCh. 4 - Two mutually exclusive projects have the estimated...Ch. 4 - Prob. 33PCh. 4 - Prob. 34PCh. 4 - Prob. 35PCh. 4 - Prob. 36PCh. 4 - Prob. 37PCh. 4 - The manager of engineering at the 900-megawatt...Ch. 4 - Prob. 39PCh. 4 - Prob. 40PCh. 4 - Prob. 41PCh. 4 - Three different plans were presented to the GAO by...Ch. 4 - The U.S. Army received two proposals for a turnkey...Ch. 4 - Prob. 44PCh. 4 - Prob. 45PCh. 4 - Prob. 46PCh. 4 - Prob. 47PCh. 4 - Prob. 48PCh. 4 - Prob. 49PCh. 4 - Prob. 50PCh. 4 - Prob. 51PCh. 4 - Prob. 52PCh. 4 - Prob. 53PCh. 4 - Prob. 54PCh. 4 - Prob. 55PCh. 4 - Prob. 56PCh. 4 - Prob. 57PCh. 4 - Prob. 58PCh. 4 - Prob. 59PCh. 4 - Prob. 60PCh. 4 - Prob. 61PCh. 4 - Prob. 62PCh. 4 - Prob. 63APQCh. 4 - Prob. 64APQCh. 4 - Prob. 65APQCh. 4 - Prob. 66APQCh. 4 - Prob. 67APQCh. 4 - Prob. 68APQCh. 4 - Prob. 69APQCh. 4 - Prob. 70APQCh. 4 - Prob. 71APQ

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics

Using the midpoint formula, calculate elasticity for each of the following changes in demand.

Principles of Economics (12th Edition)

A case study in this chapter discusses the federal minimum-wage law. a. Suppose the minimum wage is above the e...

Principles of Economics (MindTap Course List)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Biomet Implants is planning new online patient diagnostics for surgeons while they operate. The new system will cost $300,000 to install in an operating room, $5000 annually for maintenance, and have an expected life of 4 years. The revenue per system is estimated to be $80,000 in year 1 and to increase by $10,000 per year through year 4. Determine if the project is economically justified using PW analysis and an MARR of 10% per year.arrow_forwardTwo methods can be used for producing solar panels for electric power generation. Method 1 will have an initial cost of $550,000, an AOC of $160,000 per year, and $125,000 salvage value after its 3-year life. Method 2 will cost $830,000 with an AOC of $120,000, and a $240,000 salvage value after its 5-year life. Assume your boss asked you to determine which method is better, but she wants the analysis done over a 3-year planning period. You estimate the salvage value of method 2 will be 35% higher after 3 years than it is after 5 years. If the MARR is 10% per year, which method should the company selectarrow_forwardTwo methods can be used to produce solar panels for electric power generation. Method 1 will have an initial cost of $800,000, an AOC of $150,000 per year, and $125,000 salvage value after its 3-year life. Method 2 will cost $910,000 with an AOC of $125,000 and a $230,000 salvage value after its 5-year life. Assume your boss asked you to determine which method is better, but she wants the analysis done over a three-year planning period. You estimate the salvage value of Method 2 will be 40% higher after three years than it is after five years. If the MARR is 14% per year, which method should the company select? Which method should the company select?arrow_forward

- The manager of a canned-food processing plant has two labeling machine options. On the basis of a rate of return analysis with a MARR of 20% per year, determine (a) which model is economically better, and (b) if the selection changes, provided both options have a 4-year life and all other estimates remain the same. Model 105 200 First cost, $ −15,000 −25,000 AOC, $ per year −1,600 −400 Salvage value, $ 3,000 4,000 Life, years 2 4arrow_forwardPlease do not give solution in image formate thanku. Biomet Implants is planning new online patient diagnostics for surgeons while they operate. The new system will cost $300,000 to install in an operating room, $5000 annually for maintenance, and have an expected life of 10 years. The revenue per system is estimated to be $80,000 in year 1 and to increase by $10,000 per year through year 10. a) Determine NPV to see if the project is economically justified using PW analysis and an MARR of 10% per year. b) Insert a Triangle distribution with minimum at $8000, average 10,000 and maximum at 12000 as the input distribution for the revenue increase. Perform Monte Carlo Simulation and discuss the results.arrow_forwardIn order to provide drinking water as part of its 50-year plan, a west coast city is considering constructing a pipeline for importing water from a nearby community that has a plentiful supply of brackish ground water. A full-sized pipeline can be constructed at a cost of $122 million now. Alternatively, a smaller pipeline can be constructed now for $80 million and enlarged 20 years from now for another $100 million. The pumping cost will be $25,000 per year higher for the smaller pipeline during the first 20 years, but will be approximately the same thereafter. Both pipelines are expected to have the same useful life with no salvage value. (a) At an interest rate of 6% per year, which alternative is more economical? (b) Write the spreadsheet function to display the PW for the smaller pipeline alternative.arrow_forward

- The U.S. Army received two proposals for a turnkey design/build project for barracks for infantry unit soldiers in training. Proposal A involves an off-the-shelf “bare-bones” design and standard grade construction of walls, windows, doors, and other features. With this option, heating and cooling costs will be greater, maintenance costs will be higher, and replacement will occur earlier than proposal B. The initial cost for A will be $750,000. Heating and cooling costs will average $6000 per month with maintenance costs averaging $2000 per month. Minor remodeling will be required in years 5, 10, and 15 at a cost of $150,000 each time in order to render the units usable for 20 years. They will have no salvage value. Proposal B will include tailored design and construction costs of $1.1 million initially with estimated heating and cooling costs of $3000 per month and maintenance costs of $1000 per month. There will be no salvage value at the end of the 20-year life. Which proposal should…arrow_forwardThe initial cost of a packed-bed degassing reactor for removing trihalomethanes from potable water is $84,000. The annual operating cost for power, site maintenance, etc. is $13,000. If the salvage value of the pumps, blowers, and control systems is expected to be $9000 at the end of 10 years, the AW of the packed-bed reactor, at an interest rate of 8% per year, is closest to: (a) $−26,140 (b) $−25,518 (c) $−24,900 (d) $−13,140arrow_forwardIn order to provide drinking water as part of its 50-year plan, a west coast city is considering constructing a pipeline for importing water from a nearby community that has a plentiful supply of brackish ground water. A full-sized pipeline can be constructed at a cost of $125 million now. Alternatively, a smaller pipeline can be constructed now for $85 million and enlarged 20 years from now for another $90 million. The pumping cost will be $25,000 per year higher for the smaller pipeline during the first 20 years, but it will be approximately the same thereafter. Both pipelines are expected to have the same useful life with no salvage value At an interest rate of 11% per year The present worth of the full-sized pipeline is determined to be what and that of the small-sized pipeline is what Which pipeline is the most economical pipelinearrow_forward

- Two methods can be used for producing expansion anchors. Method A costs $80,000 initially and will have a $15,000 salvage value after 3 years. The operating cost with this method will be $30,000 per year. Method B will have a first cost of $120,000, an operating cost of $8000 per year, and a $40,000 salvage value after its 3-year life. At the MARR of 12% per year, which method should be used on the basis of a present worth analysis?arrow_forwardAn oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. In-house treatment will have an annual cost of $50,000 the first year, but process improvements will allow the annual cost to decline by $5,000 each subsequent year. As an alternative, an outside company will process the wastes for an initial cost of $32,400 and an annual fixed price of $30,400/year throughout the 13 year period. Either way, there is no need to treat the wastes after 13 years. Using the AW method, calculate the equivalent uniform annual cost (EUAC) of each alternative and determine how the waste should be processed. The company's MARR is 8%. LOADING... Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% per year.arrow_forwardAn irrigation return flow drain has sampling equipment that can be powered by solar cells or by running an electric line to the site and using conventional power. Solar cells will cost $14,000 to install with a useful life of 10 years. Annual costs for inspection, cleaning, etc. are expected to be $1500. A new power line will cost $12,000 to install and the power costs are estimated at $600 per year. The salvage value of the solar cells is expected to be 25% of the first cost when the sampling project ends in 4 years. The electric line will stay in place, so its salvage value is considered to be zero. At an interest rate of 10% per year, which alternative should be selected?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License