Basics Of Engineering Economy

2nd Edition

ISBN: 9780073376356

Author: Leland Blank, Anthony Tarquin

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 32P

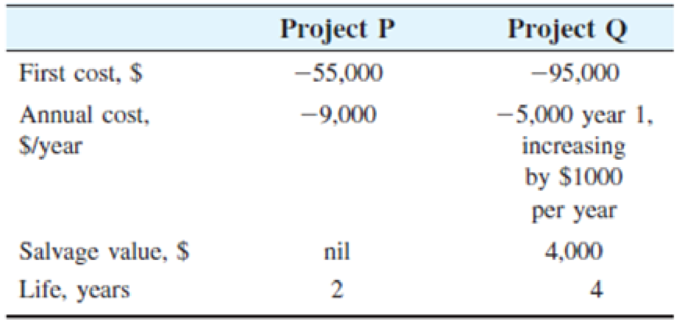

Two mutually exclusive projects have the estimated cash flows shown. Use a present worth analysis to determine which should be selected at an interest rate of 10% per year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A small manufacturing company is considering the addition of one or more of four new product lines. If the total amount of investment capital available for new ventures is $800,000, which one(s) should the company undertake on the basis of a present worth analysis? Assume the company uses a 5-year project recovery period and a MARR of 20% per year. All cash flows are in $1000 units.

Abel and Family Perfumes wants to add one or more of four new products to its current line of colognes. Historically, Abel has used a 5-year project recovery period and a MARR of 20% per year. (a) Determine which of the four options the company should undertake on the basis of a present worth analysis, provided the total amount of investment capital available is $800,000. Use a hand solution, unless assigned otherwise. (b) What products are selected if the investment limit is increased to $900,000? Use a spreadsheet, unless assigned otherwise. (All cash flows are in $1000 units.) Product Line R1 S2 T3 U4 Investment, $ −200 −400 −500 −700 M&O cost, $/year −50 −200 −300 −400 Revenue, $/year 150 450 520 770

Shown in the table are the cash flows for 4 water treatment systems that are to be compared at a MARR of 13% per year. Determine the savings between the alternative to be selected and the next one.

Chapter 4 Solutions

Basics Of Engineering Economy

Ch. 4 - State two conditions under which the do-nothing...Ch. 4 - Prob. 2PCh. 4 - Prob. 3PCh. 4 - Prob. 4PCh. 4 - Prob. 5PCh. 4 - Prob. 6PCh. 4 - Prob. 7PCh. 4 - Prob. 8PCh. 4 - Prob. 9PCh. 4 - The costs associated with manufacturing a...

Ch. 4 - Prob. 11PCh. 4 - Prob. 12PCh. 4 - Prob. 13PCh. 4 - Prob. 14PCh. 4 - Prob. 15PCh. 4 - Prob. 16PCh. 4 - Prob. 17PCh. 4 - Prob. 18PCh. 4 - Prob. 19PCh. 4 - Prob. 20PCh. 4 - Prob. 21PCh. 4 - Prob. 22PCh. 4 - Prob. 23PCh. 4 - Prob. 24PCh. 4 - Prob. 25PCh. 4 - Prob. 26PCh. 4 - Prob. 27PCh. 4 - Prob. 28PCh. 4 - Prob. 29PCh. 4 - Prob. 30PCh. 4 - Prob. 31PCh. 4 - Two mutually exclusive projects have the estimated...Ch. 4 - Prob. 33PCh. 4 - Prob. 34PCh. 4 - Prob. 35PCh. 4 - Prob. 36PCh. 4 - Prob. 37PCh. 4 - The manager of engineering at the 900-megawatt...Ch. 4 - Prob. 39PCh. 4 - Prob. 40PCh. 4 - Prob. 41PCh. 4 - Three different plans were presented to the GAO by...Ch. 4 - The U.S. Army received two proposals for a turnkey...Ch. 4 - Prob. 44PCh. 4 - Prob. 45PCh. 4 - Prob. 46PCh. 4 - Prob. 47PCh. 4 - Prob. 48PCh. 4 - Prob. 49PCh. 4 - Prob. 50PCh. 4 - Prob. 51PCh. 4 - Prob. 52PCh. 4 - Prob. 53PCh. 4 - Prob. 54PCh. 4 - Prob. 55PCh. 4 - Prob. 56PCh. 4 - Prob. 57PCh. 4 - Prob. 58PCh. 4 - Prob. 59PCh. 4 - Prob. 60PCh. 4 - Prob. 61PCh. 4 - Prob. 62PCh. 4 - Prob. 63APQCh. 4 - Prob. 64APQCh. 4 - Prob. 65APQCh. 4 - Prob. 66APQCh. 4 - Prob. 67APQCh. 4 - Prob. 68APQCh. 4 - Prob. 69APQCh. 4 - Prob. 70APQCh. 4 - Prob. 71APQ

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (4th Edition) (The Pearson Series in Economics)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

(Studying Economics) According to the text, economics majors on average make more money than most other majors ...

Econ Micro (book Only)

Exercise B1 What point is preferred along an indifference Curve?

Principles of Economics 2e

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Determine the capitalized cost of a permanent roadside historical marker that has a first cost of $72,500 and a maintenance cost of $2,400 once every 6 years. Use an interest rate of 9% per year. The capitalized cost is $arrow_forwardA mining company is considering three alternatives for use as a debris hauler out of one of the mines. Data for all three alternatives are provided as follows. If the company estimates an interest rate of 15% per year, which alternative should the mining company choose based on NPW for 24 years of operation?arrow_forwardTwo mutually exclusive alternatives are available. If the interest is 15%, select the best alternative according to the VP method. The cash flow profiles for the alternatives are as follows. draw the diagram for those alternativesarrow_forward

- Based on estimates the data for 2 types of bridges with different lives are as follows. If the minimum attractive rate of return is 9%, determine which project is more desirable using Annual Cost Method & Rate of Return Method.arrow_forwardDetermine the IROR and profitability index at 12% per year for an industrial smart-grid system that has a first cost of $400,000, an AOC of $75,000 per year, estimated annual savings of $192,000, and a salvage value of 20% of its first cost after a 5-year useful life.arrow_forwardThe construction of a volleyball court for the employees of a highly successful mid-sized publishing company in California is expected to cost $1200 and have an annual maintenance costs of $300. At an effective annual interest of 5%, what is the project's capitalized cost($)?arrow_forward

- For the cash flows shown, use an annual worth comparison and an interest rate of 12% per year. a) Determine the alternative that is economically best. b) Determine the first cost required for each of the two alternatives not selected in part a) so that all 3 alternatives are equally acceptable.arrow_forwardThe International Parcel Service has installed a new radio frequency identification system to help reduce the number of packages that are incorrectly delivered. The capital investment in the system is $65,000, and the projected annual savings are tabled below. The system’s market value at the EOY five is negligible, and the MARR is 18% per year. Calculate the present worth of the project.arrow_forwardTo choose the best alternative among the given alternatives in the annual cash flow analysis method, it is necessary to compute the EUAW for each alternative over a period of one cycle only. True / Falsearrow_forward

- Two mutually exclusive alternatives have the estimates shown below. Use annual worth analysis to determine which should be selected at an interest rate of 10% per year. Q R First cost, $ −42,000 −80,000 AOC, $ per year −6,000 −7,000 in year 1, increasing by $1,000 per year thereafter Salvage value, $ 0 4,000 Life, years 2 4arrow_forwardCompare three alternatives on the basis of their capitalized costs at i=9.00% per year and select the best alternative. (Include a minus sign if necessary.) The capitalized cost of alternative E is $ ox, alternative F is $1375347.55, and alternative G is $ The best alternative isarrow_forwardCompare the cost of the two types of composite materials on the basis of their capitalized costs. Use an interest rate of 10% per year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Break Even Analysis (BEP); Author: Tutorials Point (India) Ltd.;https://www.youtube.com/watch?v=wOEkc3O_Q_Y;License: Standard YouTube License, CC-BY

Cost Volume Profit Analysis (CVP): calculating the Break Even Point; Author: Edspira;https://www.youtube.com/watch?v=Nw2IioaF6Lc;License: Standard Youtube License