4.1 Use the information provided below to calculate the following ratios. Where applicable, express answers to two decimal places. 4.1.1 Profit margin 4.1.2 Debtors collection period 4.1.3 Return on equity 4.1.4 Acid test ratio 4.1.5 Debt to assets 4.1.6 Return on assets 4.1.7 Interest coverage 4.2 Comment on the current ratio which was 1.56:1 in 2019 and 2.19:1 in 2020. 4.3 Provide two possible reasons for a drop in the gross margin from 27.35% in 2019 to 15.82% in 2020. INFORMATION Extracts of the financial statements of Sibaya Limited are as follows: SIBAYA LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2020 R Sales (all credit) Cost of sales Gross profit Operating expenses Operating profit Interest expense 2 409 000 (2 028 000) 381 000 (276 000) 105 000 (36 000) 69 000 (19 320) Profit before tax Income tax Profit after tax 49 680

4.1 Use the information provided below to calculate the following ratios. Where applicable, express answers to two decimal places. 4.1.1 Profit margin 4.1.2 Debtors collection period 4.1.3 Return on equity 4.1.4 Acid test ratio 4.1.5 Debt to assets 4.1.6 Return on assets 4.1.7 Interest coverage 4.2 Comment on the current ratio which was 1.56:1 in 2019 and 2.19:1 in 2020. 4.3 Provide two possible reasons for a drop in the gross margin from 27.35% in 2019 to 15.82% in 2020. INFORMATION Extracts of the financial statements of Sibaya Limited are as follows: SIBAYA LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2020 R Sales (all credit) Cost of sales Gross profit Operating expenses Operating profit Interest expense 2 409 000 (2 028 000) 381 000 (276 000) 105 000 (36 000) 69 000 (19 320) Profit before tax Income tax Profit after tax 49 680

Chapter5: Evaluating Operating And Financial Performance

Section: Chapter Questions

Problem 4EP

Related questions

Question

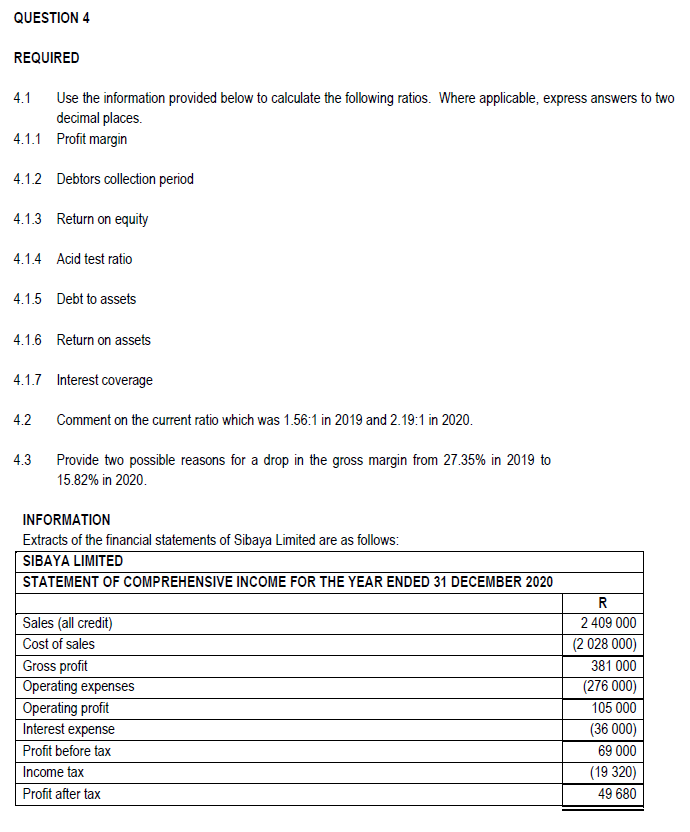

Transcribed Image Text:QUESTION 4

REQUIRED

4.1

Use the information provided below to calculate the following ratios. Where applicable, express answers to two

decimal places.

4.1.1 Profit margin

4.1.2 Debtors collection period

4.1.3 Return on equity

4.1.4 Acid test ratio

4.1.5 Debt to assets

4.1.6 Return on assets

4.1.7 Interest coverage

4.2

Comment on the current ratio which was 1.56:1 in 2019 and 2.19:1 in 2020.

4.3

Provide two possible reasons for a drop in the gross margin from 27.35% in 2019 to

15.82% in 2020.

INFORMATION

Extracts of the financial statements of Sibaya Limited are as follows:

SIBAYA LIMITED

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2020

Sales (all credit)

2 409 000

Cost of sales

(2 028 000)

Gross profit

Operating expenses

Operating profit

Interest expense

381 000

(276 000)

105 000

(36 000)

Profit before tax

69 000

Income tax

(19 320)

Profit after tax

49 680

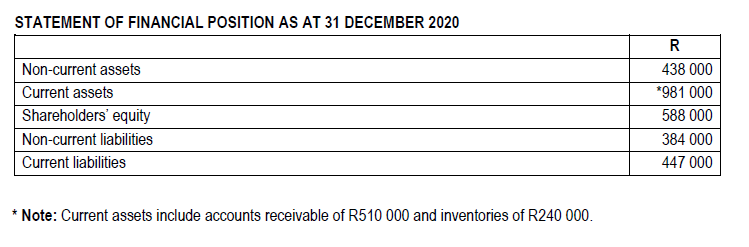

Transcribed Image Text:STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020

R

Non-current assets

438 000

Current assets

*981 000

Shareholders' equity

588 000

Non-current liabilities

384 000

Current liabilities

447 000

* Note: Current assets include accounts receivable of R510 000 and inventories of R240 000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning