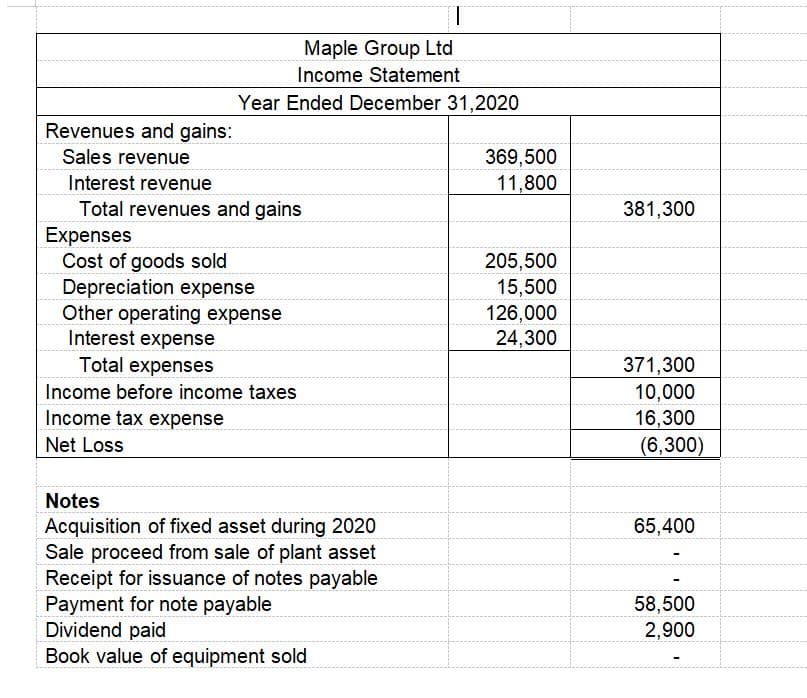

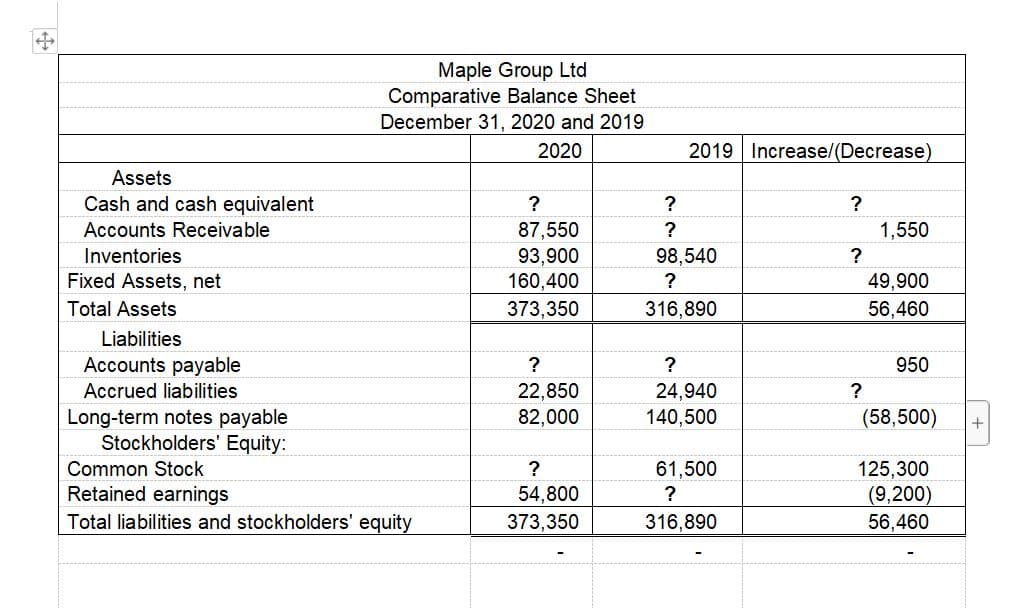

The 2020 comparative balance sheet and 2020 income statement of Maple Group Ltd, have just been prepare and presented to the owners by the company’s Accountant. Upon close examination of the financial information received, it was discovered that some figures in the balance sheet were erroneously omitted due to an oversight by the accountant who is not available to fix the problem due to his unavoidable absence from work. In addition, the owners were concerned about the movement in the company’s cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. Prepare a complete statement of cash flows for 2020 using the indirect method using the information.

The 2020 comparative balance sheet and 2020 income statement of Maple Group Ltd, have just been prepare and presented to the owners by the company’s Accountant. Upon close examination of the financial information received, it was discovered that some figures in the balance sheet were erroneously omitted due to an oversight by the accountant who is not available to fix the problem due to his unavoidable absence from work. In addition, the owners were concerned about the movement in the company’s cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners.

- Prepare a complete statement of cash flows for 2020 using the indirect method using the information.

Step by step

Solved in 3 steps with 2 images