Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 4TIF

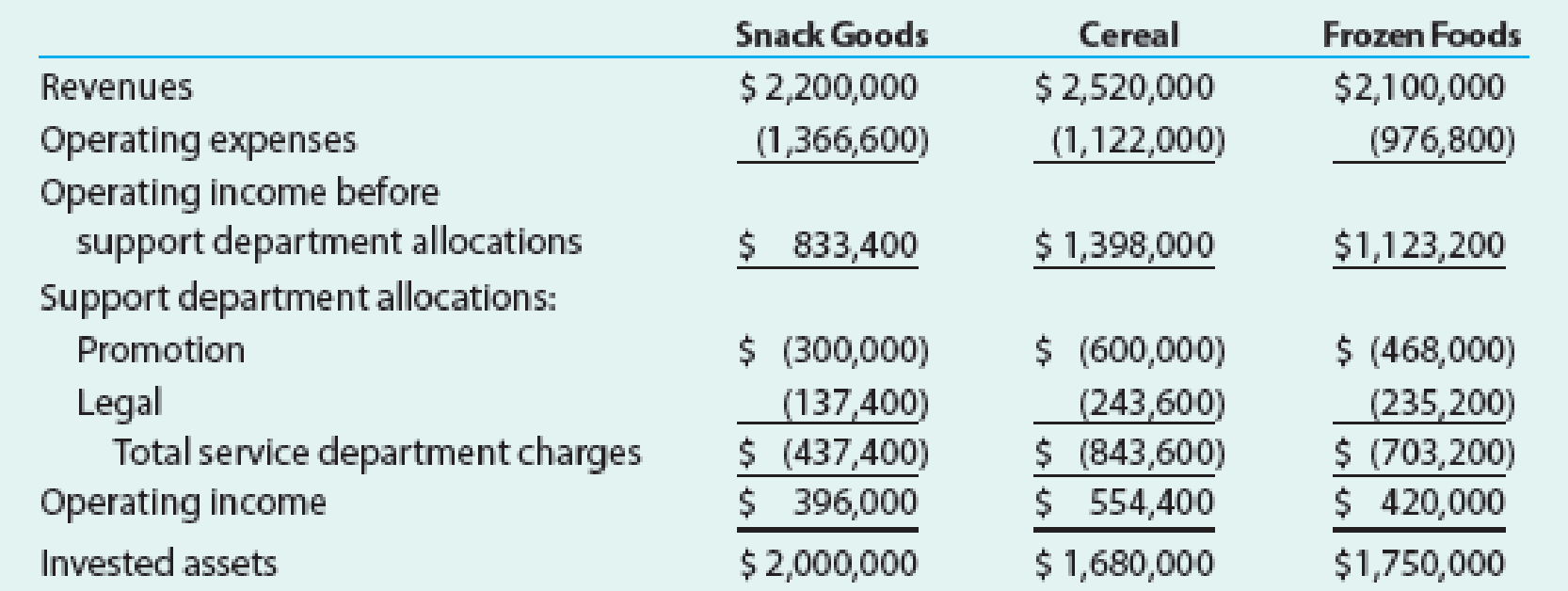

The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

- a. Which division is making the best use of invested assets and should be given priority for future capital investments?

- b. b.

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain.

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. - c. c.

Identify opportunities for improving the company’s financial performance.

Identify opportunities for improving the company’s financial performance.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Evaluating Divisional Performance

The three divisions of Delicious Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

Which division is making the best use of invested assets and should be given priority for future capital investments?

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain.

Identify opportunities for improving the company's financial performance.

Requirements:

I- TITLE OF THE CASE

II - TIME CONTEXT

(The approximate time when the case happened. Consider only this time period when you analyze the case.)

III - VIEWPOINT

(Consider always the point of view by the concerned officer/s based on the course being undertaken example: Marketing Director if the subject is marketing management, CEO if business Policy/…

Evaluating Divisional Performance

The three divisions of Delicious Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

Which division is making the best use of invested assets and should be given priority for future capital investments?

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain.

Identify opportunities for improving the company's financial performance.

Requirements:

V-STATEMENT OF THE PROBLEM

Based on the areas of consideration come up with central problem of the case. Or you can enumerate the problems you find and arrange them in order of significance in order to be able to identify the central problem.

Always write one-line statement of the problem either a declarative statement form or question form.

VI -…

Bersatu Berhad splits into two divisions, A and B, each with their own cost and revenue streams. Each of the divisions is managed by a divisional manager who has the power to make all investment decisions within the division. The cost of capital for both divisions is 12%. Historically, investment decisions have been made by calculating the return on investment (ROI) of any opportunities and at present.A new manager who has recently been appointed in division A has argued that using residual income (RI) to make investment decisions would result in ‘better goal congruence’ throughout the company. Each division is currently considering the following separate investments:

Project for Division A

Project for Division B

Capital requirement for investment

RM 82.8 million

RM40.6 million

Sales generated by investment

Rm44.6 million

Rm21.8 million

Net profit margin

28%

33%

The company is seeking to maximise shareholder wealth. Required: Calculate both the return on investment and…

Chapter 10 Solutions

Managerial Accounting

Ch. 10 - Differentiate between centralized and...Ch. 10 - Differentiate between a profit center and an...Ch. 10 - Prob. 3DQCh. 10 - What is the major shortcoming of using operating...Ch. 10 - In a decentralized company in which the divisions...Ch. 10 - How does using the return on investment facilitate...Ch. 10 - (a) Explain how return on investment might lead a...Ch. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - When using the negotiated price approach to...

Ch. 10 - Budgetary performance for cost center Vinton...Ch. 10 - Support department allocations The centralized...Ch. 10 - Prob. 3BECh. 10 - Profit margin, investment turnover, and ROI Briggs...Ch. 10 - Residual income The Commercial Division of Galena...Ch. 10 - Prob. 6BECh. 10 - Budget performance reports for cost centers...Ch. 10 - The following data were summarized from the...Ch. 10 - For each of the following support departments,...Ch. 10 - Prob. 4ECh. 10 - Service department charges In divisional income...Ch. 10 - Varney Corporation, a manufacturer of electronics...Ch. 10 - Horton Technology has two divisions, Consumer and...Ch. 10 - Rocky Mountain Airlines Inc. has two divisions...Ch. 10 - Championship Sports Inc. operates two divisionsthe...Ch. 10 - Prob. 10ECh. 10 - The operating income and the amount of invested...Ch. 10 - Prob. 12ECh. 10 - The condensed income statement for the Consumer...Ch. 10 - The Walt Disney Company (DIS) has four business...Ch. 10 - Prob. 15ECh. 10 - Prob. 16ECh. 10 - Materials used by the Instrument Division of...Ch. 10 - Prob. 18ECh. 10 - GHT Tech Inc. sells electronics over the Internet....Ch. 10 - Profit center responsibility reporting for a...Ch. 10 - Prob. 3PACh. 10 - Effect of proposals on divisional performance A...Ch. 10 - Divisional performance analysis and evaluation The...Ch. 10 - Prob. 6PACh. 10 - Prob. 1PBCh. 10 - Prob. 2PBCh. 10 - Prob. 3PBCh. 10 - Prob. 4PBCh. 10 - Divisional performance analysis and evaluation The...Ch. 10 - Prob. 6PBCh. 10 - Prob. 1MADCh. 10 - Prob. 2MADCh. 10 - Papa Johns International, Inc. (PZZA), operates...Ch. 10 - Panera Bread Company (PNRA) operates over 2,000...Ch. 10 - Prob. 5MADCh. 10 - Prob. 1TIFCh. 10 - Prob. 2TIFCh. 10 - Prob. 3TIFCh. 10 - The three divisions of Yummy Foods are Snack...Ch. 10 - Prob. 5TIFCh. 10 - Prob. 1CMACh. 10 - Prob. 2CMACh. 10 - Prob. 3CMACh. 10 - Morrisons Plastics Division, a profit center,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-32 Residual Income Refer to the information for Washington Company above. In addition, Washington Companys top management has set a minimum acceptable rate of return equal to 8%. Required: 1. Calculate the residual income for the Adams Division. 2. Calculate the residual income for the Jefferson Division.arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-31 Economic Value Added Refer to the information for Washington Company above. Required: 1. Calculate the EVA for the Adams Division. 2. Calculate the EVA for the Jefferson Division. 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth? 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washingtons management team could take to increase Jefferson Divisions EVA?arrow_forward

- Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows: The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 8,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. a. Determine the return on investment for the Specialty Products Division for the past year. b. Determine the Specialty Products Division managers bonus for the past year. c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places. d. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. e. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.arrow_forwardManagement has determined that in order to upgrade the competitor to Megatronics standards, an additional $375,000 of invested capital would be needed. a. Compute the current ROI of the Northeast Division and the division's ROI if the competitor is acquired. b. If divisional management is being evaluated on the basis of ROI, will the Northeast Division likely pursue acquisition of the competitor? c. Compute the ROI of the competitor as it is now and after the intended upgrade. d. If ROI is used as the basis for evaluation, would Megatronics Corporation likely be infavor of the acquisition of the competitor?e. Calculate the Northeast Division's ROI after acquisition of competitor but before upgrad-ing. f. Assume that Megatronics uses residual income to evaluate performance and desires a 12 percent minimum return on invested capital. Compute the current residual income of the Northeast Division and the division's residual income if the competitor is acquired.g. If divisional management…arrow_forwardJohn Ltd is an organization with two divisions: A and B, each with its own cost and revenue streams. Each of the two divisions is classified as Investment center. The company’s cost of capital is 9%. Historically, investment decisions have been made by calculating the return on investment (ROI). A new manager who has recently been appointed in division A has argued that using residual income (RI) to make investment decisions would result in ‘better goal congruence’ throughout the company. The data below shows the current position of the division as at the end of 31 December, 2019: Details of Projects Project A Project B Capital required GH¢ 82.8 million GH¢ 40.6 million Sales generated GH¢44.6 million GH¢ 21.8 million Net Profit margin 18% 25% The company is seeking to maximize shareholders wealth. Assuming that, Division A acquires a more efficient asset at GH¢17 million and Division B sold one of its assets with written down value of GH¢21 million, and profits are expected to…arrow_forward

- Paula Boothe, president of the Bramble Corporation, has mandated a minimum 8% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 10%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 12% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $1,816,000 in a new line of energy drinks that is expected to generate $319,000 in operating income. Assume that Monty Corporation's actual weighted average cost of capital is 10% and its tax rate is 30%. Calculate the economic value added of the proposed new line of energy drinks. Economic value added $______________arrow_forwardA diversified company has decided to use its overall firm WACC as a performance benchmark for rating its divisional managers and to decide whether new projects from its three divisions should be funded for investment capital. The firm WACC is 10%. The divisional WACCs for its high risk, average risk, and low risk divisions are 16%, 10%, and 8%, respectively. Please explain: (a) What will happen to the firm's overall risk and market value if the firm WACC (10%) is used to evaluate projects and managers of high risk division; (b) What will happen to the firm's overall risk and market value if the firm WACC (10%) is used to evaluate projects and managers of low risk division; and (c) How would managers of high-risk and low-risk divisions react to using firm WACC as a performance benchmark for managers and divisional investment projects.arrow_forwardGive a detailed explanation of the question below; “Alisha May, division manager of Shotgun Inc., was debating the merits of launching a new product. The budgeted income of the division was £885,000 with operating assets of £2,950,000. The proposed investment would add income of £781,250 and would require an additional investment in equipment of £3,125,000. The minimum required return on investment for the company is 15%.” Required: “Compute the ROI of the: division if the new product is not undertaken. new product alone. division if the new product is undertaken.” “Compute the Residual Income of the: division if the new product is not undertaken. new product alone. division if the new product is undertaken.” “Do you suppose that Alisha will decide to invest in the new product? Why or why not?”arrow_forward

- “Alisha May, division manager of Shotgun Inc., was debating the merits of launching a new product. The budgeted income of the division was £885,000 with operating assets of £2,950,000. The proposed investment would add income of £781,250 and would require an additional investment in equipment of £3,125,000. The minimum required return on investment for the company is 15%.” Required: “Compute the ROI of the: division if the new product is not undertaken. new product alone. division if the new product is undertaken.” “Compute the Residual Income of the: division if the new product is not undertaken. new product alone. division if the new product is undertaken.” “Do you suppose that Alisha will decide to invest in the new product? Why or why not?”arrow_forwardMr. Bailey asks that you prepare Divisional Income Statements showing what 20Y8 results would have been had the Audit Division purchased all the excess capacity of the Tax Division, using a market transfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of 800 hours, the Audit Division can perform 4 more audits during the year, and the Tax Division would charge the Audit Division the market rate of $100 per hour for the additional hours required, selling all its excess capacity to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employees. Complete the following Divisional Income Statements. If there is no amount or an amount is zero, enter “0”. BOR CPAs, Inc.Divisional Income StatementsFor the Year Ended December 31, 20Y8 Audit Division Tax Division Total Company Fees earned: Audit fees (16 engagements) $1,200,000 $1,200,000 Tax fees (45 engagements) $708,750…arrow_forwardMr. Bailey asks that you prepare Divisional Income Statements showing what 20Y1 results would have been had the Audit Division purchased all the excess capacity of the Tax Division, using a cost transfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of 800 hours, the Audit Division can perform 4 more audits during the year, and the Audit Division would pay the Tax Division's internal hourly rate of $60.00 per hour for the additional hours required, with the Tax Division selling all its excess capacity to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employees. Complete the following Income Statements. Enter all amounts as positive numbers. If there is no amount or an amount is zero, enter “0”. BOR CPAs, Inc. Income Statements For the Year Ended December 31, 20Y1 1 Audit Division Tax Division Total Company 2 Fees earned: 3 Audit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

GE McKinsey Matrix for SBU Strategies; Author: Wolters World;https://www.youtube.com/watch?v=FffD1Ze76JQ;License: Standard Youtube License