Concept explainers

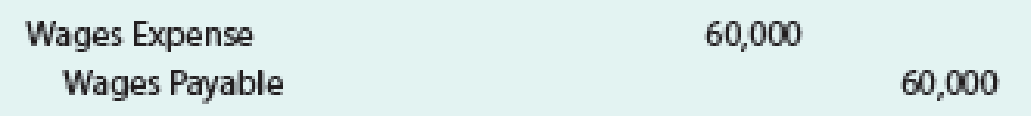

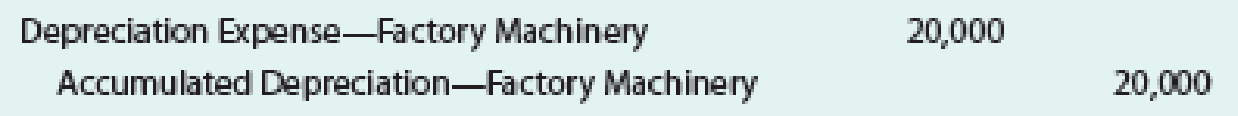

Todd Lay just began working as a cost accountant for Enteron Industries Inc., which manufactures gift items. Todd is preparing to record summary

Then the factory

Todd’s supervisor, Jeff Fastow, walks by and notices the entries. The following conversation takes place:

Jeff: That’s a very unusual way to record our factory wages and depreciation for the month.

Todd: What do you mean? This is the way I was taught in school to record wages and depreciation.

You know, debit an expense and credit Cash or payables or, in the case of depreciation, credit Accumulated Depreciation.

Jeff: Well, it’s not the credits I’m concerned about. It’s the debits—I don’t think you’ve recorded the debits correctly. I wouldn’t mind if you were recording the administrative wages or office equipment depreciation this way, but I’ve got real questions about recording factory wages and factory machinery depreciation this way.

Todd: Now I’m really confused. You mean this is correct for administrative costs but not for

- a.

Play the role of Jeff and answer Todd’s questions.

Play the role of Jeff and answer Todd’s questions. - b.

Why would Jeff accept the journal entries if they were for administrative costs?

Why would Jeff accept the journal entries if they were for administrative costs?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

- John Biggs and Patty Jorgenson are both cost accounting managers for a manufacturing division. During lunch yesterday, Patty told John that she was planning on quitting her job in three months because she had accepted a position as controller of a small company in a neighboring state. The starting date was timed to coincide with the retirement of the current controller. Patty was excited because it allowed her to live near her family. Today, the divisional controller took John to lunch and informed him that he was taking a position at headquarters and that he had recommended that Patty be promoted to his position. He indicated to John that it was a close call between him and Patty and that he wanted to let John know personally about the decision before it was announced officially. Required: What should John do? Describe how you would deal with his ethical dilemma (considering the IMA code of ethics in your response).arrow_forwardAnnabelle keeps accounting and cost records on a personal computer. During the month of January, data were lost as a result of errors made by a new operator. Fortunately, some data were retrieved and are set forth as follows:a. The debit balance in the payroll account was P130,000. This balance included P20,000 in indirect labor that was charged to the factory overhead.b. The debit balance in the factory overhead account totaled P165,000 while the total credit totaled P166,000.c. Work in process account showed a January 1 balance of P 91,000. Materials requisitioned and charged to work in process during the period amounted to P 98,000. The balance in work in process on January 31, was P82,000.d. The finished goods balance at January 1 was P50,000.e. Cost of goods sold had a debit balance of P 389,000. This amount did not include under-applied factory overhead. The balance of Cost of Sales after closing the overhead variance (immaterial) is:arrow_forwardDagley’s Donuts is a business that sells fax machines. In order to help make decisions for the business, Mr. Dagley has his staff accountant create a Schedule of Raw Materials. If the Raw Materials transferred to ‘work in progress’ is $650,000, the Ending Raw Materials is $122,000, and the Net Purchase of Raw Materials is $756,000, what were the Beginning Raw Materials for the year?arrow_forward

- Tom Kemper is the controller of the Wichita manufacturing facility of Prudhom Enterprises, Inc. The annual cost control report is one of the many reports that must be filed with corporate headquarters and is due at corporate headquarters shortly after the beginning of the New Year. Kemper does not like putting work off to the last minute, so just before Christmas he prepared a preliminary draft of the cost control report. Some adjustments would later be required for transactions that occur between Christmas and New Year’s Day. A copy of the preliminary draft report, which Kemper completed on December 21, follows: Wichita Manufacturing FacilityCost Control ReportDecember 21 Preliminary Draft ActualResults FlexibleBudget SpendingVariances Labor-hours 18,000 18,000 Direct labor $ 326,000 $ 324,000 $ 2,000 U Power 19,750 18,000 1,750 U Supplies 105,000 99,000 6,000 U Equipment depreciation 343,000 332,000 11,000 U…arrow_forwardMatt Demko is the loading dock supervisor for a dry cement packaging company. His work crew is composed of unskilled workers who load large transport trucks with bags of cement, gravel, and sand. The work is hard, and the employee turnover rate is high. Employees record their attendance on separate time cards. Demko authorizes payroll payments each week by signing the time cards and submitting them to the payroll department. Payroll then prepares the paychecks and gives them to Demko, who distributes them to his work crew. a. Prepare a systems flowchart of the procedures described here. b. Identify any control problems in the system. c. What sorts of fraud are possible in this system?arrow_forwardThis case is based on an actual situation. Centennial Construction Company, headquartered in Dallas, Texas, built a Rodeway Motel 35 miles north of Dallas. The construction foreman, whose name was Slim Chance, hired the 40 workers needed to complete the project. Slim had the construction workers fill out the necessary tax forms, and he sent their documents to the home office. Work on the motel began on April 1 and ended September 1. Each week, Slim filled out a timecard of hours worked by each employee during the week. Slim faxed the timecards to the home office, which prepared the payroll checks on Friday morning. Slim drove to the home office on Friday, picked up the payroll checks, and returned to the construction site. At 5 p.m. on Friday, Slim distributed payroll checks to the workers. Requirements Describe in detail the main internal control weakness in this situation. Specify what negative result(s) could occur because of the internal control weakness. Describe what you would…arrow_forward

- Occasion Shop, Inc., keeps accounting and cost records on a personal computer. During the month of January, data were lost as a result of errors made by a new operator. Fortunately, some data were retrieved and are set forth as follows:a. The debit balance in the payroll account was P130,000. This balance included P20,000 in indirect labor that was charged to the factory overhead.b. The debit balance in the factory overhead account totaled P165,000 while the total credit totaled P166,000.c. Work in process account showed a January 1 balance of P 91,000. Materials requisitioned and charged to work in process during the period amounted to P 98,000. The balance in work in process on January 31, was P82,000.d. The finished goods balance at January 1 was P50,000.e. Cost of goods sold had a debit balance of P 389,000. This amount did not include under-applied factory overhead. The balance of Cost of Sales after closing the overhead variance (immaterial) is?arrow_forwardABC Manufacturing is a producer of a local product used in house cleaning, called Agent C. The production manager isrequired to present a production report for the month August, however he got no idea on what information he neededfor the report, and what analysis could be made to help the top management on their decision-making.The production manager sought your expertise on the subject matter and gave to you the following information:Sales (in Pesos) 4,957,875.00Sales Volume 22,500.00Variable Costs:Cost of Direct Raw Materials 895,000.00Cost of Direct Labor 530,000.00Cost of Packaging Materials 124,200.00Fixed Costs:Monthly Depreciation 650,000.00Monthly Rent of Warehouse 100,000.00Fixed Monthly Allowance for Electricity 675,000.00Other Fixed Manufacturing Overhead 146,700.00Required:BREAKEVEN ANALYSIS1. Compute the selling price per unit of Agent C. _________________2. Compute the variable cost per unit of Agent C. _________________3. Compute the variable cost rate of Agent C.…arrow_forwardAelan Products Company, a small manufacturer, has submitted the items below concerning last year's operations. The president's secretary, trying to be helpful, has alphabetized the list. Administrative salaries $4,800 Advertising expense 2,400 Depreciation—factory building 1,600 Depreciation—factory equipment 3,200 Depreciation—office equipment 360 Direct labour cost 43,800 Raw materials inventory, beginning 4,200 Raw materials inventory, ending 6,400 Finished goods inventory, beginning 93,960 Finished goods inventory, ending 88,820 General liability insurance expense 480 Indirect labour cost 23,600 Insurance on factory 2,800 Purchases of raw materials 29,200 Repairs and maintenance of factory 1,800 Sales salaries 4,000 Taxes on factory 900 Travel and entertainment expense 2,820 Work in process inventory, beginning 3,340 Work in process inventory, ending 2,220…arrow_forward

- Specter Company, a small manufacturer, has submitted the items below concerning last year'soperations. The president's secretary, trying to be helpful, has alphabetized the list.Administrative salaries $2,400Advertising expense 1,200Depreciation—factory building 800Depreciation—factory equipment 1,600Depreciation—office equipment 180Direct labour cost 21,900Raw materials inventory, beginning 2,100Raw materials inventory, ending 3,200Finished goods inventory, beginning 46,980Finished goods inventory, ending 44,410General liability insurance expense 240Indirect labour cost 11,800Insurance on factory 1,400Purchases of raw materials 14,600Repairs and maintenance of factory 900Sales salaries 2,000Taxes on factory 450Travel and entertainment expense 1,410Work in process inventory, beginning 1,670Work in process inventory, ending 1,110Required:a. Prepare a schedule of Cost of Goods Manufactured in good form for the year. UseDecember and current year for time period. b. Determine the Cost of…arrow_forwardDave’s Scooters is a small manufacturer of specialty scooters. The company employs 14 production workers and four administrative persons. The following procedures are used to process the company’s weekly payroll:a. Whenever an employee receives a pay raise, the supervisor must fill out a wage adjustment form, which is signed by the company president. This form is used to change the employee’s wage rate in the payroll system.b. All employees are required to record their hours worked by clocking in and out on a time clock. Employees must clock out for lunch break. Due to congestion around the time clock area at lunch time, management has not objected to having one employee clock in and out for an entire department.c. Whenever a salaried employee is terminated, Personnel authorizes Payroll to remove the employee from the payroll system. However, this procedure is not required when an hourly worker is fired. Hourly employees only receive a paycheck if their time cards show hours worked.…arrow_forwardSM Corp. keeps accounting and cost records on a personal computer. During the month of January, date were lost as a result of errors made by a new operator. Fortunately, some data were retrived and are set forth as follows: a) The debit balance in the Payroll acount was P130,000. This balance included P20,000 in indirect labor that was charged to the Factory Overhead account. b) The debit balance in the Factory Overhead account totaled P166,000. This balance included the indirect labor hour amount in (a). c) Factory overhead is applied to the products at 150 percent of direct labor cost. d) The Work in Process account showed a January 1 balance of P91,000. Materials requisitioned and charged to Work in Process during the period amounted to P98,000. The balance in Work in Process on January 31, was P82,000. e) The Finished Goods balance at January 1 was P82,000. f) Cost of Goods Sold had a debit balance of P389,000. This amount did not included underapplied or overapplied…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,