1.

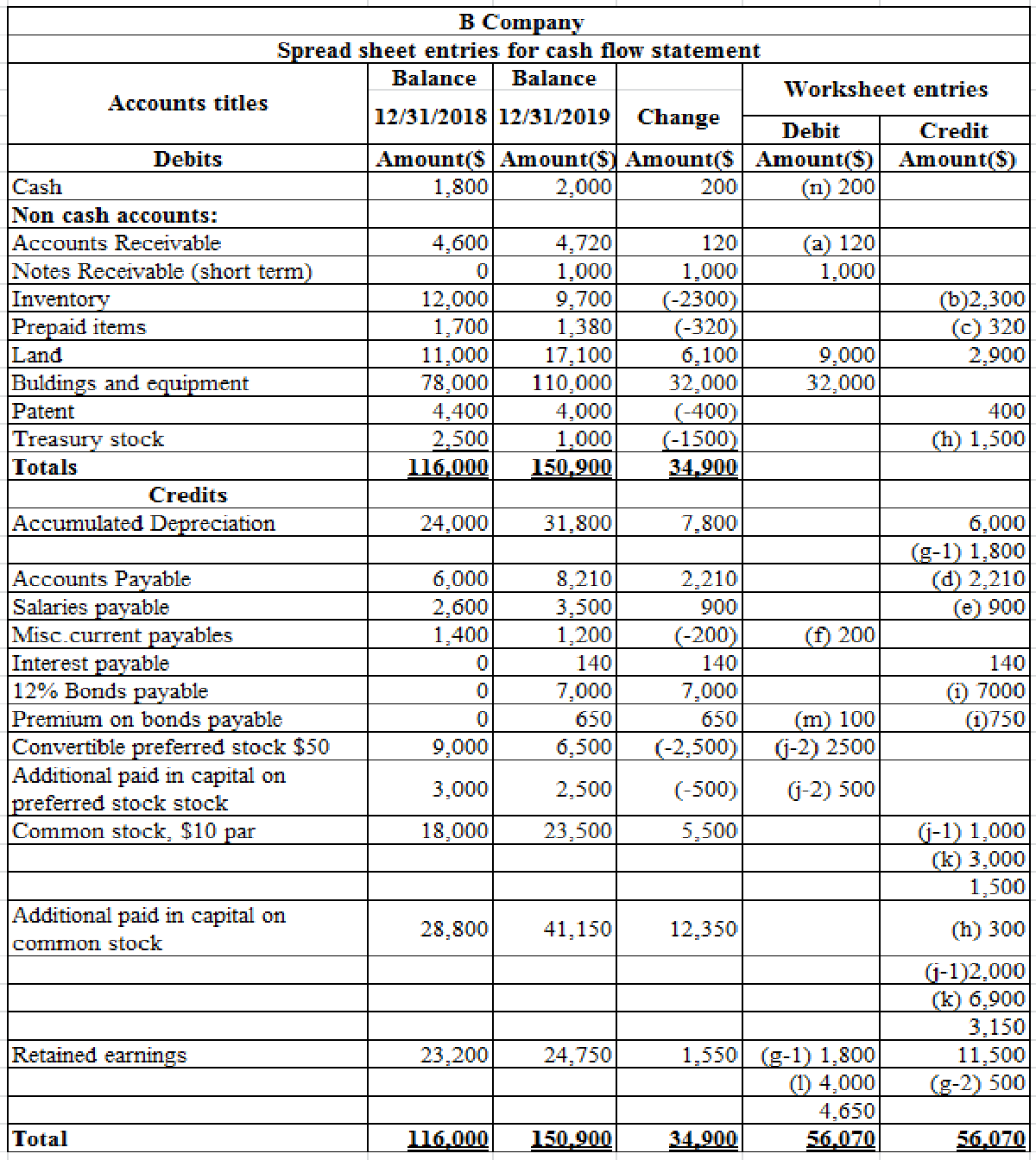

Prepare a spreadsheet to support the cash flow statement of B Company for the year 2019.

1.

Explanation of Solution

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of cash flows: Statement of cash flow reports all the cash transactions which are responsible for inflow and outflow of cash and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

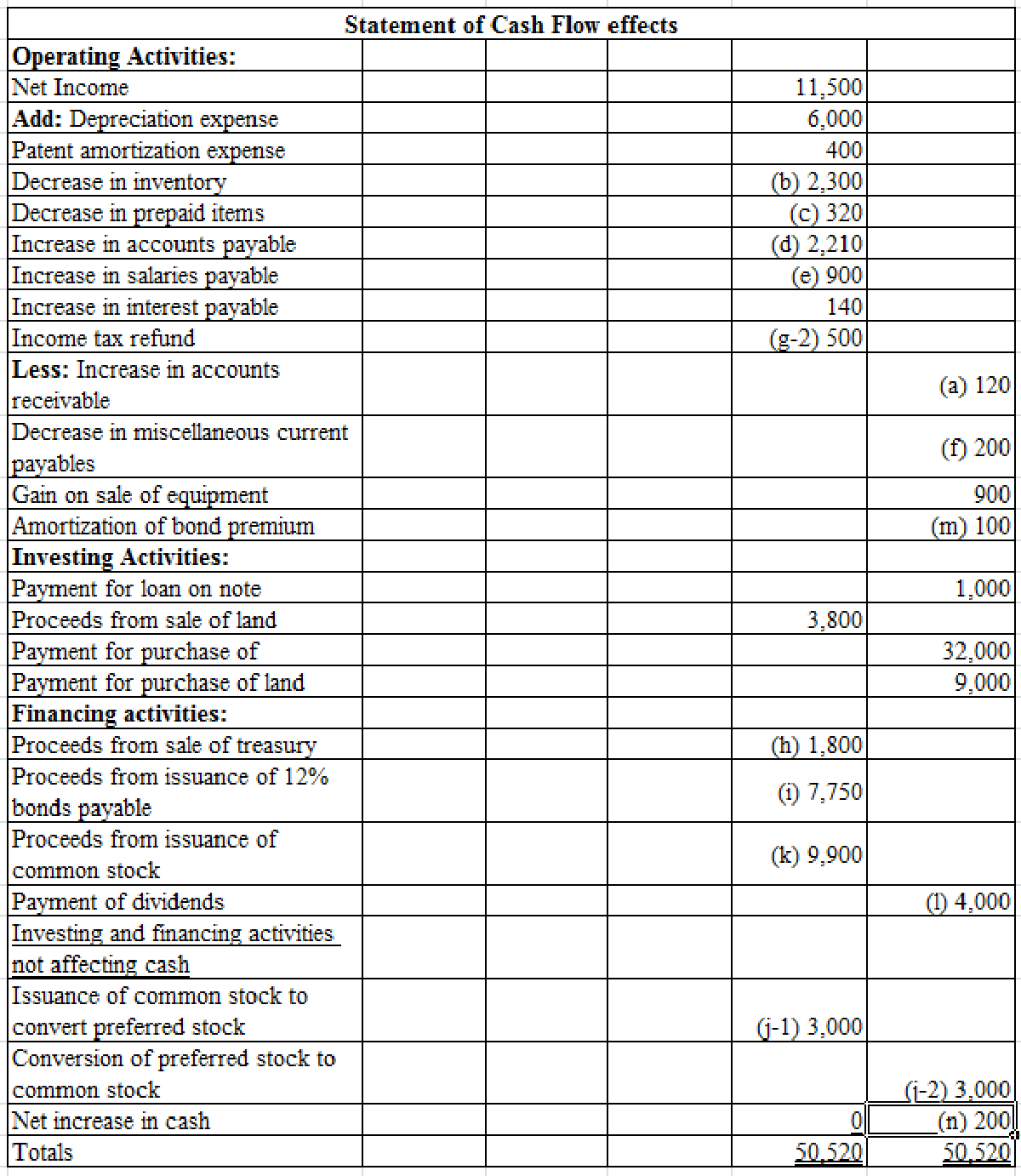

Prepare a spreadsheet entry to support the cash flow statement.

Table (1)

Table (2)

Working notes:

a. Calculate the Changes in accounts receivable.

b. Calculate the changes in inventory.

c. Calculate the change in prepaid item.

d. Calculate the changes in accounts payable.

e. Calculate the changes in salaries payable.

f. Calculate the changes in miscellaneous current payable.

g-1) Understated of depreciation expenses for the last year by $1,800.

g-2) Received income tax refund of $500.

h) Calculate the additional paid in capital received through treasury stock.

i). Calculate the premium on bonds payable.

j-1) Common stock issued to convert the preferred stock by $3,000.

j-2) Preferred stock converted into common stock for $3,000.

k) Calculate the Premium on common stock.

l) Cash dividend paid by $4,000.

m) Amortization of premium on bonds payable by $100.

n) Cash increased by $200.

2.

Prepare a cash flow statement under indirect method of B Company for the year 2019 and show operating cash flow in the separate schedule.

2.

Explanation of Solution

Operating activities: Operating activities include

Financing activities: Financing activities includes cash inflows and outflows from issuance of common stock and debt, payment of debt and dividends.

Investing activities: Investing activities includes cash inflows and

Prepare the cash flow statement under indirect method.

| B company | ||

| Statement of cash flow | ||

| For the year end 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Operating activities: | ||

| Net cash provided by operating activities ( schedule 1) | $22,950 | |

| Investing activities: | ||

| Proceeds from sale of land | $3,800 | |

| Payment for loan on note receivable | (1,000) | |

| Payment for purchase of land | (9,000) | |

| Payment for purchase of equipment | (32,000) | |

| Net cash used for investing activities | ($38,200) | |

| Financing activities: | ||

| Proceeds from sale of | $ 1,800 | |

| Proceeds from issuance of 12% bonds payable | 7,750 | |

| Proceeds from issuance of common stock | 9,900 | |

| Payment of dividends | (4,000) | |

| Net cash provided by financing activities | 15,450 | |

| Net increase in cash (Schedule 2) | $200 | |

| Cash, January 1, 2019 | 1,800 | |

| Cash, December 31, 2019 | $2,000 | |

| Schedule 1: Cash flows from operating activities | ||

| Net income | $11,500 | |

| Adjustment for non-cash income items: | ||

| Add: | 6,000 | |

| Patent amortization expense | 400 | |

| Less: Amortization of bond premium | (100) | |

| Gain on sale of equipment | (900) | |

| Adjustment for cash flow effects from | ||

| Increase in accounts receivable | (120) | |

| Decrease in inventories | 2,300 | |

| Decrease in prepaid items | 320 | |

| Increase in accounts payable | 2,210 | |

| Increase in salaries payable | 900 | |

| Increase in interest payable | 140 | |

| Decrease in miscellaneous current payables | (200) | |

| Income tax refund | 500 | |

| Net cash provided by operating activities | $22,950 | |

| Schedule 2: Investing and Financing activities not affecting cash | ||

| Financing activities: | ||

| Conversion of | ($3,000) | |

| Issuance of common stock to convert preferred stock | 3,000 | |

Table (3)

Therefore cash balance as on December 31, 2019 is $2,000.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

- Statement of Cash Flows The following are Mueller Companys cash flow activities: a. Net income, 68,000 b. Increase in accounts receivable, 4,400 c. Receipt from sale of common stock, 12,300 d. Depreciation expense, 11,300 e. Dividends paid, 24,500 f. Payment for purchase of building, 65,000 g. Bond discount amortization, 2,700 h. Receipt from sale of long-term investments at cost, 10,600 i. Payment for purchase of equipment, 8,000 j. Receipt from sale of preferred stock, 20,000 k. Increase in income taxes payable, 3,500 l. Payment for purchase of land, 9,700 m. Decrease in accounts payable, 2,900 n. Increase in inventories, 10,300 o. Beginning cash balance, 18,000 Required: Prepare Mueller Company's statement of cash flows.arrow_forwardPartial Statement of Cash Flows Service Company had net income during the current year of $65,800. The following information was obtained from Services balance sheet: Accounts receivable $26,540 increase Inventory 32,180 increase Accounts payable 9,300 decrease Interest payable 2,120 increase Accumulated depreciation (Building) 14,590 increase Accumulated depreciation (Equipment) 32,350 increase Additional Information: 1. Equipment with accumulated depreciation of $18,000 was sold during the year. 2. Cash dividends of $29,625 were paid during the year. Required: 1. Prepare the net cash flows from operating activities using the indirect method. 2. CONCEPTUAL CONNECTION How would the cash proceeds from the sale of equipment he reported on the statement of cash flows? 3. CONCEPTUAL CONNECTION How would the cash dividends be reported on the statement of cash flows? 4. CONCEPTUAL CONNECTION What could the difference between net income and cash flow from operating activities signal to financial statement users?arrow_forwardStatement of cash flowsindirect method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, 250,000. b. Depreciation reported on the income statement, 135,000. c. Equipment was purchased at a cost of 420,000 and fully depreciated equipment costing 90,000 was discarded, with no salvage realized. d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty. e. 30,000 shares of common stock were issued at 20 for cash. f. Cash dividends declared and paid, 45,000. Instructions Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.arrow_forward

- EXPANDED STATEMENT OF CASH FLOWS Financial statements for McDowell Company as well as additional information relevant to cash flows during the period are given below and on the next page. Additional information: 1. Store equipment was sold in 20-2 for 35,000. Additional information on the store equipment sold is provided below. 2. Depreciation expense for the year was 112,000. 3. The following purchases were made for cash: 4. Declared and paid cash dividends of 60,000. 5. Issued 10,000 shares of 10 par common stock for 142 per share. 6. Acquired additional office equipment by issuing a note payable for 16,000. REQUIRED Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2. SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-12A for McDowell Company, prepare the following: 1. A schedule for the calculation of cash generated from operating activities for McDowellCompany for the year ended December 31, 20-2. 2. A partial statement of cash flows for McDowell Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.arrow_forwardEXPANDED STATEMENT OF CASH FLOWS Financial statements for McGinnis Company as well as additional information relevant to cash flows during the period are given below and on the next page. Additional information: 1. Office equipment was sold in 20-2 for 35,000. Additional information on the office equipment sold is provided below. 2. Depreciation expense for the year was 70,000. 3. The following purchases were made for cash: 4. Declared and paid cash dividends of 40,000. 5. Issued 10,000 shares of 10 par common stock for 22 per share. 6. Acquired additional office equipment by issuing a note payable for 8,000. REQUIRED Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.arrow_forwardEXPANDED STATEMENT OF CASH FLOWS Financial statements for McGinnis Company as well as additional information relevant to cash flows during the period are given below and on the next page. Additional information: 1. Office equipment was sold in 20-2 for 35,000. Additional information on the office equipment sold is provided below. 2. Depreciation expense for the year was 70,000. 3. The following purchases were made for cash: 4. Declared and paid cash dividends of 40,000. 5. Issued 10,000 shares of 10 par common stock for 22 per share. 6. Acquired additional office equipment by issuing a note payable for 8,000. REQUIRED Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2. STATEMENT OF CASH FLOWS UNDER THE DIRECT METHOD Using the information provided in Problem 23-12B for McGinnis Company, prepare the following: 1. A schedule for the calculation of cash generated from operating activities for McGinnis Company for the year ended December 31, 20-2. 2. A statement of cash flows for McGinnis Company prepared under the direct method for the year ended December 31, 20-2.arrow_forward

- Statement of Cash Flows A list of Fischer Companys cash flow activities is presented here: a. Patent amortization expense, 3,500 b. Machinery was purchased for 39,500 c. At year-end, bonds payable with a face value of 20,000 were issued for 17,000 d. Net income, 47,200 k. Inventories increased by 15,400 e. Dividends paid, 16,000 f. Depreciation expense, 12,900 g. Preferred stock was issued for 13,600 h. Investments were acquired for 21,000 i. Accounts receivable increased by 4,300 j. Land was sold at cost, 11,000 k. Inventories increased by 15,400 l. Accounts payable increased by 2,700 m. Beginning cash balance, 19,400 Required: Prepare Fischers statement of cash flows.arrow_forwardIn the current year, Harrisburg Corporation had net income of 35,000, a 9,000 decrease in accounts receivable, a 7,000 increase in inventory, an 8,000 increase in salaries payable, a 13,000 decrease in accounts payable, and 10,000 in depreciation expense. Using the indirect method, prepare the operating activities section of its statement of cash flows based on this information.arrow_forwardStatement of Cash Flows The following are several items involving Tejera Companys cash flow activities: a. Net income, 60,400 b. Receipt from issuance of common stock, 32,000 c. Payment for purchase of equipment, 41,500 d. Payment for purchase of land, 19,600 e. Depreciation expense, 20,500 f. Patent amortization expense, 1,200 g. Payment of dividends, 21,000 h. Decrease in salaries payable, 2,600 i. Increase in accounts receivable, 10,300 j. Beginning cash balance, 30,700 Required: Prepare Tejeras statement of cash flows using the direct method.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,