Concept explainers

Determining missing items from computations

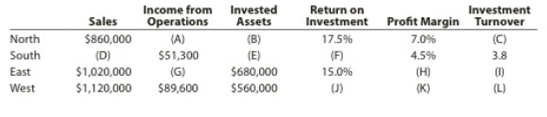

Data for the North, South, East, and West divisions of Free Bird Company are as follows:

- A. Determine the missing items, identifying each by the letters (A) through (L). (Round percentages and investment turnover to one decimal place.)

- B. Determine the residual income for each division, assuming that the minimum acceptable return on investment established by management is 12%.

- C. Which division is the most profitable in terms of (1) return on investment and (2) residual income?

(a)

Profit margin: This ratio gauges the operating profitability by quantifying the amount of income earned from business operations from the sales generated.

Formula of profit margin:

Investment turnover: This ratio gauges the operating efficiency by quantifying the amount of sales generated from the assets invested.

Formula of investment turnover:

Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Formula of ROI according to Dupont formula:

Residual income: The remaining income from operations after deducting the desired acceptable income is referred to as residual income.

Formula of residual income:

| Income from operations | XXX |

| Less minimum acceptable income from operations as a percent of invested assets | XXX |

| Residual income | XXX |

Table (1)

To compute: The missing items

Explanation of Solution

1)

Compute income from operations.

2)

Compute invested assets.

Note: Refer to missing amount (a) for value of income from operations.

3)

Compute investment turnover.

4)

Compute sales value.

5)

Compute sales value.

Note: Refer to missing amount (d) for value of sales.

6)

Compute ROI.

Note: Refer to missing amount (e) for value of invested assets.

7)

Compute income from operations.

8)

Compute profit margin.

Note: Refer to missing amount (g) for value of income from operations.

9)

Compute investment turnover.

10)

Compute ROI.

11)

Compute profit margin.

12)

Compute investment turnover.

(b)

Explanation of Solution

1)

Determine residual income of N Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for N Division.

Note: Refer to missing amount (b) of part (a) for value of invested assets.

Step 2: Determine residual income of N Division.

| Particulars | Amount ($) |

| Income from operations | $60,200 |

| Less minimum acceptable income from operations as a percent of invested assets | 41,280 |

| Residual income | $18,920 |

Table (2)

Note: Refer to missing amount (a) of part (a) for value of income from operations, and Step 1 for value and computation of minimum acceptable income.

2)

Determine residual income of S Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for S Division.

Note: Refer to missing amount (e) of part (a) for value of invested assets.

Step 2: Determine residual income of S Division.

| Particulars | Amount ($) |

| Income from operations | $51,300 |

| Less minimum acceptable income from operations as a percent of invested assets | 36,000 |

| Residual income | $15,300 |

Table (3)

Note: Refer to Step 1 for value and computation of minimum acceptable income.

3)

Determine residual income of E Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for E Division.

Step 2: Determine residual income of E Division.

| Particulars | Amount ($) |

| Income from operations | $102,000 |

| Less minimum acceptable income from operations as a percent of invested assets | 81,600 |

| Residual income | $20,400 |

Table (4)

Note: Refer to missing amount (g) of part (a) for value of income from operations, and Step 1 for value and computation of minimum acceptable income.

4)

Determine residual income of W Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for W Division.

Step 2: Determine residual income of W Division.

| Particulars | Amount ($) |

| Income from operations | $89,600 |

| Less minimum acceptable income from operations as a percent of invested assets | 67,200 |

| Residual income | $22,400 |

Table (5)

Note: Refer to missing amount (g) of part (a) for value of income from operations, and Step 1 for value and computation of minimum acceptable income.

(c) 1

Explanation of Solution

The division with highest return on investment is considered as the most profitable division. Hence, N Division is the most profitable division with highest ROI of 17.5%.

Want to see more full solutions like this?

Chapter 23 Solutions

Financial & Managerial Accounting

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-32 Residual Income Refer to the information for Washington Company above. In addition, Washington Companys top management has set a minimum acceptable rate of return equal to 8%. Required: 1. Calculate the residual income for the Adams Division. 2. Calculate the residual income for the Jefferson Division.arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forward

- A multinational corporation has a number of divisions, two of which are the North American Division and the Pacific Rim Division. Data on the two divisions are as follows: Round all rates of return to four significant digits. Required: 1. Compute residual income for each division. By comparing residual income, is it possible to make a useful comparison of divisional performance? Explain. 2. Compute the residual rate of return by dividing the residual income by the average operating assets. Is it possible now to say that one division outperformed the other? Explain. 3. Compute the return on investment for each division. Can we make meaningful comparisons of divisional performance? Explain. 4. Add the residual rate of return computed in Requirement 2 to the required rate of return. Compare these rates with the ROI computed in Requirement 3. Will this relationship always be the same?arrow_forwardMargin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: At the beginning of last year, Elway had 28,300,000 in operating assets. At the end of the year, Elway had 23,700,000 in operating assets. Required: 1. Compute average operating assets. 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.) 3. Compute ROI. (Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forwardCommunication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forward

- The following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardDivisional performance analysis and evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Instructions 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no support department allocations. 2. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each division. Round percentages and the investment turnover to one decimal place. 3. If managements minimum acceptable return on investment is 10%, determine the residual income for each division. 4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).arrow_forwardEffect of proposals on divisional performance A condensed income statement for the Commercial Division of Maxell Manufacturing Inc. for the year ended December 31, 20Y9, is as follows: Assume that the Commercial Division received no allocations from support departments. The president of Maxell Manufacturing has indicated that the divisions return on a 2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of 312,500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by 105,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by 560,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional 1,875,000 for the year. Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of 595,000, reduce cost of goods sold by 406,700, and reduce operating expenses by 175,000. Assets of 1,338,000 would be transferred to other divisions at no gain or loss. Instructions 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Commercial Division for the past year. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round the investment turnover and return on investment to one decimal place. 4. Which of the three proposals would meet the required 21% return on investment? 5. If the Commercial Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the presidents required 21% return on investment?arrow_forward

- Refer to the data given in Exercise 10.8. Required: 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) 2. Compute the divisional residual income (rounded to the nearest dollar) for each of the following four alternatives: a. The Espresso-Pro is added. b. The Mini-Prep is added. c. Both investments are added. d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of residual income, which alternative do you think the divisional manager will choose? 3. Based on your answer in Requirement 2, compute the profit or loss from the divisional managers investment decision. Was the correct decision made?arrow_forwardThe income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the return on investment. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the residual income for each year. Explain how this compares to your findings in part C.arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-31 Economic Value Added Refer to the information for Washington Company above. Required: 1. Calculate the EVA for the Adams Division. 2. Calculate the EVA for the Jefferson Division. 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth? 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washingtons management team could take to increase Jefferson Divisions EVA?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College