Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 17P

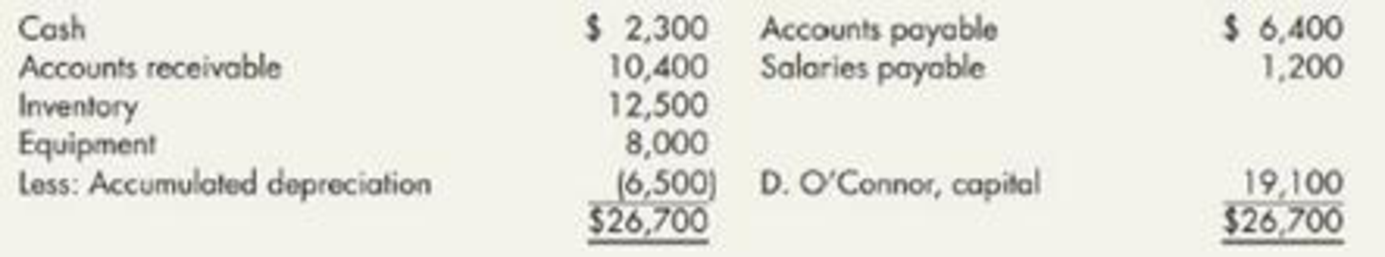

Comprehensive (Appendix 3.1) Dawson O’Connor is the owner of Miller Island Sales, a distributor of fishing supplies. The following is the balance sheet of the company as of December 31, 2018:

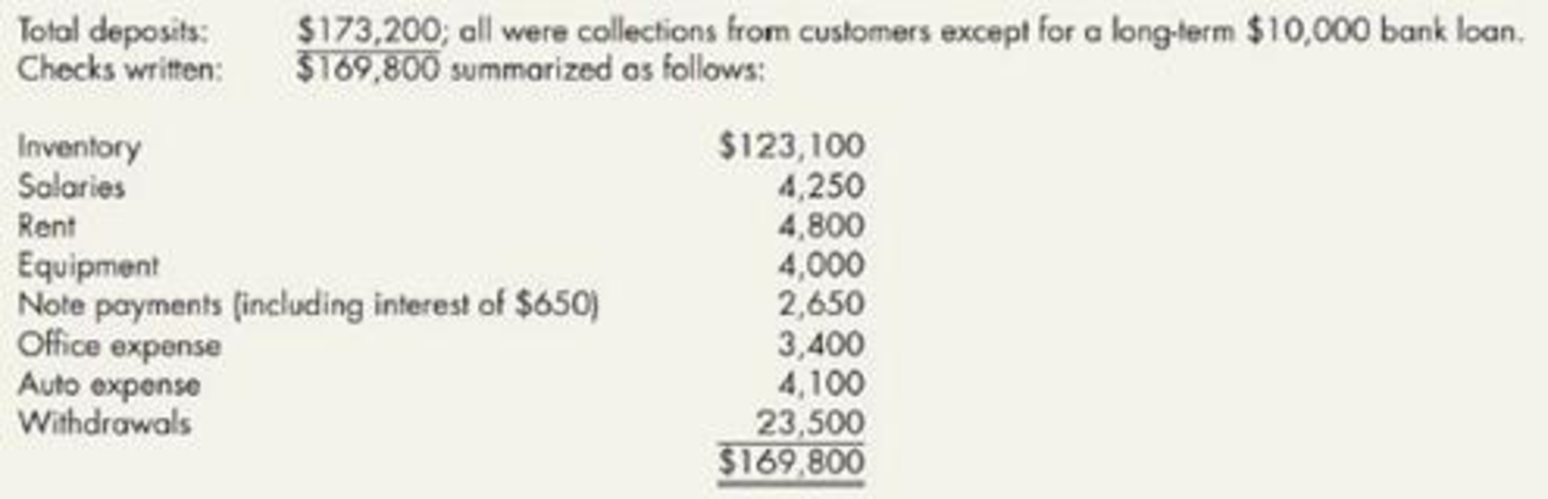

Dawson keeps very few records and has asked you to help him prepare the 2019 financial statements for Miller Island Sales. An analysis of the 2019 cash transactions recorded in the company’s checkbook indicates deposits and checks as follows:

Other information about the company is as follows:

- 1. Accounts receivable at December 31, 2019; $9,200.

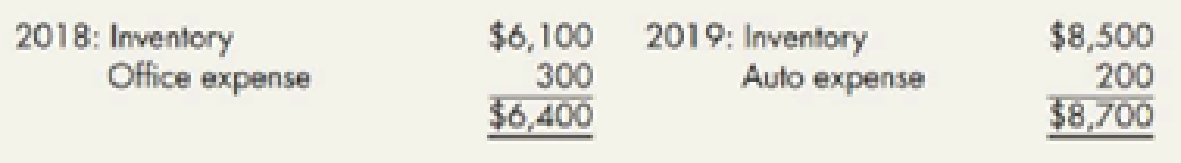

- 2. Accounts payable at December 31:

- 3. Salaries payable at December 31, 2019, $1,800.

- 4. Equipment is

depreciated by the straight-line method over a 10-year life. The equipment purchased in 2019 was acquired on July 1. All of the equipment will have zero salvage value at the end of its useful life. - 5. Interest payable at December 31. 2019: $140.

- 6. The company uses a periodic inventory system Inventory at December 31, 2019: $17,400.

Required:

- 1. Prepare a worksheet to summarize the transactions and adjustments of Miller Island Sales for 2019. (Hint: Include debit and credit columns for both transactions and adjustments.)

- 2. Prepare a 2019 income statement and a balance sheet as of December 31, 2019. (Contributed by Waller A. Parker)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

As the accountant of the popular Italian restaurant, Magical Sicily, you have been requested to assist the bookkeeper to prepare the bank reconciliation statement at 31 March 2019.

The following information is provided:

The bank balance as per the general ledger at 31 March 2019 is an R5 158 in overdraft.

The bank balance as per the bank statement as at 31 March 2019 is a debit of R5 924.

The following transactions were identified to be on the bank statement and were not accounted for by the bookkeeper:

Bank charges amounted to R1 230.

Interest was paid on the overdraft to the value of R840.

The monthly debit order for the insurance premium to the value of R1 200.

A fixed deposit for R6 400 has matured. The capital sum plus interest of R300 had been transferred into the bank account.

The following items were identified in accounting records (general ledger bank account) that were not reflected on the bank statement:

The following cheques were issued during…

ABC company are involved with the following transactions for 2021 from the books of the business. This company operates one bank account to reflect all cash and cheque transactions. You are now required to read these transactions carefully then prepare the relevant documents and books as outlined in the requirements below.

1 Aug 3 Aug

5 Aug

7 Aug 10 Aug 10 Aug

11 Aug

12 Aug

Started business with $150, 000 in the bank

Bought supplies on credit from Right Way Manufacturers

24 Boxes Air Filter

96 Bottles fuel injector cleaner 48 Boxes Spark Plug

36 Boxes Brake Shoe

24 Boxes Disc Pads

Provided services for cash less 10% discount 12 small motorbike engines

6 large motorbike engines (full service)

8 medium size motorbike engines (full service)

Paid Rent by cheque Paid Wages by cheque

Bought Fixtures from CT Limited paying by cash

Provided services on credit to Auto Care.

24 small motorbike engines

8 large motor bike engines (partial service)

12 medium size motorbike engine (partial service)…

You are the Accountant of Mr. Bean Trading, and you are given the following information relating to 31 August 2021 Financial year..

Cash Book closing balance as of 31 August 2021 Dr N$ 1 560

the following information was discovered after you closed off the cash book for 31 August 201.

Client Jone deposited N$ 2 000 directly in the bank account

Stop order was paid directly from the bank account N$ 4 500 to Ms. Van Wyk .

Service fee was charged against the bank account N$ 100

THe bank credited the bank account with interest on the credit balance with N$ 500.

Payment to Mr. Brix of N$ 750 was not on the bank statement.

Payment to Ms. Goal of N$ 250 was not on the bank statement

A deposit of 31 August 2021 was not on the bank statement: N$ 400

Prepare the following as of 31 August 2021

Cash book

Bank Reconciliation

Chapter 3 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 3 - What is the primary purpose of an accounting...Ch. 3 - What is the relationship between the accounting...Ch. 3 - Show the expanded accounting equation using the 10...Ch. 3 - Explain and distinguish between a transaction; an...Ch. 3 - Explain how the accounting equation organizes...Ch. 3 - What is the difference between a permanent and a...Ch. 3 - Prob. 7GICh. 3 - Why is it advantageous to a company to initially...Ch. 3 - What is a perpetual inventory accounting system?...Ch. 3 - Give examples of transactions that: a. Increase an...

Ch. 3 - Give examples of transactions that: a. Increase...Ch. 3 - Prob. 12GICh. 3 - Prob. 13GICh. 3 - Prob. 14GICh. 3 - Prob. 15GICh. 3 - Explain and provide examples of deferrals,...Ch. 3 - Prob. 17GICh. 3 - Prob. 18GICh. 3 - Prob. 19GICh. 3 - Prob. 20GICh. 3 - Prob. 21GICh. 3 - What are the major financial statements of a...Ch. 3 - Prob. 23GICh. 3 - Prob. 24GICh. 3 - Prob. 25GICh. 3 - Prob. 26GICh. 3 - Prob. 27GICh. 3 - Prob. 28GICh. 3 - Prob. 29GICh. 3 - What is cash-basis accounting? What must a company...Ch. 3 - On May 1, Johnson Corporation purchased inventory...Ch. 3 - On January 1, Tolson Company purchased a building...Ch. 3 - On July 1, Friler Company purchased a 1-year...Ch. 3 - Prob. 4RECh. 3 - Garcia Company rents out a portion of its building...Ch. 3 - Prob. 6RECh. 3 - Goldfinger Corporation had account balances at the...Ch. 3 - Prob. 8RECh. 3 - For the current year, Vidalia Company reported...Ch. 3 - Use the information in RE3-6, (a) assuming Ringo...Ch. 3 - (Appendix 3.1) Vickelly Company uses cash-basis...Ch. 3 - Financial Statement Interrelationship Draw a...Ch. 3 - Journal Entries Mead Company uses a perpetual...Ch. 3 - Journal Entries The following are selected...Ch. 3 - Adjusting Entries Your examination of Sullivan...Ch. 3 - Adjusting Entries The following are several...Ch. 3 - Adjusting Entries The following partial list of...Ch. 3 - Basic Income Statement The following are selected...Ch. 3 - Periodic Inventory System Raynolde Company uses a...Ch. 3 - Closing Entries Lloyd Bookstore shows the...Ch. 3 - Financial Statements Turtle Company has prepared...Ch. 3 - Worksheet for Service Company Whitaker Consulting...Ch. 3 - Worksheet, Including Inventory Surian Motors...Ch. 3 - Reversing Entries On December 31, 2019, Kellams...Ch. 3 - Special Journals The following are several...Ch. 3 - (Appendix 3.1) Cash-Basis Accounting Puntarelli...Ch. 3 - Adjusting Entries The following information is...Ch. 3 - Prob. 2PCh. 3 - Adjusting Entries Sarah Companys trial balance on...Ch. 3 - Prob. 4PCh. 3 - Errors in Financial Statements At the end of the...Ch. 3 - Journal Entries, Posting, and Trial Balance Luke...Ch. 3 - Effects of Errors: During the current accounting...Ch. 3 - Financial Statements Mackenzie Inc. uses a...Ch. 3 - Prob. 9PCh. 3 - Worksheet Victoria Company has the following...Ch. 3 - Worksheet Devlin Company has prepared the...Ch. 3 - Comprehensive On November 30, 2019. Davis Company...Ch. 3 - Reversing Entries Thomas Company entered into two...Ch. 3 - Reversing Entries On December 31, 2019, Mason...Ch. 3 - Adjusting Entries At the end of 2019, Richards...Ch. 3 - Prob. 16PCh. 3 - Comprehensive (Appendix 3.1) Dawson OConnor is the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Complex Balance Sheet Presented below is the unaudited balance sheet as of December 31, 2019, prepared by Zeus Manufacturing Corporations bookkeeper. Your company has been engaged to perform an audit, during which you discover the following information: 1. Checks totaling 14,000 in payment of accounts payable were mailed on December 31, 2019, but were not recorded until 2020. Late in December 2019, the bank returned a customers 2,000 check marked NSF, but no entry was made. Cash includes 100,000 restricted for building purposes. 2. Included in accounts receivable is a 30,000 note due on December 31, 2022, from Zeuss president. 3. During 2019, Zeus purchased 500 shares of common stock of a major corporation that supplies Zeus with raw materials. Total cost of this stock was 51,300, and fair value on December 31, 2019, was 51,300. Zeus plans to hold these shares indefinitely. 4. Treasury stock was recorded at cost when Zeus purchased 200 of its own shares for 32 per share in May 2019. This amount is included in investments. 5. On December 31, 2019, Zeus borrowed 500,000 from a bank in exchange for a 10% note payable, manning December 31, 2024. Equal principal payments are due December 31 of each year beginning in 2020. This note is collateralized by a 250,000 tract of land acquired as a potential future building site, which is included in land. 6. The mortgage payable requires 50,000 principal payments, plus interest, at the end of each month. Payments were made on January 31 and February 28, 2020. The balance of this mortgage was due June 30, 2020. On March 1, 2020, prior to issuance of the audited financial statements, Zeus consummated a non-cancelable agreement with the lender to refinance this mortgage. The new terms require 100,000 annual principal payments, plus interest, on February 28 of each year, beginning in 2021. The final payment is due February 28, 2028. 7. The lawsuit liability will be paid in 2020. 8. Of the total deferred tax liability; 5,000 is considered a current liability. 9. The current income tax expense reported in Zeuss 2019 income statement was 61,200. 10. The company was authorized to issue 100,000 shares of 50 par value common stock.arrow_forwardInner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.arrow_forwardThe accounts in the ledger of Hickory Furniture Company as of December 31, 2019, are listed in alphabetical order as follows. All accounts have normal balances. The balance of the cash account has been intentionally omitted. Prepare an unadjusted trial balance, listing the accounts in their normal order and inserting the missing figure for cash.arrow_forward

- Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.arrow_forwardThe following items are found in the cash account of AAA Company at December 31, 2021. The company’s controller asks your opinion whether the items listed below should be considered as part of cash account and come up with an adjusting entry to adjust the cash account.• A check worth P288,000 from customer who paid the account net of the 4% discount. The company records the transaction as credit to Accounts Receivable for the proceeds.• Postage stamps, P1,000;• Cash in closed bank (F Bank), P195,000;• Redemption fund, P300,000;• Sinking fund, P300,000. This will be used on May 1, 2022 to redeem the bonds payable;• Change fund, P25,000;• X Bank Checking Account No. 0004568, P410,000.• Y Checking Account No. 0002347, P275,000.;• Overdraft in Z Checking Account No. 00011256, P150,000 resulting from a withdrawal of a company’s check dated January 3, 2022 in payment of account, P450,000. This was recorded in the company’s disbursement ledger at December 31, 2021;• Overdraft in X Checking…arrow_forwardNatalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure that her cash account does not have any errors and is accurate and up-to-date is to prepare a bank reconciliation at the end of each month.Natalie would like you to help her. She asks you to prepare a bank reconciliation for June 2021 using the following information. GENERAL LEDGER—COOKIE CREATIONS INC. Cash Date Explanation Ref Debit Credit Balance 2021 June 1 Balance 2,657 1 750 3,407 3 Check #600 625 2,782 3 Check #601 95 2,687 8 Check #602 56 2,631 9 1,050 3,681 13 Check #603 425 3,256 20 155 3,411 28 Check #604 297 3,114 28 110 3,224 PREMIER BANKStatement of Account—Cookie Creations Inc.June 30, 2021 Date Explanation Checks and…arrow_forward

- 1)Prepare a bank reconciliation for Daryl Swan to determine how much cash Swan actually has at October 31, 2019? 2)By using the data from above, make the following journal entries that Swan should record on October 31 to update her Cash account. 2a)T o account for the EFT collection of rent 2b)To account for NSF cheques returned by the bank. 2c)To correct the error in recording the salary of the part-time employee.arrow_forwardThe accountant of ABC has collected the following information for the month of July 2019. ABC’s bank statement for July 2019 shows the following data: Balance on 1 July as per bank $29,500 Balance on 31 July as per bank $15,907.45 The cash balance as per company records as of July 31 is $11,589.45. Further review of the data reveals the following information: Errors: Check no115 for $1,226. The bank correctly paid the amount, but ABC recorded the check as $1,262. Outstanding checks on July 31, total $5,904 Deposits in transit on July 31 total $2,201.40 Bank statement shows: A. Debit-NSF check: $425.60 B. Debit-bank fee $30 C. Credit- collection of note receivable for $1,000 plus interest earned $50 and bank collection fee $15. Required:Prepare bank reconciliation on July 31, 2019.arrow_forwardAA Corporation shows a cash balance of P1,570,000 as of December 31, 2022. The following cash transactions were included in this cash balance: 1. A check from a customer for P111.000 was received on December 28, 2022 as payment of accounts due to AA. The check is dated January 3, 2023. 2 A check dated September 15, 2022 was held by the cashier amounting to P230,000. The check was not deposited in the bank as of December 31, 2022 because it was misplaced by the cashier. 3. A customers check for P180,000 was deposited on December 28 but returned by bank on December 30 marked NSF. 4. A check drawn by AA as payment of accounts due to supplier amounting to P325,000. The was still held by the custodian as of December 31, 2022 and was released to supplier on January 4, 2023. What is the correct cash balance as of December 31, 2022?arrow_forward

- The are the auditor of CK Company for the year ended, Dec. 31, 2020. The finance manager of the company presented the following information relating to cash balances: Petty Cash (Imprest fund balance) - P20,000 Cash in Bank – LBP (checking account) - 526,000 Cash in Bank – BDO (savings account) - 700,000 Cash in Bank – Metrobank (peso savings acct) - 200,000 Cash in Bank – Metrobank (dollar savings acct) - $2,000 The following information was gathered during the conduct of your audit: The total bills and coins as per cash count amounts to P3,000 A total of receipts amounting to P16,240 relating to travel expenses were unreplenished from PCF as of Dec, 31, 2020 The LBP account has the following transactions and details: Bank Statement Balance as of Dec. 31, 2020 – P700,000 A total of P50,000 Deposits in Transit Outstanding Checks amounting to P300,000 Total deposits already included in the bank but not yet recorded in the book, P70,000 A check that…arrow_forwardThe accountant of Jonathan Manufacturing Company was tasked to perform monthly bank reconciliation. She downloaded the company’s April 30, 2019 bank statement that showed a balance of P32,400. She also printed the cash ledger from the company’s computerized accounting system. It contains the ending balance of P8,350. She also found the following reconciling items:a. The bank statement showed bank service fee of P800.b. The bank collected P1,500 from a note receivable for Jonathan Manufacturing. Also, a collection fee of P250.00 was charged.c. Deposit in transit, P51,000.d. Checks outstanding on April 30, P79,100.e. The accountant found a check issued to Rhys Corp. for P4,500 that cleared the bank but was not in the cash ledger. Requirement:a. Prepare the bank reconciliation statement.b. Journalize the adjusting entries.arrow_forwardPrepare journal entries for the following transactions, using the following accounts as needed: Cash Petty Cash Accounts Receivable Supplies Computer Equipment Accounts Payable Unearned Services Income Services Income Lavender, Capital Auto Expense Repairs and Maintenance Expense Miscellaneous Expense Postage Expense Wages Expense Cash Over and Short PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the transactions. On Jan. 1, Crisp Company had decided to establish a petty cash fund in the amount of $900. DR CR On Jan. 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $85, Supplies $280, Postage Expense $265, Repairs and Maintenance Expense $115, Miscellaneous Expense $135. The cash on hand at this time was $25. DR DR DR DR DR DR or CR? CR On Jan. 14, the petty cash fund needed…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY