Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 5E

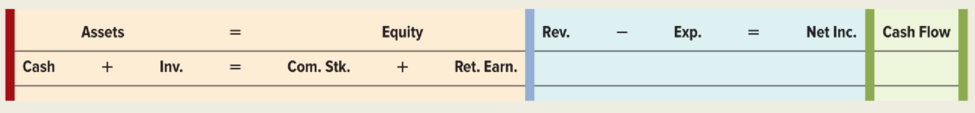

Exercise 3-5 Recording inventory transactions in a financial statements model

Milo Clothing experienced the following events during 2018, its first year of operation:

1. Acquired $30,000 cash from the issue of common stock.

2. Purchased inventory for $15,000 cash.

3. Sold inventory costing $9,000 for $20,000 cash.

4. Paid $1,500 for advertising expense.

Required

Record the events in a statements model like the one shown here.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Exercise 3-1A (Static) Determining the cost of financing inventory LO 3-1

On January 1, Year 1, Jana started a small flower merchandising business that she named Jana’s Flowers. The company experienced the following events during the first year of operation:

Started the business by issuing common stock for $30,000 cash.

Paid $19,000 cash to purchase inventory.

Sold merchandise that cost $10,000 for $21,000 on account.

Collected $16,000 cash from accounts receivable.

Paid $3,750 for operating expenses.

Required

a. Organize ledger accounts under an accounting equation and record the events in the accounts. In the last column of the table, provide appropriate account titles for the Retained Earnings amounts.

b-1. Prepare an income statement.

b-2. Prepare a balance sheet.

b-3. Prepare a statement of cash flows.

c. Since Jana sold inventory for $21,000, she will be able to recover more than half of the $30,000 she invested in the stock. Do you agree with this…

Problem 5-3

Whitelands Inc. had the following operating transactions during January 2020, its first month of operations.

Date Transaction

1/1 Purchased 2 units of inventory costing $4 each on credit

1/3 Purchased 3 units of inventory costing $5 each on credit

1/10 Purchased 4 units of inventory costing $6 each on credit

1/21 Paid for the January 1 purchase

1/23 Paid for the January 3 purchase

1/30 Sold 7 units of inventory at $10 each on credit

1/30 Matched the inventory cost to January 30 on a FIFO basis

1/31 Estimated that 10% of credit sales will not be realized in cash

Required:

a. Record the above transactions in Whitelands journal (attached in the template below).

b. Present Whitelands’ income statement through gross profit for January 2020 (attached in the template below).

c. Report accounts receivable, inventory, and accounts payable on Whitelands’ January 31, 2020 balance sheet

a. Record the above transactions in Whitelands journal below.…

QUESTION 3:

A company with an accounting date of 31 October carried out a physical check of inventory on 4 November 20X3, leading to an inventory value at cost at this date of $483,700.

Between 1 November 20X3 and 4 November 20X3 the following transactions took place: 1 Goods costing $38,400 were received from suppliers.

2 Goods that had cost $14,800 were sold for $20,000.

3 A customer returned, in good condition, some goods which had been sold to him in October for $600 and which had cost $400.

4 The company returned goods that had cost $1,800 in October to the supplier, and received a credit note for them.

What figure should appear in the company's financial statements at 31 October 20X3 for closing inventory, based on this information

Chapter 3 Solutions

Survey Of Accounting

Ch. 3 - 1. Define merchandise inventory. What types of...Ch. 3 - 2. What is the difference between a product cost...Ch. 3 - 3. How is the cost of goods available for sale...Ch. 3 - 4. What portion of cost of goods available for...Ch. 3 - 5. When are period costs expensed? When are...Ch. 3 - 6. If PetCo had net sales of 600,000, goods...Ch. 3 - Prob. 7QCh. 3 - 8. What are the effects of the following types of...Ch. 3 - 9. Northern Merchandising Company sold inventory...Ch. 3 - 10. If goods are shipped FOB shipping point, which...

Ch. 3 - 11. Define transportation-in. Is it a product or a...Ch. 3 - Prob. 12QCh. 3 - Prob. 13QCh. 3 - 14. Dyer Department Store purchased goods with the...Ch. 3 - 15. Eastern Discount Stores incurred a 5,000 cash...Ch. 3 - 16. What is the purpose of giving credit terms to...Ch. 3 - Prob. 17QCh. 3 - 18. Ball Co. purchased inventory with a list price...Ch. 3 - 22. Explain the difference between purchase...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - 25. What is the advantage of using common size...Ch. 3 - 27. What is the purpose of preparing a schedule of...Ch. 3 - 28. Explain how the periodic inventory system...Ch. 3 - Prob. 25QCh. 3 - Exercise 3-1 Determining the cost of financing...Ch. 3 - Exercise 3-2 Comparing a merchandising company...Ch. 3 - Exercise 3-3 Effect of inventory transactions on...Ch. 3 - Exercise 3-4 Effect of inventory transactions on...Ch. 3 - Exercise 3-5 Recording inventory transactions in a...Ch. 3 - Exercise 4-6A Understanding the freight terms FOB...Ch. 3 - Exercise 3-7 Effect of purchase returns and...Ch. 3 - Exercise 3-8 Accounting for product costs:...Ch. 3 - Effect of product cost and period cost: Horizontal...Ch. 3 - Cash Discounts and Purchase Returns On April 6,...Ch. 3 - Exercise 4-9A Determining the effect of inventory...Ch. 3 - Inventory financing costs Bill Norman comes to you...Ch. 3 - Effect of shrinkage: Perpetual system Ho Designs...Ch. 3 - Comparing gross margin and gain on sale of land...Ch. 3 - Single-step and multistep income statements The...Ch. 3 - Prob. 16ECh. 3 - Effect of cash discounts on financial statements:...Ch. 3 - Using common size statements and ratios to make...Ch. 3 - Prob. 19ECh. 3 - Determining cost of goods sold: Periodic system...Ch. 3 - Identifying product and period costs Required...Ch. 3 - Problem 4-23A Identifying freight costs Required...Ch. 3 - Effect of purchase returns and allowances and...Ch. 3 - Preparing a schedule of cost of goods sold and...Ch. 3 - Prob. 25PCh. 3 - Comprehensive cycle problem: Perpetual system At...Ch. 3 - Prob. 27PCh. 3 - Comprehensive cycle problem: Periodic system...Ch. 3 - Prob. 1ATCCh. 3 - ATC 3-2 Group Exercise Multistep income statement...Ch. 3 - Prob. 3ATCCh. 3 - Prob. 4ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Appendix Periodic inventory accounts, multiple-step income statement, closing entries On December 31, 2018, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Cash 13,500 Dividends 25,000 Accounts Receivable 72,000 Sales 3,280,000 Inventory, January 1, 2018 257,000 Purchases 2,650,000 Estimated Returns Inventory, January 1,2018 35,000 Purchases Returns and Allowances 93,000 Purchases Discounts 37,000 Office Supplies 3,000 Freight In 48,000 Prepaid Insurance 4,500 Sales Salaries Expense 300,000 Land 150,000 Advertising Expense 45,000 Store Equipment 270,000 Delivery Expense 9,000 Accumulated Depreciation Store Equipment 55,900 Depreciation Expense Store Equipment 6,000 Office Equipment 78,500 Miscellaneous Selling Expense 12,000 Accumulated Depreciation Office Equipment 16,000 Office Salaries Expense 175,000 Rent Expense 28,000 Accounts Payable 77,800 Insurance Expense 3,000 Salaries Payable 3,000 Office Supplies Expense 2,000 Customer Refunds Payable 50,000 Depreciation Expense Office Equipment 1,500 Unearned Rent 8,300 Notes Payable 50,000 Miscellaneous Administrative Expense 3,500 Common Stock 150,000 Rent Revenue 7,000 Retained Earnings 365,600 Interest Expense 2,000 Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2018. The inventory as of December 31, 2018, was 305,000. The estimated cost of customer returns inventory for December 31, 2018, is estimated to increase to 40,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2018. 4. What would be the net income if the perpetual inventory system had been used?arrow_forwardPeriodic inventory accounts, multiple-step income statement, closing entries On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Cash 13,500 Accounts Receivable 72,000 Merchandise Inventory, January 1,2019 257,000 Estimated Returns Inventory 35,000 Office Supplies 3,000 Prepaid Insurance 4,500 Land 150,000 Store Equipment 270,000 Accumulated DepreciationStore Equipment 55000 Office Equipment 78,500 Accumulated DepreciationOffice Equipment 16000 Accounts Payable 27,800 Customer Refunds Payable 50,000 Salaries Payable 3,000 Unearned Rent 8,300 Notes Payable 50,000 Shirley Wyman, Capital 515,600 Shirley Wyman, Drawing 25,000 Sales 3280000 Purchases 2650000 Purchases Returns and Allowances 93,000 Purchases Discounts 37,000 Freight In 48,000 Sales Salaries Expense 300,000 Advertising Expense 45,000 Delivery Expense 9,000 Depreciation ExpenseStore Equipment 6,000 Miscellaneous Selling Expense 12,000 Office Salaries Expense 175,000 Rent Expense 28,000 Insurance Expense 3,000 Office Supplies Expense 2,000 Depreciation Expense-Office Equipment 1,500 Miscellaneous Administrative Expense 3,500 Rent Revenue 7,000 Interest Expense 2,000 Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardPeriodic inventory accounts, multiple-step income statement, closing entries On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Cash 125,000 Accounts Receivable 340,000 Merchandise Inventory. July 1,2018 415,000 Estimated Returns Inventory 25,000 Office Supplies 9,000 Prepaid Insurance 18,000 Land 300,000 Store Equipment 550,000 Accumulated DepreciationStore Equipment 190,000 Office Equipment 250,000 Accumulated DepreciationOffice Equipment 110,000 Accounts Payable 85,000 Customer Refunds Payable 20,000 Salaries Payable 9,000 Unearned Rent 6,000 Notes Payable 50,000 Amy Gant, Capital 820,000 Amy Gant, Drawing 275,000 Sales 6,590,000 Purchases 4,100,000 Purchases Returns and Allowances 32,000 Purchases Discounts 13,000 Freight In 45,000 Sales Salaries Expense 580,000 Advertising Expense 315,000 Delivery Expense 18,000 Depreciation ExpenseStore Equipment 12,000 Miscellaneous Selling Expense 28,000 Office Salaries Expense 375,000 Rent Expense 43,000 Insurance Expense 17,000 Office Supplies Expense 5,000 Depreciation Expense-Office Equipment 4,000 Miscellaneous Administrative Expense 16,000 Rent Revenue 32,500 Interest Expense 2,500 Instructions 1.Does Simkins Company use a periodic or perpetual inventory system? Explain. 2.Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3.Prepare the closing entries for Simkins Company as of June 30, 2019. 4.What would the net income have been if the perpetual inventory system had been used?arrow_forward

- Exercise 3-51 Adjustment for Supplies The downtown location of Chicago Clothiers purchases large quantities Of supplies, including plastic garment bags and paper bags and boxes. At December 31, 2019, the following information is available concerning these supplies: Supplies inventory, 1/1/2019 $4,150 Supplies inventory, 12/31/2019 5,220 Supplies purchased for cash during 2019 12,690 All purchases of supplies during the year are debited to the supplies inventory. Required: What is the expense reported on the income statement associated with the use of supplies during 2019? What is the adjusting entry at December 31, 2019? By how much would assets and income be overstated or understated if the adjusting entry were not recorded?arrow_forwardPeriodic inventory accounts, multiple-step income statement, closing entries On December 31, 2016, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Cash 5,13,500 Accounts Receivable 72,000 Merchandise Inventory, January 1,2016 257,000 Office Supplies 3,000 Prepaid Insurance 4,500 Land 150,000 Store Equipment 270,000 Accumulated DepreciationStore Equipment 55,900 Office Equipment 78,500 Accumulated DepreciationOffice Equipment 16,000 Accounts Payable 27,800 Salaries Payable 3,000 Unearned Rent 8,300 Notes Payable 50,000 Common Stock 150,000 Retained Earnings 430,500 Dividends 25,000 Sales 3,280,000 Purchases 2,650,000 Purchases Returns and Allowances 93,000 Purchases Discounts 37,000 Freight In 48,000 Sales Salaries Expense 300,000 Advertising Expense 45,000 Delivery Expense 9,000 Depreciation ExpenseStore Equipment 6,000 Miscellaneous Selling Expense 12,000 Office Salaries Expense 175,000 Rent Expense 28,000 Insurance Expense 3,000 Office Supplies Expense 2,000 Depreciation ExpenseOffice Equipment 1,500 Miscellaneous Administrative Expense 3,500 Rent Revenue 7,000 Interest Expense 2,000 Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2016. The merchandise inventory as of December 31, 2016, was 305,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2016. 4. What would lie the net income if the perpetual inventory system had been used?arrow_forwardMultiple step income statement and balance sheet The following selected accounts anti their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2019: Cash 92,000 Accounts Receivable 450,000 Merchandise Inventory 370,000 Estimated Returns Inventory 5,000 Office Supplies 10,000 Prepaid Insurance 12,000 Office Equipment 220,000 Accumulated DepreciationOffice Equipment 58,000 Store Equipment 650,000 Accumulated DepreciationStore Equipment 87,500 Accounts Payable 38,500 Customer Refunds Payable 10,000 Salaries Payable 4,000 Note Payable (final payment due 2032) 140,000 Gerri Faber. Capital 431,000 Gerri Faber, Drawing 300,000 Sales 8,925,00 Cost of Merchandise Sold 5,620,00 Sales Salaries Expense 850,000 Advertising Expense 420,000 Depreciation Expense Store Equipment 33,000 Miscellaneous Selling Expense 18,000 Office Salaries Expense 540,000 Rent Expense 48,000 Insurance Expense 24,000 Depredation ExpenseOffice Equipment 10,000 Office Supplies Expense 4,000 Miscellaneous Administrative Exp. 6,000 Interest Expense 12,000 Instructions 1.Prepare a multiple-step income statement. 2.Prepare a statement of owners equity. 3.Prepare a balance sheet, assuming that the current portion of the note payable is 7,000. 4.Briefly explain how multiple-step and single-step income statements differ.arrow_forward

- Appendix 2 PR 5-10B Periodic inventory accounts, multiple-step income statement, closing entries On June 30, 20Y9, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 20Y9. The inventory as of June 30, 20Y9, was 508,000. The estimated cost of customer returns inventory for June 30, 20Y9, is estimated to increase to 33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 20Y9. 4. What would be the net income if the perpetual inventory system had been used?arrow_forwardCost of goods sold and related items The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2018: Estimated returns of current year sales 11,600 Inventory, May 1, 2017 380,000 Inventory, April 30,2018 415,000 Purchases 3,800,000 Purchases returns and allowances 150,000 Purchases discounts 80,000 Sales 5,850,000 Freight in 16,600 A. Prepare the cost of goods sold section of the income statement for the year ended April 30, 2018, using the periodic inventory system. B. Determine the gross profit to be reported on the income statement for the year ended April 30, 2018. C. Would gross profit he different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forwardINCOME STATEMENT Problem 2-2 Jacob Company provided the following data for the current year; Inventory, January 1 2,000,000 Purchases 7,500,000 Purchase Returns and Allowances 500,000 Sales Returns and Allowances 750,000 Inventory on December 31 2,800,000 Gross profit rate on net sales 20% What is the gross sales for the current year? 7,750,000 8,500,000 7,000,000 9,125,000arrow_forward

- Question-2: Copple Hardware Store completed the following merchandising transactions inthe month of May. At the beginning of May, the ledger of Copple showed Cash of Tk.5,000and Share Capital—Ordinary of Tk.5,000.May 1: Purchased merchandise on account from Nute’s Wholesale Supply Tk.4,200, terms2/10, n/30.May 2: Sold merchandise on account Tk.2,300, terms 1/10, n/30. The cost of the merchandisesold was Tk.1,300.May 5: Received credit from Nute’s Wholesale Supply for merchandise returned Tk.500.May 9: Received collections in full, less discounts, from customers billed on sales ofTk.2,300 on May 2.May 10: Paid Nute’s Wholesale Supply in full, less discount.May 11: Purchased supplies for cash Tk.400.May 12: Purchased merchandise for cash Tk.1,400.May 15: Received refund for poor quality merchandise from supplier on cash purchaseTk.150.May 17: Purchased merchandise from Sherrick Distributors Tk.1,300, FOB shipping pointterms 2/10, n/30.May 19: Paid freight on May 17 purchase Tk.130.May…arrow_forwardQuestion 5Consider the following transactions that occurred in April 2013 for Kings:April 3 Purchased inventory on terms 1/10, n/e.o.m. $7,000April 4 Purchased inventory for cash $1,800April 6 Returned $700 of inventory from April 4 purchaseApril 8 Sold goods on term of 2/15, n/35 of $6,000 that cost $2,940April 10 Paid for goods purchased on April 3April 12 Received goods from April 8 sale of $500 that cost $220April 23 Received payment from April 8 customerApril 25 Sold goods to Harrisons for $1,200 that cost $450. Terms of n/30 were offered.As a courtesy to Harrisons, $125 of freight was added to the invoice for whichcash was paid directly to UPS by Kings. April 29 Received payment from Harrison’sRequired:6- 6 -1. Journalize April transactions for kings. No explanations are required?arrow_forwardExercise 6-43 (Algorithmic)Applying the Cost of Goods Sold Model The following amounts were obtained from the accounting records of Steed Company: Required: Compute the missing amounts. 2017 2018 2019 Beginning inventory $10,600 $fill in the blank 1 $fill in the blank 2 Net purchases fill in the blank 3 74,300 58,100 Ending inventory 11,200 fill in the blank 4 13,750 Cost of goods sold 44,500 49,800 fill in the blank 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY