College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

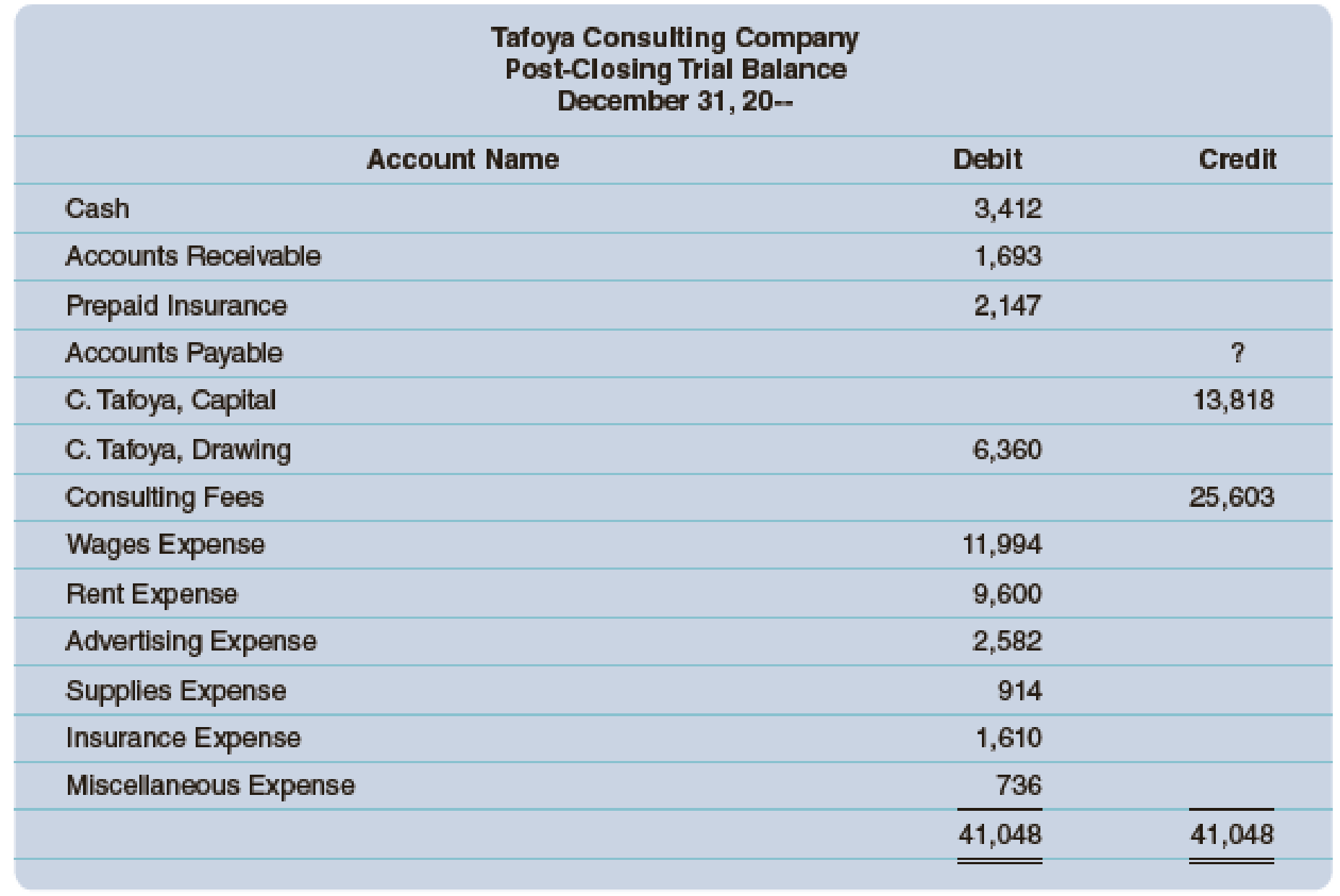

Chapter 5, Problem 3A

The post-closing

- a. Analyze the work and prepare a response to what you have reviewed.

- b. Journalize the closing entries.

- c. What is the net income or net loss?

- d. Is there an increase or a decrease in Capital?

- e. What would be the ending amount of Capital?

- f. What is the new balance of the post-closing trial balance?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Once closing entries have been entered in the general journal and posted to the ledger, what is the effect on the owner’s capital (or retained earnings) account?

Explain the purpose of a post-closing trial balance in your own words and answer this question: Is the post-closing trial balance mandatory as a step in the accounting cycle?

Reflect on this question: Assuming a company’s first year-end, would financial statements be affected if the closing process were not completed? Explain.

The following information is available for Zephyr Company before closing the accounts. After all of the closing, entries are made, what will be the balance in the Zephyr, Capital account?

Net Income $117,300

Zephyr, Capital $112,000

Zephyr, withdrawals $42,000

__ $117,300.

__ $229,300.

__ $262,600

__ $187,300.

__ $972,700.

The net income of Plum Consultancy is $500,000. The company has passed the closing entries for revenue and expense accounts. Which of the following is the closing entry to transfer the net income?

a. A debit to Income Summary for $500,000 and a credit to Capital for $500,000

b. A debit to Consulting Revenue for $500,000 and a credit to Capital for $500,000

c. A debit to Capital for $500,000 and a credit to Consulting Revenue for $500,000

d. A debit to Capital for $500,000 and a credit to Income Summary for $500,000

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Ch. 5 - What is the third step in the accounting cycle?...Ch. 5 - Which of the following accounts would be closed...Ch. 5 - If Income from Services had a 20,400 credit...Ch. 5 - Which of the following accounts would appear on a...Ch. 5 - Under the cash basis of accounting, which of the...Ch. 5 - Prob. 6QYCh. 5 - Number in order the following steps in the...Ch. 5 - List the steps in the closing procedure in the...Ch. 5 - What is the purpose of closing entries? What is a...Ch. 5 - What are real accounts? What are nominal accounts?...

Ch. 5 - What is the purpose of the Income Summary account?...Ch. 5 - What is the purpose of the post-closing trial...Ch. 5 - Write the third closing entry to transfer the net...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Classify the following accounts as real...Ch. 5 - The ledger accounts after adjusting entries for...Ch. 5 - As of December 31, the end of the current year,...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - After all revenue and expenses have been closed at...Ch. 5 - Identify whether the following accounts would be...Ch. 5 - Prob. 8ECh. 5 - Indicate with an X whether each of the following...Ch. 5 - Prepare a statement of owners equity for The...Ch. 5 - Prob. 1PACh. 5 - The partial work sheet for Ho Consulting for May...Ch. 5 - The account balances of Bryan Company as of June...Ch. 5 - Williams Mechanic Services prepared the following...Ch. 5 - Prob. 1PBCh. 5 - Prob. 2PBCh. 5 - Prob. 4PBCh. 5 - Toms Catering Services prepared the following work...Ch. 5 - Rather than going directly to college, some...Ch. 5 - Prob. 2ACh. 5 - The post-closing trial balance submitted to you by...Ch. 5 - You are preparing a post-closing trial balance for...Ch. 5 - The bookkeeper has completed a work sheet and has...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

Plantwide and Departmental Overhead Allocation; Activity-Based Costing; Segmented Income Statements Koontz Comp...

Introduction To Managerial Accounting

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

What are assets limited as to use and how do they differ from restricted assets?

Accounting for Governmental & Nonprofit Entities

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partial work sheet for Ho Consulting for May follows: Required 1. Write the owners name on the Capital and Drawing T accounts. 2. Record the account balances in the T accounts for owners equity, revenue, and expenses. 3. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 4. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 5,840arrow_forwardThe ledger accounts after adjusting entries for Cortez Services are presented below. a. Journalize the following closing entries and number as steps 1 through 4. b. What is the new balance of J. Cortez, Capital after closing? Show your calculations.arrow_forwardThe partial work sheet for Ho Consulting for May follows: Required If you are using working papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 5,840arrow_forward

- The partial work sheet for Emil Consulting for June is as follows: Required If you are using Working Papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 4,930arrow_forwardIdentify which of the following accounts would be listed on the companys Post-Closing Trial Balance. A. Accounts Receivable B. Accumulated Depreciation C. Cash D. Office Expense E. Note Payable F. Rent Revenue G. Retained Earnings H. Unearned Rent Revenuearrow_forwardWhich of these accounts is included in the post-closing trial balance? A. Sales Revenue B. Salaries Expense C. Retained Earnings D. Dividendsarrow_forward

- The final step of the accounting cycle is the closing process. The main goal of this stage of the cycle is to ensure that the balance of each temporary account is returned to zero and that net income is transferred to the owner's capital account. The first step in successfully undertaking the closing process is to understand the difference between a temporary account and a permanent account. Roscoe has some questions about the process. Answer the following questions (1) - (3). 1. If a temporary account has an ending balance of $57,000, what is its beginning balance for the following accounting period? If there is no amount or an amount is zero, enter “0”. 2. If a permanent account has an ending balance of $57,000, what is its beginning balance for the following accounting period? Roscoe has attempted to prepare the closing entries for Chandler Company on the Roscoe’s Journal panel. He’s not sure if he’s entered the journal entries correctly, and asks you to review them. You…arrow_forwardIf closing entries are prepared and posted correctly, a post-closing trial balance will show: a credit balance in Income summary account if the company generated net income for the period. 2. a credit balance for the owner’s capital account. 3. a debit balance for the owner’s drawing account. 4. only balance sheet accountsarrow_forwardThe ledger of Crane Company contains the following balances: Owner’s Capital $29,200, Owner’sDrawings $2,700, Service Revenue $50,000, Salaries and Wages Expense $27,400, and SuppliesExpense $7,100.The closing entries are as follows:(1) Close revenue accounts.(2) Close expense accounts.(3) Close net income/(loss).(4) Close drawings.Enter the balances in T-accounts, post the closing entries in the order presented in the problemand use the numbers as a referencearrow_forward

- How many of the following statements regarding the trial balances are true? Trial balances are prepared after journal entries are posted to the general ledger to be sure the total debit balances equal the total credit balances in the general ledger. The adjusted trial balance is used to prepare financial statements and closing entries. Only the post-closing trial balance shows the end-of-year balance for Retained Earnings. Group of answer choices A. None B. One C. Two D. Threearrow_forwardThe ledger of Wildhorse Company contains the following balances: Owner’s Capital $30,500, Owner’s Drawings $2,600, Service Revenue $51,000, Salaries and Wages Expense $26,300, and Supplies Expense $6,200.The closing entries are as follows: (1) Close revenue accounts. (2) Close expense accounts. (3) Close net income/(loss). (4) Close drawings. Enter the balances in T-accounts, post the closing entries in the order presented in the problem and use the numbers as a reference. Salaries and Wages Expense select an option enter a debit amount select an option enter a credit amount Supplies Expense select an option enter a debit amount select an option enter a credit amount Service Revenue select an…arrow_forward1. If additional investments were made during the year, what information in addition to the work sheet would be needed to prepare the statement of owner’s equity? 2. On which financial statement are permanent accounts reported? 3. What is the purpose of the post-closing trial balance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY