Concept explainers

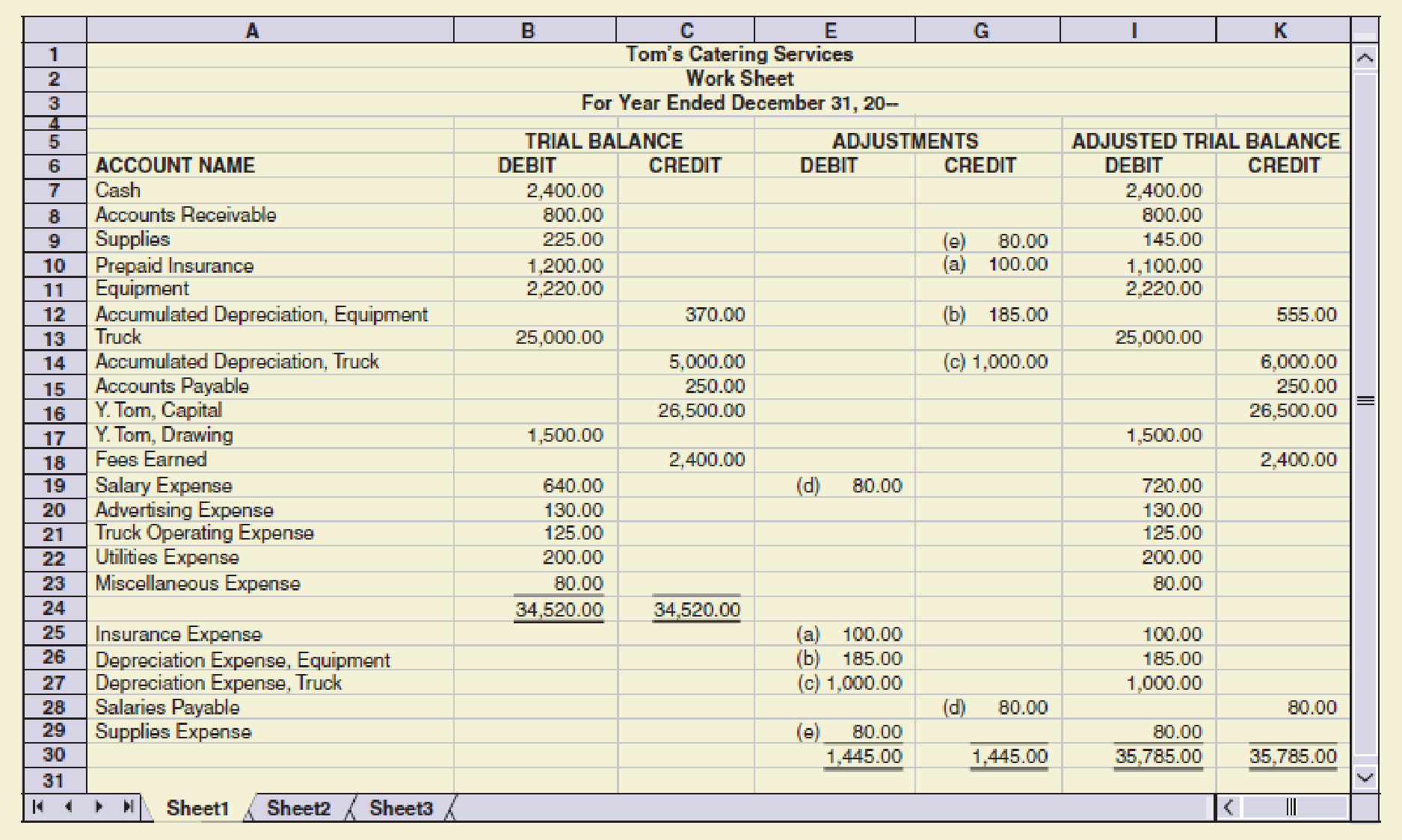

Tom’s Catering Services prepared the following work sheet for the year ended December 31, 20--.

Required

1. Complete the work sheet. (Skip this step if using QuickBooks or general ledger.)

2. Prepare an income statement.

3. Prepare a statement of owner’s equity; assume that there was an additional investment of $2,500 on December 1. (Skip this step if using QuickBooks. The additional investment assumption has already been completed in the data file.)

4. Prepare a

5. Journalize the closing entries with the four steps in the correct sequence.

6. Prepare a post-closing

Check Figure

Net income, $19,567

Trending nowThis is a popular solution!

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

- Williams Mechanic Services prepared the following work sheet for the year ended March 31,20--. Required 1. Complete the work sheet. (Skip this step if using CLGL.) 2. Prepare an income statement. 3. Prepare a statement of owners equity. Assume that there was an additional investment of 5,000 on March 13. 4. Prepare a balance sheet. 5. Journalize the closing entries using the four steps in the correct sequence. 6. Prepare a post-dosing trial balance. Check Figure Post-closing trial balance total, 31,765arrow_forwardToms Catering Services prepared the following work sheet for the year ended December 31, 20--. Required 1. Complete the work sheet. (Skip this step if using CLGL.) 2. Prepare an income statement. 3. Prepare a statement of owners equity. Assume that there was an additional investment of 2,500 on December 1. 4. Prepare a balance sheet 5. Journalize the closing entries with the four steps in the correct sequence. 6. Prepare a post-closing trial balance. Check Figure Post-closing trial balance total, 31,665arrow_forwardPrepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forward

- During the first month of operations, Landish Modeling Agency recorded transactions in T account form. Foot and balance the accounts. Then prepare a trial balance, an income statement, a statement of owners equity, and a balance sheet dated March 31, 20--.arrow_forwardFollowing is the chart of accounts of Sanchez Realty Company: Sanchez completed the following transactions during April (the first month of business): Required 1. Journalize the transactions for April in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of April 30, 20. 4. Prepare an income statement for the month ended April 30, 20. 5. Prepare a statement of owners equity for the month ended April 30, 20. 6. Prepare a balance sheet as of April 30, 20. If you we using CLGL, use the year 2020 when preparing all reports.arrow_forwardLaras Landscaping Service has the following chart of accounts: The following transactions were completed by Laras Landscaping Service: Required 1. Journalize the transactions in the general journal. Provide a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. (Skip this step if you are using CLGL.) 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated March 31, 20. If you are using CLGL, use the year 2020 when recording transaction! and preparing reports.arrow_forward

- At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April 30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owners equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forwardThe partial work sheet for Adams’ Shoe Shine is shown, prepare a statement of owner’s equity, assuming no additional investment was made by the owner. Adams’ Shoe Shine Work Sheet (Partial) For Month Ended June 30, 20-- 1 INCOME STATEMENT INCOME STATEMENT BALANCE SHEET BALANCE SHEET 2 ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT 3 Cash 3,262.00 4 Accounts Receivable 1,244.00 5 Supplies 800.00 6 Prepaid Insurance 640.00 7 Office Equipment 2,100.00 8 Accumulated Depreciation-Office Equipment 110.00 9 Accounts Payable 1,850.00 10 Wages Payable 260.00 11 Mary Adams, Capital 6,000.00 12 Mary Adams, Drawing 2,000.00 13 Service Fees 4,813.00 14 Wages Expense 1,080.00 15 Advertising Expense 34.00…arrow_forwardTurner Engineering completed the following transactions in the month of June.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. Jun. 1 Tony Turner, the owner, invested $144,000 cash, office equipment with a value of $16,000, and $82,000 of drafting equipment to launch the company. Jun. 2 The company purchased land worth $60,000 for an office by paying $21,700 cash and signing a long-term note payable for $38,300. Jun. 3 The company purchased a portable building with $44,000 cash and moved it onto the land acquired on June 2. Jun. 4 The company paid $9,600 cash for the premium on an 18-month insurance policy. Jun. 5 The company completed and delivered a set of plans for a client and collected $15,000 cash. Jun. 6 The company purchased $33,200 of additional drafting equipment by paying $20,500 cash and signing a long-term note payable for…arrow_forward

- Turner Engineering completed the following transactions in the month of June.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. Jun. 1 Tony Turner, the owner, invested $144,000 cash, office equipment with a value of $16,000, and $82,000 of drafting equipment to launch the company. Jun. 2 The company purchased land worth $60,000 for an office by paying $21,700 cash and signing a long-term note payable for $38,300. Jun. 3 The company purchased a portable building with $44,000 cash and moved it onto the land acquired on June 2. Jun. 4 The company paid $9,600 cash for the premium on an 18-month insurance policy. Jun. 5 The company completed and delivered a set of plans for a client and collected $15,000 cash. Jun. 6 The company purchased $33,200 of additional drafting equipment by paying $20,500 cash and signing a long-term note payable for…arrow_forwardGonzalez Engineering completed the following transactions in the month of June.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. Jun. 1 Maria Gonzalez, the owner, invested $108,000 cash, office equipment with a value of $7,000, and $64,000 of drafting equipment to launch the company. Jun. 2 The company purchased land worth $51,000 for an office by paying $9,100 cash and signing a long-term note payable for $41,900. Jun. 3 The company purchased a portable building with $53,000 cash and moved it onto the land acquired on June 2. Jun. 4 The company paid $4,200 cash for the premium on an 18-month insurance policy. Jun. 5 The company completed and delivered a set of plans for a client and collected $7,800 cash. Jun. 6 The company purchased $22,400 of additional drafting equipment by paying $11,500 cash and signing a long-term note payable for…arrow_forwardCamarillo dry cleaners is owned and operated by Kelly camarillo,currently a building and equipment are being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company at wholesale rates. The assets and the liabilities of the business on November 1 of the current year are as follows: cash $5,400, accounts receivable $18,750, supplies $1,560, land $35,000, accounts payable $5,880, business transactions during November are summarized as follows; a) paid rent for month, $2,450 b) charged customers for dry cleaning sales on account, $7,150 c) paid creditors on account, $1,680 d) purchased supplies on account, $840 e) received cash from customers for dry cleaning sales, $14,600 f) received cash from customers on account, $14,750 g) received monthly invoice for dry cleaning expense for November, (to be paid on December 10) $7,400 h) paid the following; wages expense, $1,800, truck expenses, $510, miscellaneous expense,$190 I) determined that the…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning