Fundamentals Of Cost Accounting (6th Edition)

6th Edition

ISBN: 9781259969478

Author: WILLIAM LANEN, Shannon Anderson, Michael Maher

Publisher: McGraw Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 51E

Physical Quantities Method

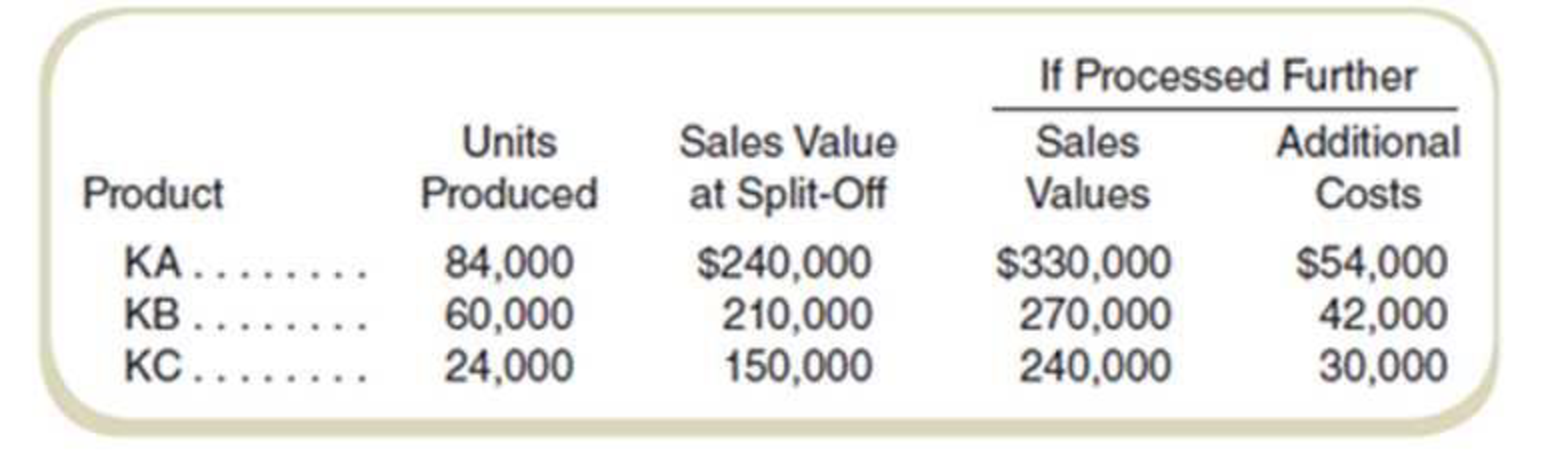

The following questions relate to Kyle Company, which manufactures products KA, KB, and KC from a joint process. Joint product costs were $189,000. Additional information follows:

Required

- a. Assuming that joint product costs are allocated using the physical quantities (units produced) method, what was the total cost of product KA (including $54,000 if processed further)?

- b. Assuming that joint product costs are allocated using the sales value at split-off (net realizable value method), what was the total cost of product KB (including the $42,000 if processed further)?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Vicerelandu, Inc. manufactures X, Y, and Z from a joint process. Joint product costs were P60,000. Additional information are as follows:(see pic)

1. Assuming that joint costs are allocated using the physical measures (units produced) approach, what were the total costs allocated to product

X ________________________ Y ______________________ Z ______________________2. Assuming that joint product costs are allocated using the relative sales value at split-off approach, what were the total costs allocated to product

X_________________________ y ______________________ Z ______________________

Ilang Ilang Company manufactures Product A and B from a joint process which yield a by-product.

Ilang Ilang accounts for the revenue from its by-product sales as deduction from the cost of goods sold of its main products.

Additional information follows:

A

B

C

Total

Unit produced

15000

9000

6000

30000

Joint Costs

264000

Sales Value at Split off

290000

150000

10000

450000

Joint products are allocated using the relative sales value at split off approach

What was the joint cost allocated to Product B?

Net Realizable Value Method, Decision to Sell at Split-off or Process Further

Arvin, Inc., produces two products, ins and outs, in a single process. The joint costs of this process were $60,000, and 14,000 units of ins and 36,000 units of outs were produced. Separable processing costs beyond the split-off point were as follows: ins, $102,000; outs, $450,000. Ins sell for $8.00 per unit; outs sell for $15.00 per unit.

Required:

1. Allocate the $60,000 joint costs using the estimated net realizable value method.

Allocated Joint Cost

Ins

$fill in the blank 1

Outs

$fill in the blank 2

2. Suppose that ins could be sold at the split-off point for $7.00 per unit. Should Arvin sell ins at split-off or process them further?Ins

be processed further as there will be $fill in the blank 4

profit if sold at split-off.

Chapter 11 Solutions

Fundamentals Of Cost Accounting (6th Edition)

Ch. 11 - Why do companies allocate costs? What are some of...Ch. 11 - What are the three methods of allocating service...Ch. 11 - What are the similarities and differences among...Ch. 11 - What criterion should be used to determine the...Ch. 11 - What is a limitation of the direct method of...Ch. 11 - What is a limitation of the step method of...Ch. 11 - Prob. 7RQCh. 11 - Why would a number of accountants express a...Ch. 11 - Prob. 9RQCh. 11 - What is the basic difference between the...

Ch. 11 - Prob. 11RQCh. 11 - If cost allocations arc arbitrary and potentially...Ch. 11 - Prob. 13CADQCh. 11 - Prob. 14CADQCh. 11 - Prob. 15CADQCh. 11 - Prob. 16CADQCh. 11 - Prob. 17CADQCh. 11 - Prob. 18CADQCh. 11 - What are some of the factors that a company needs...Ch. 11 - Prob. 20CADQCh. 11 - Prob. 21CADQCh. 11 - Prob. 22CADQCh. 11 - How is joint cost allocation like service...Ch. 11 - Prob. 24CADQCh. 11 - In what ways is joint cost allocation similar to...Ch. 11 - Why Are Costs Allocated?Ethical Issues You are the...Ch. 11 - Cost Allocation: Direct Method Caro Manufacturing...Ch. 11 - Allocating Service Department Costs First to...Ch. 11 - Cost Allwat ion: Direct Method University Printers...Ch. 11 - Prob. 30ECh. 11 - Cost Allocation: Step Method

Refer to the data for...Ch. 11 - Cost Allocation: Reciprocal Method

Refer to the...Ch. 11 - Cost Allocation: Reciprocal Method, Two Service...Ch. 11 - Cost Allocation: Reciprocal Method

Refer to the...Ch. 11 - Prob. 35ECh. 11 - Prob. 36ECh. 11 - Prob. 37ECh. 11 - Prob. 38ECh. 11 - Prob. 39ECh. 11 - Prob. 40ECh. 11 - Net Realizable Value Method: Multiple Choice

Oak...Ch. 11 - Sell or Process Further: Multiple Choice

Refer to...Ch. 11 - Net Realizable Value Method Euclid Corporation...Ch. 11 - Estimated Net Realizable Value Method Blasto,...Ch. 11 - Net Realizable Value Method to Solve for Unknowns...Ch. 11 - Net Realizable Value Method Bixel Components...Ch. 11 - Net Realizable Value Method with By-Products...Ch. 11 - Net Realizable Value Method Deming Sons...Ch. 11 - Physical Quantities Method

Refer to the facts in...Ch. 11 - Sell or Process Further

Refer to the facts in...Ch. 11 - Physical Quantities Method The following questions...Ch. 11 - Physical Quantities Method; Sell or Process...Ch. 11 - Physical Quantities Method with By-Product...Ch. 11 - Step Method with Three Service Departments Model,...Ch. 11 - Comparison of Allocation Methods BluStar Company...Ch. 11 - Solve for Unknowns: Direct Method Franks Foods has...Ch. 11 - Solve for Unknowns: Step Method RT Renovations is...Ch. 11 - Cost Allocation: Step Method with Analysis and...Ch. 11 - Prob. 59PCh. 11 - Prob. 60PCh. 11 - Direct, Step, and Reciprocal Methods:...Ch. 11 - Cost Allocation: Step and Reciprocal Methods...Ch. 11 - Allocate Service Department Costs: Direct and Step...Ch. 11 - Prob. 64PCh. 11 - Prob. 65PCh. 11 - Prob. 66PCh. 11 - Prob. 67PCh. 11 - Prob. 68PCh. 11 - Fletcher Fabrication, Inc., produces three...Ch. 11 - Findina Missing Data: Net Realizable Value Spartan...Ch. 11 - Finding Missing Data: Net Realizable Value Blaine,...Ch. 11 - Joint Costing in a Process Costing Context:...Ch. 11 - Find Maximum Input Price: Estimated Net Realizable...Ch. 11 - Effect of By-Product versus Joint Cost Accounting...Ch. 11 - Prob. 75PCh. 11 - Prob. 76P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs 12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Required: 1. Allocate the joint cost to L-Ten, Triol, and Pioze using the net realizable value method. (Round the percentages to four significant digits. Round all cost allocations to the nearest dollar.) 2. What if it cost 2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to the three products?arrow_forwardJoint cost allocation-market value at split-off method Toil Oil processes crude oil to jointly produce gasoline, diesel, and kerosene. One batch produces 3,415 gallons of gasoline, 2,732 gallons of diesel, and 1,366 gallons of kerosene at a joint cost of 112,000. After the split-off point, all products are processed further, but the estimated market price for each product at the split-off point is as follows: Using the market value at split-off method, allocate the 12,000 joint cost of production to each product.arrow_forwardLaramie Industries produces two joint products, H and C. Prior to the split-off point, the company incurred costs of $66,000. Product H weighs 44 pounds and product C weighs 66 pounds. Product H sells for $250 per pound and product C sells for $295 per pound. Based on a physical measure of output, allocate joint costs to products H and C.arrow_forward

- Clarion Industries produces two joint products, Y and Z. Prior to the split-off point, the company incurred costs of $36,000. Product Y weighs 25 pounds and product Z weighs 75 pounds. Product Y sells for $150 per pound and product Z sells for $125 per pound. Based on a physical measure of output, allocate joint costs to products Y and Z.arrow_forwardLeMoyne Manufacturing Inc.’s joint cost of producing 2,000 units of Product X, 1,000 units of Product Y, and 1,000 units of Product Z is $50,000. The unit sales values of the three products at the split-off point are Product X–$30, Product Y–$100, and Product Z–$90. Ending inventories include 200 units of Product X, 300 units of Product Y, and 100 units of Product Z. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales values at split-off. Assume that Product Z can be sold for $120 a unit if it is processed after split-off at a cost of $10 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forwardOakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forward

- Venezuela Oil Inc. transports crude oil to its refinery where it is processed into main products gasoline, kerosene, and diesel fuel, and by-product base oil. The base oil is sold at the split-off point for $1,000,000 of annual revenue, and the joint processing costs to get the crude oil to split-off are $10,000,000. Additional information includes: Required: Determine the allocation of joint costs using the net realizable value method, rounding the sales value percentages to the nearest tenth of a percent. (Hint: Reduce the amount of the joint costs to be allocated by the amount of the by-product revenue.)arrow_forwardThomas Corporation produces heating units. The following values apply for a part used in their production (purchased from external suppliers): D = 12,500 Q = 250 P = 45 C = 4.50 Required: 1. For Thomas, calculate the ordering cost, the carrying cost, and the total cost associated with an order size of 250 units. 2. Calculate the EOQ and its associated ordering cost, carrying cost, and total cost. Compare and comment on the EOQ relative to the current order quantity. 3. What if Thomas enters into an exclusive supplier agreement with one supplier who will supply all of the demands with smaller, more frequent orders? Under this arrangement, the ordering cost is reduced to 0.45 per order. Calculate the new EOQ and comment on the implications.arrow_forwardPacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were 50,000, and 14,000 units of overs and 36,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, 18,000; unders, 23,040. Overs sell for 2.00 per unit; unders sell for 3.14 per unit. Required: 1. Allocate the 50,000 joint costs using the estimated net realizable value method. 2. Suppose that overs could be sold at the split-off point for 1.80 per unit. Should Pacheco sell overs at split-off or process them further? Show supporting computations.arrow_forward

- Joint cost allocation net realizable value method Natures Garden Inc. produces wood chips, wood pulp, and mulch. These products are produced through harvesting trees and sending the logs through a wood chipper machine. One batch of logsproduces 20,304 cubic yards of wood chips, 14,100 cubic yards of mulch, and 9,024 cubic yards ofwood pulp. The joint production process costs a total of 32,000 per batch. After the split-off point,wood chips are immediately sold for 25 per cubic yard while wood pulp and mulch are processedfurther. The market value of the wood pulp and mulch at the split-off point is estimated to be 22and 24 per cubic yard, respectively. The additional production process of the wood pulp costs 5per cubic yard, after which it is sold for 30 per cubic yard. The additional production process ofthe mulch costs 4 per cubic yard, after which it is sold for 32 per cubic yard. Allocate the jointcosts of production to each product using the net realizable value method.arrow_forwardBreegle Company produces three products (B-40, J-60, and H-102) from a single process. Breegle uses the physical volume method to allocate joint costs of 22,500 per batch to theproducts. Based on the following information, which product(s) should Breegle continue toprocess after the split-off point in order to maximize profit? a. B-40 only b. J-60 only c. H-102 only d. B-40 and H-102 onlyarrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License