Concept explainers

Variable-Costing and Absorption-Costing Income

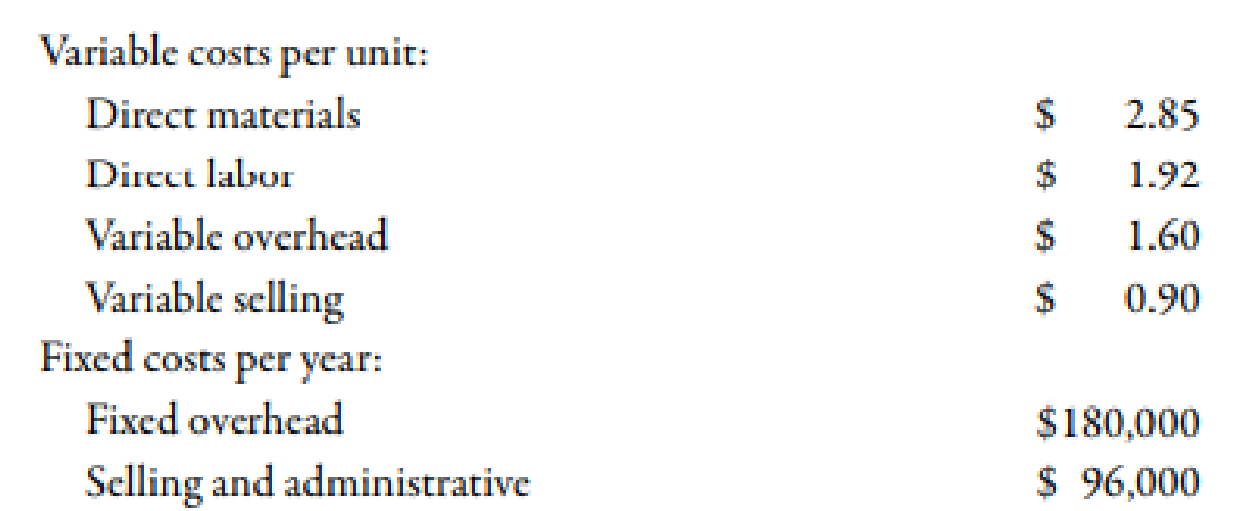

Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows:

During the year, Borques produced 200,000 wooden pallets and sold 204,300 at $9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing.

Required:

- 1. What is the per-unit inventory cost that is acceptable for reporting on Borques’s balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory?

- 2. Calculate absorption-costing operating income.

- 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why?

- 4. Calculate variable-costing operating income.

- 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?

1.

Calculate per unit cost of inventory. Also, calculate the units of ending inventory and total cost of ending inventory.

Explanation of Solution

Cost:

Cost can be defined as the cash and cash equivalent which is incurred against the products or its related services which will benefit the organization in the future. There are two types of costs that are fixed and variable costs.

Calculation of per unit cost of inventory:

| Particulars |

Amount ($) |

| Direct material | 2.85 |

| Direct labor | 1.92 |

| Variable overhead | 1.60 |

| Fixed overhead1 | 0.90 |

| Total | 7.27 |

Table (1)

Therefore, per unit cost of inventory is $7.27.

Use the following formula to calculate the units of ending inventory.

Substitute 8,200 units for opening finished goods, and 200,000 units for manufactured goods and 204,300 units for closing finished goods in the above formula.

Therefore, a unit of ending inventory is 3,900 units.

Use the following formula to calculate the cost of ending inventory.

Substitute $7.27 for per-unit inventory cost and 3,900 units for units of ending inventory in the above formula.

Therefore, the cost of ending inventory is $28,353.

Working Note:

1. Calculation of fixed overhead:

2.

Compute the operating income with the help of absorption costing.

Explanation of Solution

Calculation of operating income:

| Particulars |

Amount ($) |

| Sales1 | 1,838,700 |

| Less: cost of goods sold2 | 1,485,261 |

| Gross margin | 353,439 |

| Less: Selling and administrative expenses | 279,870 |

| Operating income | 73,569 |

Table (2)

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold:

3.

Calculate per unit cost of inventory with the help of variable costing. Also, identify the difference in the amount in part 1.

Explanation of Solution

Calculation of per unit cost of inventory with the help of variable costing:

| Particulars |

Amount ($) |

| Direct material | 2.85 |

| Direct labor | 1.92 |

| Variable overhead | 1.60 |

| Total | 6.37 |

Table (3)

Therefore, per unit cost of inventory with the help of variable costing is $6.37.

The difference between per unit cost of inventory occurs because the absorption costing includes the amount of both variable and fixed costing. On the contrary, variable costing does not include the amount of fixed costing. That is why under absorption costing the value of per unit of ending inventory is higher as compared to the variable costing.

4.

Compute the operating income with the help of variable costing.

Explanation of Solution

Calculation of operating income:

| Particulars |

Amount ($) |

| Sales1 | 1,838,700 |

| Less: cost of goods sold2 | 1,485,261 |

| Selling and administrative expenses3 | 183,870 |

| Contribution margin | 353,439 |

| Less: Fixed overhead | 180,000 |

| Fixed Selling and administrative expenses | 96,000 |

| Operating income | 77,439 |

Table (4)

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold:

2. Calculation of selling and administrative expenses:

5.

Compute the operating income with the help absorption costing and variable costing:

Explanation of Solution

Calculation of operating income with the help of absorption costing:

| Particulars |

Amount ($) |

| Sales1 | 1,770,300 |

| Less: cost of goods sold2 | 1,430,009 |

| Gross margin | 340,291 |

| Less: Selling and administrative expenses | 273,030 |

| Operating income | 67,261 |

Table (5)

Therefore, the amount of operating income under absorption costing is $67,261.

Calculation of operating income with the help of variable costing:

| Particulars |

Amount ($) |

| Sales1 | 1,770,300 |

| Less: cost of goods sold3 | 1,252,979 |

| Selling and administrative expenses4 | 177,030 |

| Contribution margin | 340,291 |

| Less: Fixed overhead | 180,000 |

| Fixed Selling and administrative expenses | 96,000 |

| Operating income | 64,291 |

Table (6)

Therefore, the amount of operating income under variable costing is $64,291.

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold under absorption costing:

3. Calculation of cost of goods sold under variable costing:

4. Calculation of selling and administrative expenses:

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Income Statements under Absorption and Variable Costing In the coming year, Kalling Company expects to sell 28,700 units at 32 each. Kallings controller provided the following information for the coming year: Required: 1. Calculate the cost of one unit of product under absorption costing. 2. Calculate the cost of one unit of product under variable costing. 3. Calculate operating income under absorption costing for next year. 4. Calculate operating income under variable costing for next year.arrow_forwardCost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forwardEstimated income statements, using absorption and variable costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 50,000 units instead of 40,000 units, thus creating an ending inventory of 10,000 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. Prepare an estimated income statement, comparing operating results if 40,000 and 50,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement?arrow_forward

- Functional-Based versus Activity-Based Costing For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped. Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the companys market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line. Upon investigation, they were informed that the only real change in product-costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products: The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number. During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior years output for that product. Required: (Note: Round rates and unit cost to the nearest cent.) 1. CONCEPTUAL CONNECTION Compute the amount of accounting cost assigned to a backpack before the duffel-bag line was added by using a plantwide rate approach based on units produced. Is this assignment accurate? Explain. 2. Suppose that the company decided to assign the accounting costs directly to the product lines by using the number of transactions as the activity driver. What is the accounting cost per unit of backpacks? Per unit of duffel bags? 3. Compute the amount of accounting cost assigned to each backpack and duffel bag by using departmental rates based on direct labor hours. 4. CONCEPTUAL CONNECTION Which way of assigning overhead does the best jobthe functional-based approach by using departmental rates or the activity-based approach by using transactions processed for each product? Explain. Discuss the value of ABC before the duffel-bag line was added.arrow_forwardJellison Company had the following operating data for its first two years of operations: Jellison produced 90,000 units in the first year and sold 80,000. In the second year, it produced 80,000 units and sold 90,000 units. The selling price per unit each year was 12. Jellison uses an actual costing system for product costing. Required: 1. Prepare income statements for both years using absorption costing. Has firm performance, as measured by income, improved or declined from Year 1 to Year 2? 2. Prepare income statements for both years using variable costing. Has firm performance, as measured by income, improved or declined from Year 1 to Year 2? 3. Which method do you think most accurately measures firm performance? Why?arrow_forwardContribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: It is expected that 12,000 units will be sold at a price of 240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions 1. Prepare an estimated income statement for 20Y7. 2. What is the expected contribution margin ratio? 3. Determine the break-even sales in units and dollars. 4. Construct a cost-volume-profit chart indicating the break-even sales. 5. What is the expected margin of safety in dollars and as a percentage of sales? (Round to one decimal place.) 6. Determine the operating leverage.arrow_forward

- Cost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income statement is as follows: Required: 1. Compute the break-even point in units and sales dollars calculated using the break-even units. 2. What was the margin of safety for Victoria last year in sales dollars? 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by 250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?arrow_forwardStep Costs, Relevant Range Bellati Inc. produces large industrial machinery. Bellati has a machining department and a group of direct laborers called machinists. Each machinist can machine up to 500 units per year. Bellati also hires supervisors to develop machine specification plans and oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee, at most, three machinists. Bellatis accounting and production history shows the following relationships between number of units produced and the annual costs of supervision and materials handling (by machinists): Required: 1. Prepare a graph that illustrates the relationship between direct labor cost and number of units produced in the machining department. (Let cost of direct labor be the vertical axis and number of units be the horizontal axis.) Would you classify this cost as a strictly variable cost, a fixed cost, or a step cost? 2. Prepare a graph that illustrates the relationship between the cost of supervision and the number of units produced. (Let cost of supervision be the vertical axis and number of units be the horizontal axis.) Would you classify this cost as a strictly variable cost, a fixed cost, or a step cost? 3. Suppose that the normal range of production is between 1,400 and 1,500 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 500 units. What is the increase in the cost of direct labor? Cost of supervision?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,