Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 9, Problem 11CE

Refer to Cornerstone Exercise 9.9.

Required:

- 1. Calculate the yield ratio based on the standard amounts given.

- 2. Calculate the

standard cost per pound of the yield (rounded to the nearest cent). - 3. Calculate the standard yield for actual input of 2,000 pounds of direct materials.

- 4. Calculate the yield variance.

- 5. What if the total 2,000 pounds of direct materials put into process resulted in a yield of 825 pizzas? How would that affect the yield variance?

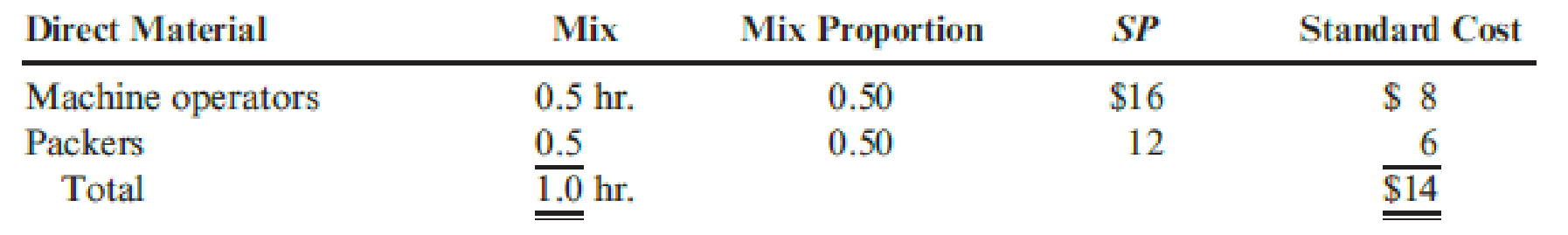

Mangia Pizza Company makes frozen pizzas that are sold through grocery stores. Mangia uses two types of direct labor: machine operators and packers. Mangia developed the following standard mix for spreading on premade pizza shells to produce 16 giant-size sausage pizzas.

Mangia’s recent batch (designed to produce 400 pizzas) used 400 direct labor hours. Of the total, 160 were for machine operators, and the remaining 240 hours were for packers. The actual yield was 780 pizzas.

Required:

- 1. Calculate the standard mix (SM) in hours for machine operators and for packers.

- 2. Calculate the mix variance.

- 3. Calculate the actual proportion of hours worked by machine operators and by packers. Use these results to explain the direction (favorable or unfavorable) of the mix variance.

- 4. What if of the total 400 direct labor hours worked, 200 were worked by each type of direct labor? How would that affect the mix variance?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume the following:

The actual price per pound is $2.25.

The standard quantity of pounds allowed per unit of finished goods is 4 pounds.

The actual quantity of materials purchased and used in production is 50,000 pounds.

The materials price variance is $12,500 U.

The materials quantity variance is $4,000 F.

What is the total number of units produced (finished goods) during the period?

Production of each unit of 001 requires 8 lbs. of B at a cost of P9 per lb. and 4 lbs. of X at P11.20 per lb. However, for production of 1,000 units of 001 10,000 lbs. were used, 75% of which was for material B at a cost of P8 per lb. for B and P9 per lb. for X. What is the material price, mix, and yield and quantity variance?

Assume the following:

The standard price per pound is $2.15.

The standard quantity of pounds allowed per unit of finished goods is 4 pounds.

The actual quantity of materials purchased was 53,000 pounds, whereas the quantity of materials used in production was 50,100 pounds.

The actual purchase price per pound of materials was $2.25.

The company produced 13,000 units of finished goods during the period.

What is the materials quantity variance?

Multiple Choice

$6,235 F

$6,525 F

$4,275 F

$4,085 F

Chapter 9 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 9 - Discuss the difference between budgets and...Ch. 9 - What is the quantity decision? The pricing...Ch. 9 - Why is historical experience often a poor basis...Ch. 9 - Prob. 4DQCh. 9 - How does standard costing improve the control...Ch. 9 - The budget variance for variable production costs...Ch. 9 - Explain why the direct materials price variance is...Ch. 9 - The direct materials usage variance is always the...Ch. 9 - The direct labor rate variance is never...Ch. 9 - Prob. 10DQ

Ch. 9 - Prob. 11DQCh. 9 - What is the cause of an unfavorable volume...Ch. 9 - Prob. 13DQCh. 9 - Explain how the two-, three-, and four-variance...Ch. 9 - Prob. 15DQCh. 9 - Prob. 1CECh. 9 - Direct Materials Usage Variance Refer to...Ch. 9 - Refer to Cornerstone Exercise 9.1. Guillermos Oil...Ch. 9 - Kavallia Company set a standard cost for one item...Ch. 9 - Yohan Company has the following balances in its...Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Variances Refer to Cornerstone Exercise 9.6....Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Refer to Cornerstone Exercise 9.9. Required: 1....Ch. 9 - Quincy Farms is a producer of items made from farm...Ch. 9 - During the year, Dorner Company produced 280,000...Ch. 9 - Zoller Company produces a dark chocolate candy...Ch. 9 - Oerstman, Inc., uses a standard costing system and...Ch. 9 - Refer to the data in Exercise 9.15. Required: 1....Ch. 9 - Chypre, Inc., produces a cologne mist using a...Ch. 9 - Refer to Exercise 9.17. Chypre, Inc., purchased...Ch. 9 - Delano Company uses two types of direct labor for...Ch. 9 - Jameson Company produces paper towels. The company...Ch. 9 - Madison Company uses the following rule to...Ch. 9 - Laughlin, Inc., uses a standard costing system....Ch. 9 - Responsibility for the materials price variance...Ch. 9 - Which of the following is true concerning labor...Ch. 9 - A company uses a standard costing system. At the...Ch. 9 - Relevant information for direct labor is as...Ch. 9 - Which of the following is the most likely...Ch. 9 - Haversham Corporation produces dress shirts. The...Ch. 9 - Plimpton Company produces countertop ovens....Ch. 9 - Algers Company produces dry fertilizer. At the...Ch. 9 - Misterio Company uses a standard costing system....Ch. 9 - Petrillo Company produces engine parts for large...Ch. 9 - Business Specialty, Inc., manufactures two...Ch. 9 - Vet-Pro, Inc., produces a veterinary grade...Ch. 9 - Refer to the data in Problem 9.34. Vet-Pro, Inc.,...Ch. 9 - Energy Products Company produces a gasoline...Ch. 9 - Nuevo Company produces a single product. Nuevo...Ch. 9 - Ingles Company manufactures external hard drives....Ch. 9 - As part of its cost control program, Tracer...Ch. 9 - Aspen Medical Laboratory performs comprehensive...Ch. 9 - Leather Works is a family-owned maker of leather...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chypre, Inc., produces a cologne mist using a solvent mix (water and pure alcohol) and aromatic compounds (the scent base) that it sells to other companies for bottling and sale to consumers. Chypre developed the following standard cost sheet: On May 2, Chypre produced a batch of 1,000 gallons with the following actual results: Required: 1. Calculate the yield ratio. 2. Calculate the standard cost per unit of the yield. (Round to the nearest cent.) 3. Calculate the direct materials yield variance. (Round to the nearest cent.) 4. Calculate the direct materials mix variance. (Round to the nearest cent.)arrow_forwardRefer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forwardEd Co. manufactures two types of O rings, large and small. Both rings use the same material but require different amounts. Standard materials for both are shown. At the beginning of the month, Edve Co. bought 25,000 feet of rubber for $6.875. The company made 3,000 large O rings and 4,000 small O rings. The company used 14,500 feet of rubber. A. What are the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance? B. If they bought 10,000 connectors costing $310, what would the direct materials price variance be for the connectors? C. If there was an unfavorable direct materials price variance of $125, how much did they pay per toot for the rubber?arrow_forward

- Refer to the data in Problem 9.34. Vet-Pro, Inc., also uses two different types of direct labor in producing the anti-anxiety mixture: mixing and drum-filling labor (the completed product is placed into 50-gallon drums). For each batch of 20,000 gallons of direct materials input, the following standards have been developed for direct labor: The actual direct labor hours used for the output produced in March are also provided: Required: 1. Compute the direct labor mix and yield variances. (Round standard price of yield to four significant digits.) 2. Compute the total direct labor efficiency variance. Show that the total direct labor efficiency variance is equal to the sum of the direct labor mix and yield variances. Vet-Pro, Inc., produces a veterinary grade anti-anxiety mixture for pets with behavioral problems. Two chemical solutions, Aranol and Lendyl, are mixed and heated to produce a chemical that is sold to companies that produce the anti-anxiety pills. The mixture is produced in batches and has the following standards: During March, the following actual production information was provided: Required: 1. Compute the direct materials mix and yield variances. 2. Compute the total direct materials usage variance for Aranol and Lendyl. Show that the total direct materials usage variance is equal to the sum of the direct materials mix and yield variances.arrow_forwardUse the following information to complete Brief Exercises 10-36 and 10-37: Ambient Inc. produces aluminum cans. Each can has a standard labor requirement of 0.03 hour. During the month of May, 500,000 cans were produced using 14,000 labor hours @ 15.00. The standard wage rate is 14.50 per hour. 10-37 Labor Rate and Efficiency Variances Refer to the information for Ambient Inc. above. Required: Calculate the labor rate and efficiency variances using the columnar and formula approaches.arrow_forwardUse the following standard cost card for 1 gallon of ice cream to answer the questions. Actual direct costs incurred to make 50 gallons of ice cream: 275 quarts of cream at $1.05 per quart 832 ounces of sugar at $0.075 per ounce 165 minutes of labor at $37 per hour All materials used were bought during the current period. A. Compute the material and labor variances. B. comment on the results and possible causes of the variances.arrow_forward

- Use the following information to complete Brief Exercises 10-25 and 10-26: Tico Inc. produces plastic bottles. Each bottle has a standard labor requirement of 0.03 hour. During the month of April, 900,000 bottles were produced using 25,200 labor hours @ 15.00. The standard wage rate is 13.50 per hour. 10-26 Labor Rate and Efficiency Variances Refer to the information above for Tico Inc. on the previous page Required: Calculate the labor rate and efficiency variances using the columnar and formula approaches.arrow_forwardDirect materials variances Bellingham Company produces a product that requires 2.5 standard pounds per unit. The standard price is 3.75 per pound. If 15,000 units used 36,000 pounds, which were purchased at 4.00 per pound, what is the direct materials (A) price variance, (B) quantity variance, and (C) cost variance?arrow_forwardSuppose that Motorola uses the normal distribution to determine the probability of defects and the number of defects in a particular production process. Assume that the production process manufactures items with a mean weight of 10 ounces. Calculate the probability of a defect and the suspected number of defects for a 1,000-unit production run in the following situations. a. The process standard deviation is 0.15, and the process control is set at plus or minus one standard deviation. Units with weights less than 9.85 or greater than 10.15 ounces will be classified as defects. b. Through process design improvements, the process standard deviation can be reduced to 0.05. Assume that the process control remains the same, with weights less than 9.85 or greater than 10.15 ounces being classified as defects. c. What is the advantage of reducing process variation, thereby causing process control limits to be at a greater number of standard deviations from the mean?arrow_forward

- Buenolorl Company produces a well-known cologne. The standard manufacturing cost of the cologne is described by the following standard cost sheet: Management has decided to investigate only those variances that exceed the lesser of 10% of the standard cost for each category or 20,000. During the past quarter, 250,000 four-ounce bottles of cologne were produced. Descriptions of actual activity for the quarter follow: a. A total of 1.35 million ounces of liquids was purchased, mixed, and processed. Evaporation was higher than expected. (No inventories of liquids are maintained.) The price paid per ounce averaged 0.42. b. Exactly 250,000 bottles were used. The price paid for each bottle was 0.048. c. Direct labor hours totaled 48,250, with a total cost of 733,000. Normal production volume for Buenolorl is 250,000 bottles per quarter. The standard overhead rates are computed by using normal volume. All overhead costs are incurred uniformly throughout the year. (Note: Round unit costs to the nearest cent and total amounts to the nearest dollar.) Required: 1. Calculate the upper and lower control limits for materials and labor. 2. Compute the total materials variance, and break it into price and usage variances. Would these variances be investigated? 3. Compute the total labor variance, and break it into rate and efficiency variances. Would these variances be investigated?arrow_forwardKavallia Company set a standard cost for one item at 328,000; allowable deviation is 14,500. Actual costs for the past six months are as follows: Required: 1. Calculate the variance from standard for each month. Which months should be investigated? 2. What if the company uses a two-part rule for investigating variances? The allowable deviation is the lesser of 4 percent of the standard amount or 14,500. Now which months should be investigated?arrow_forwardThe production cost for UV protective sunglasses is $5.50 per unit and fixed costs are $19,400 per month. How much is the favorable or unfavorable variance if 14,000 units were produced for a total of $97,000?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY