Effects of FIFO and LIFO

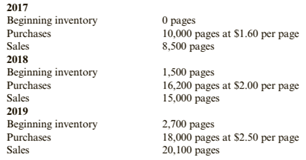

Sheepskin Company sells to colleges and universities a special paper that is used for diplomas. Sheepskin typically makes one purchase of the special paper each year on January 1. Assume that Sheepskin uses a perpetual inventory system. You have the following data for the 3 years ending in 2019:

Required:

1. What would the ending inventory and cost of goods sold be for each year if FIFO is used?

2. What would the ending inventory and cost of goods sold be for each year if LIFO is used?

3. CONCEPTUAL CONNECTION For each year, explain the cause of the differences in cost of goods sold under FIFO and LIFO.

(a)

Inventory costing methods:

FIFO and LIFO are those methods which are used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the FIFO.

Answer to Problem 55E

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

In the year

In the year

Opening Inventory

In the year

Opening Inventory

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

(b)

Inventory costing methods:

FIFO and LIFO are those methods which are used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the LIFO.

Answer to Problem 55E

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

In the year

In the year

Opening Inventory

In the year

Opening Inventory

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

(c)

Inventory costing methods:

FIFO and LIFO are those methods which are used for calculation of closing inventory and cost of goods sold.

The reason for difference in cost of goods sold under both methods.

Answer to Problem 55E

The reason for the difference in the cost of goods sold in both the methods i.e. FIFO and LIFO is their different nature of taking the purchases for the sale. It means FIFO takes the purchases which came first and LIFO takes the purchases which came last i.e. latest purchases.

Explanation of Solution

| FIFO | LIFO | |||||

| Particular | ||||||

| Cost of goods sold | ||||||

| Closing inventory value | ||||||

As seen un above table, the difference in cost of goods sold in FIFO and LIFO is due to the recording the sales in different manner. In the FIFO method, the sales are made from the purchases which are made at first place i.e. first come first out scenario by which old stock is cleared first and then the latest one.

In the LIFO method, it is opposite which means the sales are made from the purchases which are made latest i.e. last come last out scenario by which new stock is sold out first and then the old one.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting

- Inventory Pools Stone Shoe Company adopted dollar-value LIFO on January 1, 2019. The company produces four products and uses a single inventory pool. The companys beginning inventory consists of the following: During 2019, the company has the following purchases and sales: Required: 1. Compute the dollar-value LIFO cost of the ending inventory. Round the cost index to 4 decimal places and all other amounts to the nearest dollar. 2. Next Level By how much would the companys gross profit differ if it had used four pools instead of a single pool?arrow_forwardOn January 5, 2019, ShoeKing Corp. sells for cash 500 pairs of volleyball shoes to FootAction, a shoe retailer, for 70 each. FootAction has the right to return the shoes for any reason up to March 31, 2019, for a full refund. The cost of each pair of shoes is 32. ShoeKing predicts that it is probable that 40 pairs of the shoes will be returned. ShoeKing uses the perpetual method for inventory. Required: 1. Prepare ShoeKings journal entry on January 5, 2019, to account for this transaction. 2. Assume that FootAction returns 35 pairs of shoes on March 31, 2019. Prepare the journal entry to record this return.arrow_forwardWebster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X, Y, and Z. Websters beginning inventory consisted of the following: During 2019, Webster had the following purchases and sales: Required: 1. Compute the LIFO cost of the ending inventory assuming Webster uses a single inventory pool. Round cost index to 4 decimal places. 2. Compute the LIFO cost of the ending inventory assuming Webster uses three inventory pools. Round cost indexes to 4 decimal places.arrow_forward

- Goods in Transit Gravais Company made two purchases on December 29, 2019. One purchase for 3,000 was shipped FOB destination, and the second for 4,000 was shipped FOB shipping point. Neither purchase had been received nor paid for on December 31, 2019. Required: Which of these purchases, if either, does Gravais include in inventory on December 31, 2019? What is the cost?arrow_forwardInventory Costing and LCM Ortman Enterprises sells a chemical used in various manufacturing processes. On January 1, 2019, Ortman had 5,000,000 gallons on hand, for which it had paid $0.50 per gallon. During 2019, Ortman made the following purchases: During 2019, Ortman sold 65 000,000 gallons at $0.75 per gallon (35,000,000 gallons were sold on June 29 and 30,000,000 gallons were sold on Nov. 22), leaving an ending inventory of 7,000,000 gallons. Assume that Ortman uses a perpetual inventory system. Ortman uses the lower of cost or market for its inventories, as required by generally accepted accounting principles. Required: 1. Assume that the market value of the chemical is $0.76 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 2. Assume that the market value of the chemical is $0.58 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)arrow_forwardRescue Sequences LLC purchased inventory by issuing a 30,000, 10%, 60-day note on October 1. Prepare the journal entries for Rescue Sequences to record the purchase and payment assuming it uses a perpetual inventory system and a 360-day calendar fiscal year. Rescue Sequences LLC uses a perpetual inventory system.arrow_forward

- Company accepts goods on consignment from R Company and also purchases goods from S Company during the current month. E Company plans to sell the merchandise to customers during the following month. In each of these independent situations, who owns the merchandise at the end of the current month and should therefore include it in their companys ending inventory? Choose E, R, or S. A. Goods ordered from R, delivered and displayed on Es showroom floor at the end of the current month. B. Goods ordered from S, in transit, with shipping terms FOB destination. C. Goods ordered from R, in transit, with no stated shipping terms. D. Goods ordered from S, delivered and displayed on Es showroom floor at the end of the current month, with shipping terms FOB destination. E. Goods ordered from S, in transit, with shipping terms FOB shipping point.arrow_forwardUse the same information in RE9-1 except that the note is not interest bearing. Assume that the note is discounted at a 15% rate. RE9-1 Rescue Sequences LLC purchased inventory by issuing a 30,000, 10%, 60-day note on October 1. Prepare the journal entries for Rescue Sequences to record the purchase and payment assuming it uses a perpetual inventory system and a 360-day calendar fiscal year. Rescue Sequences LLC uses a perpetual inventory system.arrow_forwardRecording Sale and Purchase Transactions Alpharack Company sells a line of tennis equipment to retailers. Alpharack uses the perpetual inventory system and engaged in the following transactions during April 2019, its first month of operations: a. On April 2, Alpharack purchased, on credit, 360 Wilbur T-100 tennis rackets with credit terms of 2/10, n/30. The rackets were purchased at a cost of S30 each. Alpharack paid Barker Trucking $195 to transport the tennis rackets from the manufacturer to Alpharacks warehouse, shipping terms were F.O.B. shipping point, and the items were shipped on April 2. b. On April 3, Alpharack purchased, for cash, 115 packs of tennis balls for $10 per pack. c. On April 4, Alpharack purchased tennis clothing, on credit, from Designer Tennis Wear. The cost of the clothing was $8,250. Credit terms were 2/10, n/25. d. On April 10, Alpharack paid for the purchase of the tennis rackets in Transaction a. e. On April 15, Alpharack determined that $325 of the tennis clothing was defective. Alpharack returned the defective merchandise to Designer Tennis Wear. f. On April 20, Alpharack sold 1 18 tennis rackets at $90 each, 92 packs of tennis balls at $12 per pack, and $5,380 of tennis clothing. All sales were for cash. The cost of the merchandise sold was $7,580 and no sales returns are expected. g. On April 23, customers returned $860 of the merchandise purchased on April 20. The cost of the merchandise returned was $450. h. On April 25, Alpharack sold another 55 tennis rackets, on credit, for $90 each and 15 packs of tennis balls at $12 per pack, for cash. The cost of the merchandise sold was $1,800. i. On April 29, Alpharack paid Designer Tennis Wear for the clothing purchased on April 4 minus the return on April 15. j. On April 30, Alpharack purchased 20 tennis bags, on credit, from Bag Designs for $320. The bags were shipped F.O.B. destination and arrived at Alpharack on May 3. Required: 1. Prepare the journal entries to record the sale and purchase transactions for Alpharack during April 2019. 2. Assuming operating expenses of $8,500 and income taxes of $1,180, prepare Alpharacks income statement for April 2019.arrow_forward

- Kraft Manufacturing Company manufactures two products: Mult and Tran. At December 31, 2019, Kraft used the FIFO inventory method. Effective January 1, 2020, Kraft changed to the LIFO inventory method. The cumulative effect of this change is not determinable, and, as a result, the ending inventory of 2019, for which the FIFO method was used, is also the beginning inventory for 2020 for the LIFO method. Any layers added during 2020 should be costed by reference to the first acquisitions of 2020, and any layers liquidated during 2020 should be considered a permanent liquidation. The following information was available from Krafts inventory records for the two most recent years: Required: Compute the effect on income before income taxes for the year ended December 31, 2020, resulting from the change from the FIFO to the LIFO inventory method.arrow_forwardJohn Neff owns and operates Waikiki Surf Shop. A year-end trial balance is provided on page 561. Year-end adjustment data for the Waikiki Surf Shop are shown below. Neff uses the periodic inventory system. Year-end adjustment data are as follows: (a, b)A physical count shows that merchandise inventory costing 51,800 is on hand as of December 31, 20--. (c, d, e)Neff estimates that customers will be granted 2,000 in refunds of this years sales next year and the merchandise expected to be returned will have a cost of 1,200. (f)Supplies remaining at the end of the year, 600. (g)Unexpired insurance on December 31, 2,600. (h)Depreciation expense on the building for 20--, 5,000. (i)Depreciation expense on the store equipment for 20--, 3,000. (j)Wages earned but not paid as of December 31, 1,800. (k)Neff also offers boat rentals which clients pay for in advance. Unearned boat rental revenue as of December 31 is 3,000. Required 1. Prepare a year-end spreadsheet. 2. Journalize the adjusting entries. 3. Compute cost of goods sold using the spreadsheet prepared for part (1).arrow_forwardCompany is considering purchasing EKC Company. EKCs balance sheet at December 31, 2019, is as follows: At December 31, 2019, Elm discovered the following about EKC: a. No allowance for uncollectible accounts has been established. An allowance of 5,000 is considered appropriate. b. The LIFO inventory method has been used. The FIFO inventory method would be used if EKC were purchased by Elm. The FIFO inventors-valuation of the December 31, 2019, ending inventors-would be 180,000. c. The fair value of the property, plant, and equipment (net) is 730,000. d. The company has an unrecorded patent that is worth 120,000. e. The book values of the current liabilities and bonds payable are the same as their market values. Required: 1. Compute the value of the goodwill if Elm pays 1,350,000 for EKC. 2. Next Level Why would the book value of a companys identifiable net assets differ from its market value?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning